يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Should Eased U.S.-EU Tariff Pressures Reframe Crane NXT’s (CXT) Global Risk Perception?

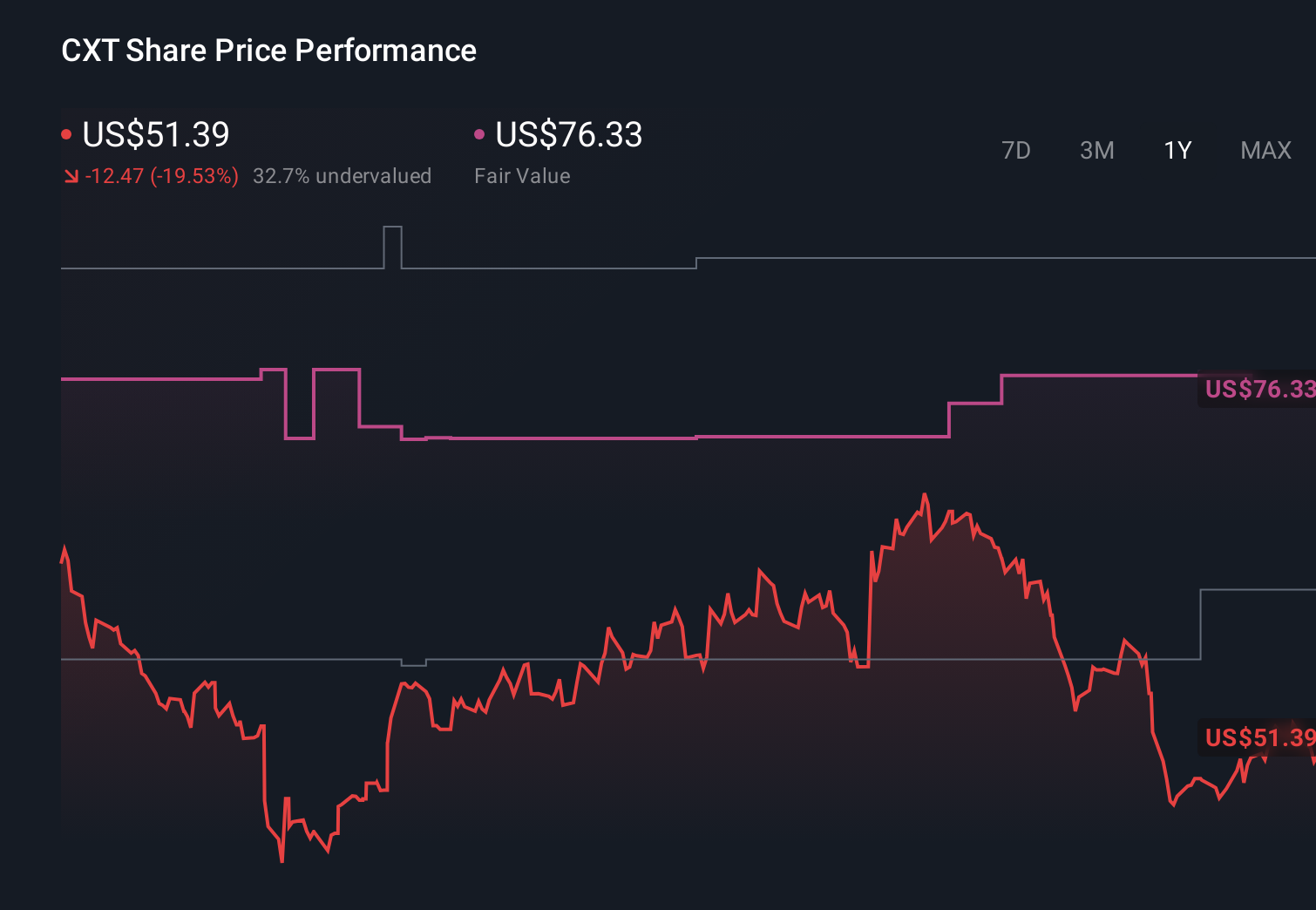

Crane NXT, Co. CXT | 52.10 | -1.03% |

- The U.S. administration previously called off planned 10% tariffs on European allies, easing trade tensions and improving the backdrop for internationally exposed companies such as Crane NXT.

- This policy reversal reduced immediate trade-policy uncertainty, a factor that can be particularly important for technology suppliers integrated into global supply chains.

- We will now examine how the easing of U.S.-EU tariff pressures shapes Crane NXT's investment narrative and perceived risk profile.

AI is about to change healthcare. These 109 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Crane NXT's Investment Narrative?

To own Crane NXT today, you need to believe in a steady, execution-led story rather than a dramatic turnaround. The company has been growing sales, raising full-year guidance and lifting its dividend, but margins have come under pressure and debt is still on the high side, all under a relatively new management team and board. The near term catalyst is clear: the upcoming Q4 2025 earnings release and any update to the outlook, especially around earnings growth and balance sheet priorities. The recent U.S. decision to back away from 10% tariffs on European allies helps at the margin by easing one external risk, which partly explains the stock’s relief bounce, but it does not fundamentally change the bigger issues investors are watching.

However, one operational risk could matter more than the tariff headlines for shareholders. Despite retreating, Crane NXT's shares might still be trading 24% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 4 other fair value estimates on Crane NXT - why the stock might be worth just $49.27!

Build Your Own Crane NXT Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Crane NXT research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Crane NXT research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Crane NXT's overall financial health at a glance.

No Opportunity In Crane NXT?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 23 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.