يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

ServisFirst Bancshares Q4 Net Interest Margin Strengthens Bullish Narratives On Profitability

ServisFirst Bancshares Inc SFBS | 86.77 | +1.74% |

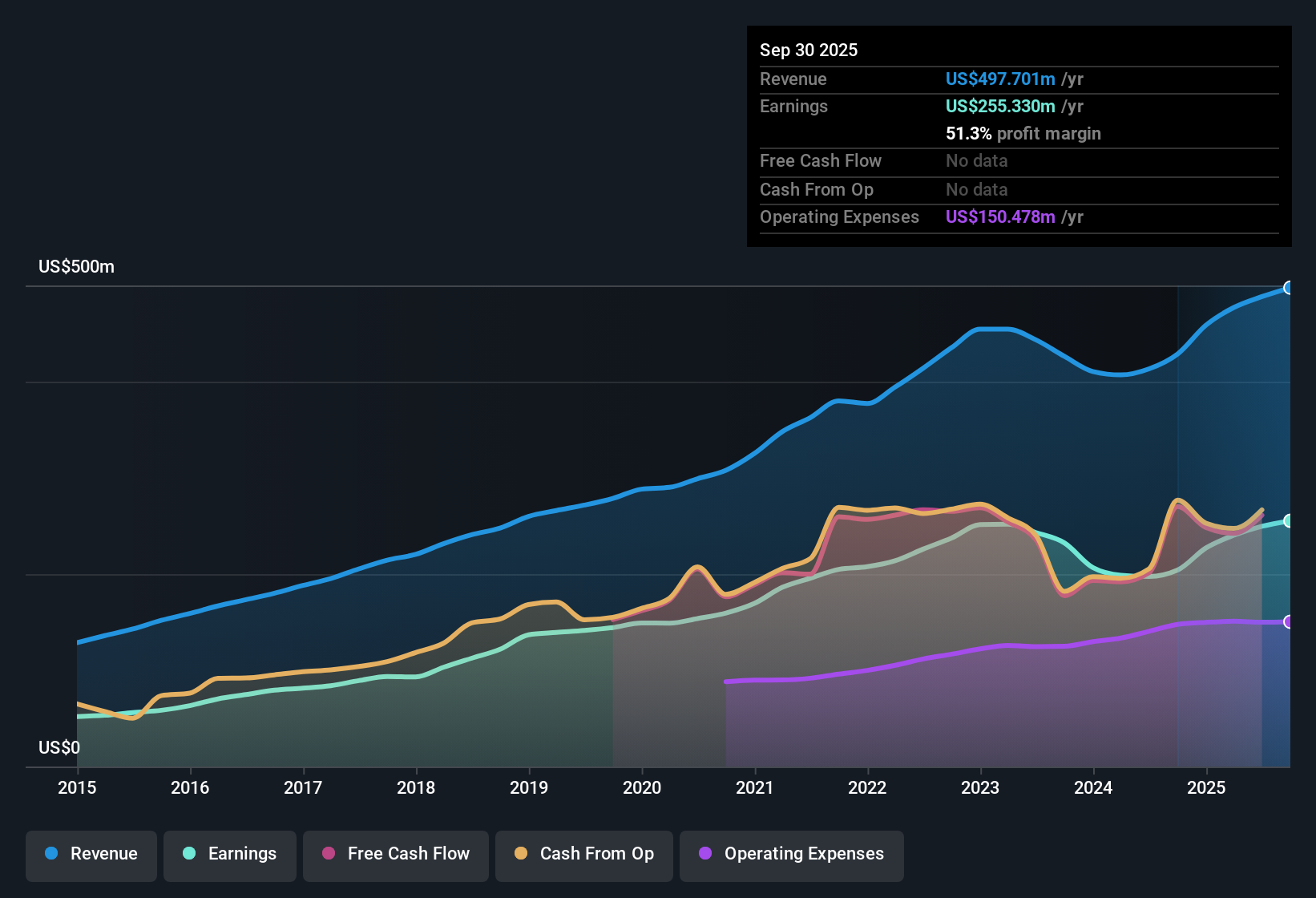

ServisFirst Bancshares (SFBS) capped FY 2025 with fourth quarter revenue of US$154.3 million and EPS of US$1.58, as trailing twelve month figures reached US$527.1 million in revenue and EPS of US$5.06. Over the past year, revenue has moved from US$458.7 million on a trailing basis to US$527.1 million, while EPS over the same period shifted from US$4.17 to US$5.06, providing additional context for how you might think about the bank’s earnings power. With a trailing net profit margin of 52.5% and a cost to income ratio that stayed in the low 30% range, the latest results keep the spotlight firmly on efficiency and profitability.

See our full analysis for ServisFirst Bancshares.With the headline numbers on the table, the next step is to see how this earnings print lines up against the widely followed growth and risk narratives around ServisFirst, and where those stories might merit a fresh look.

3.38% net interest margin with tight cost control

- Net interest margin in Q4 stood at 3.38%, alongside a cost to income ratio of 28.78%, compared with 3.09% and 35.22% respectively in Q3.

- What stands out for the bullish view is how this pairing of margin and costs feeds into profitability, with trailing net profit margin at 52.5% and trailing revenue at US$527.1 million. This strongly supports the idea of a straightforward commercial bank model turning a high share of revenue into net income.

- Trailing net income of US$276.5 million on that US$527.1 million in revenue illustrates how much of each dollar of revenue is landing on the bottom line.

- Quarter by quarter, revenue moved from US$120.8 million in Q2 to US$126.8 million in Q3 and US$154.3 million in Q4, which lines up with the narrative of a business focused on traditional lending and cash management converting higher activity into higher earnings.

Loan book reaches US$13.7b with higher non performing balances

- Total loans reached US$13.7b in Q4 2025, up from US$12.6b in Q4 2024, while non performing loans on a trailing basis were US$168.9 million compared with US$42.5 million a year earlier.

