يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Should Stanley Black & Decker's Tariff Response and Price Hikes Prompt Action From SWK Investors?

Stanley Black & Decker, Inc. SWK | 72.80 | -1.82% |

- Stanley Black & Decker recently presented at Morgan Stanley’s 13th Annual Laguna Conference, where senior management discussed the company’s outlook and operational challenges.

- An important insight from the event was management’s disclosure of an US$800 million annualized tariff impact and their announcement of further price increases to help counter these cost pressures.

- To understand how the company’s efforts to manage tariff headwinds could reshape its future prospects, we’ll examine the implications for Stanley Black & Decker’s investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 28 best rare earth metal stocks of the very few that mine this essential strategic resource.

Stanley Black & Decker Investment Narrative Recap

To own Stanley Black & Decker stock, an investor needs confidence in the company’s ability to execute on cost-saving plans and restore durable margin growth despite persistent macro challenges. The recent management update on the magnitude of tariff impacts and forthcoming price hikes is important, but the primary short-term catalyst, the $2 billion restructuring initiative to enhance gross margins, remains unchanged. The main risk to monitor is whether weak demand and elevated tariffs will continue to pressure volumes and limit pricing power.

Among recent announcements, the disclosure of an upcoming second price increase for the fourth quarter is directly relevant in this context. This move, made in response to an $800 million annualized cost burden from tariffs, tests the limits of customer willingness to absorb higher prices without further volume declines, making it critical for near-term profitability as the company approaches the final leg of its restructuring program.

Yet, investors should take special note that while restructuring may cushion some margin pressure, reliance on price hikes carries its own limits when...

Stanley Black & Decker’s outlook calls for $16.8 billion in revenue and $1.3 billion in earnings by 2028. This projection is based on an assumed annual revenue growth rate of 3.5% and a near tripling of earnings from the current $478.3 million.

Uncover how Stanley Black & Decker's forecasts yield a $86.74 fair value, a 12% upside to its current price.

Exploring Other Perspectives

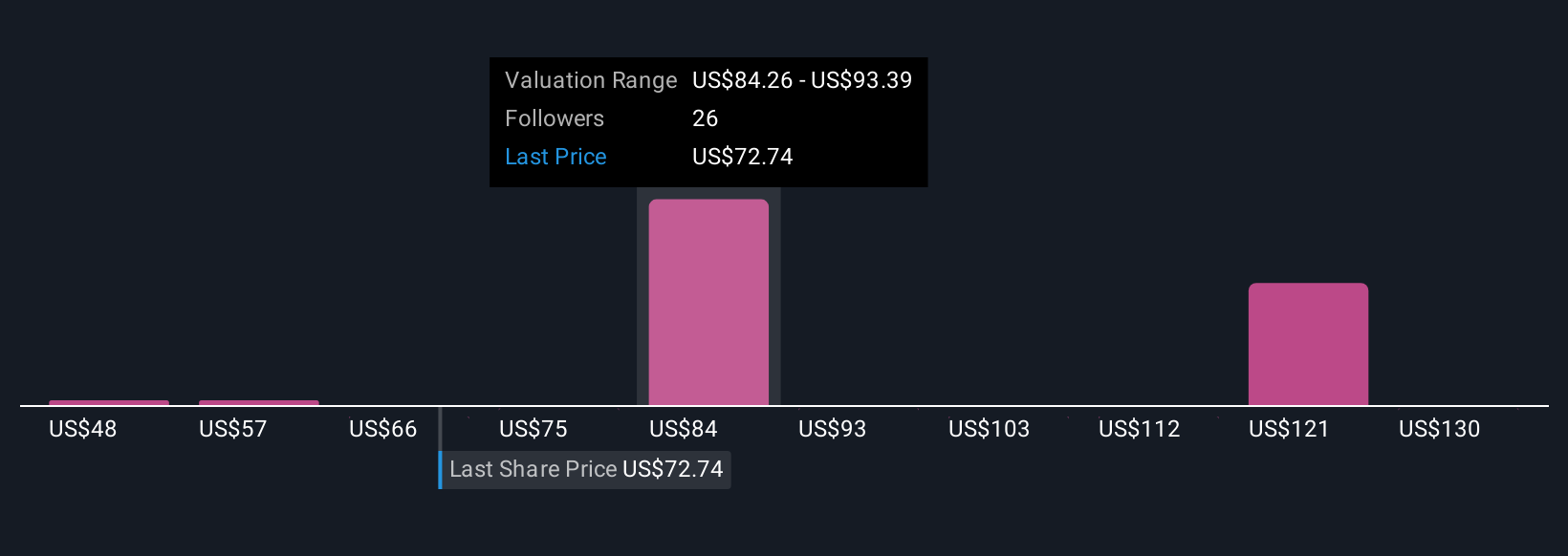

Ten private investors in the Simply Wall St Community set Stanley Black & Decker's fair value between US$47.77 and US$139 per share. While views are wide ranging, many are aware that ongoing tariff pressures and weak demand can affect the company's ability to convert cost reductions into sustainable growth.

Explore 10 other fair value estimates on Stanley Black & Decker - why the stock might be worth 38% less than the current price!

Build Your Own Stanley Black & Decker Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Stanley Black & Decker research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Stanley Black & Decker research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Stanley Black & Decker's overall financial health at a glance.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.