- Critics highlight credit risk as a key concern for a commercial focused regional bank, and the rise in non performing loans challenges any very bullish claim that asset quality is a non issue, even though earnings grew 21.7% over the past year.

- On a quarterly view, non performing loans moved from US$42.5 million in Q4 2024 to US$73.9 million in Q1 2025, then to US$72.2 million in Q2 and US$167.6 million in Q3 before ending at US$168.9 million in Q4, which gives bears concrete figures to point to when they talk about credit risk.

- At the same time, total loans increased from US$12.6b in Q4 2024 to US$13.7b in Q4 2025, so part of the story is simply a larger book, and that mix of growth plus higher non performing balances is exactly where bearish and bullish views tend to clash.

DCF fair value higher than price while P/E runs richer than peers

- The shares trade at US$87.46 against a DCF fair value of US$141.83, a gap of about 38.3%, while the trailing P/E of 17.3x sits above both the peer average of 13.7x and the US Banks industry at 11.8x.

- Supporters of the bullish case point to that large DCF fair value gap alongside 16.9% trailing revenue growth and 21.7% earnings growth as evidence that the current price does not fully reflect the company’s earnings power. At the same time, the richer P/E gives a simple cross check that the market is already assigning a premium versus many other banks.

- Trailing basic EPS of US$5.06 and trailing net income of US$276.5 million back up the idea that recent profitability has been strong enough to justify a more detailed valuation look rather than relying purely on headline multiples.

- The 1.74% dividend yield adds a small income component on top, which some bulls see as a plus when they compare the current share price to both the DCF fair value of US$141.83 and the single analyst target of US$92.00.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on ServisFirst Bancshares's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

ServisFirst’s strong profitability sits alongside sharply higher non performing loans and a premium P/E. This combination raises questions about credit quality and valuation risk.

If that mix makes you cautious, you may want to focus instead on companies screened for healthier balance sheets and lower financial stress using our CTA_SCREENER_SOLID_BALANCE_SHEET to look for potentially sturdier options.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.