يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Sierra Bancorp (BSRR) Net Profit Margin Near 28.4% Reinforces Bullish Earnings Narratives

Sierra Bancorp BSRR | 37.54 | +1.24% |

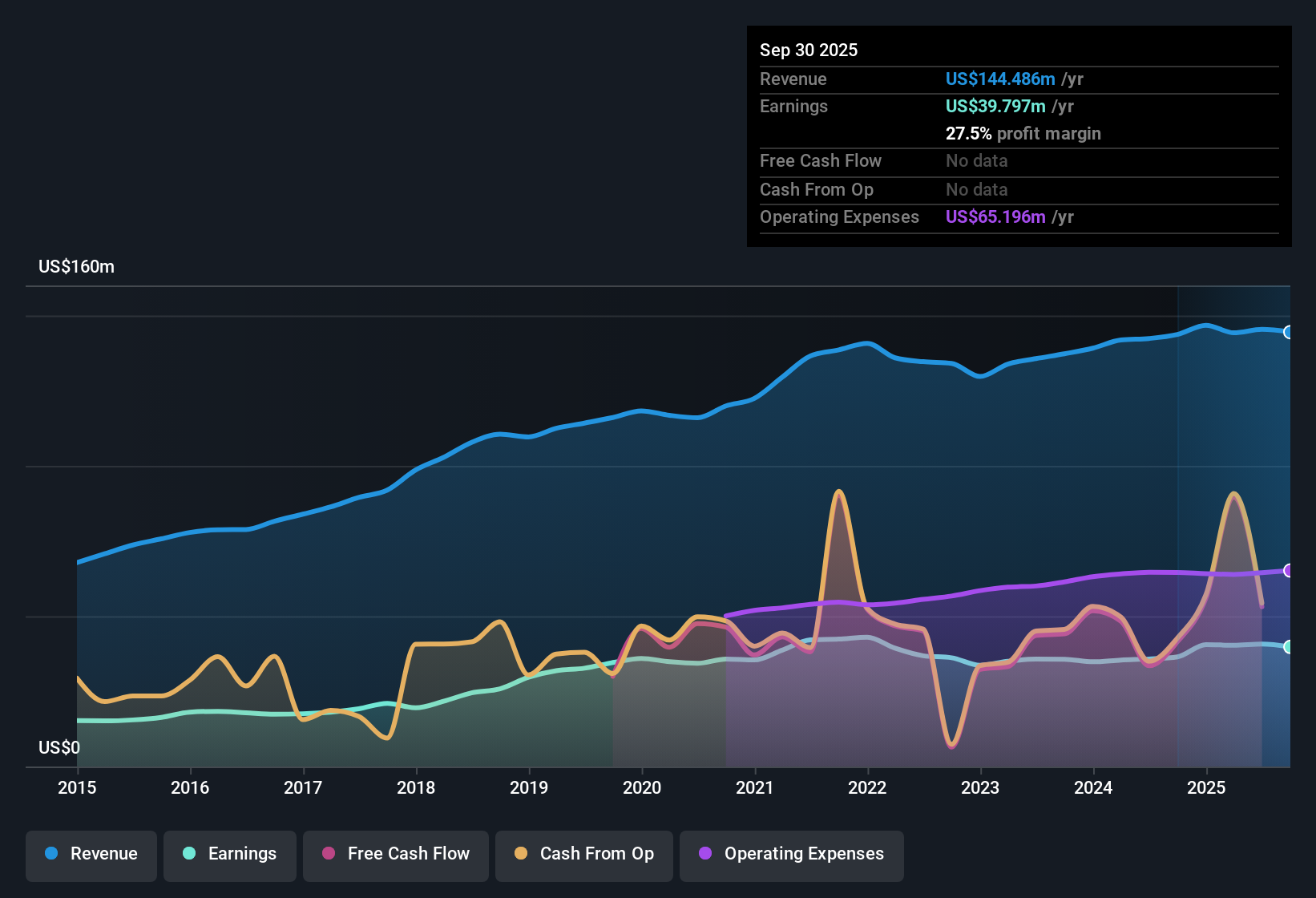

Sierra Bancorp (BSRR) has just posted its FY 2025 numbers, with fourth quarter revenue of US$40.2 million, basic EPS of US$0.97 and net income of US$12.9 million setting the tone for the year. The bank has seen quarterly revenue move from US$35.5 million in Q4 2024 through US$34.7 million, US$38.0 million and US$36.3 million to US$40.2 million most recently. Basic EPS over the same stretch ran from US$0.73 to US$0.66, US$0.78, US$0.73 and now US$0.97, giving you a clear view of how the top line and EPS have been tracking into this release. With trailing twelve month revenue of US$149.2 million and EPS of US$3.19, the latest set of results frames a business where margins and earnings power are central to how investors read the story.

See our full analysis for Sierra Bancorp.With the headline numbers on the table, the next step is to see how this earnings profile lines up with the most widely held narratives about Sierra Bancorp, and where the fresh data might challenge those views.

Loan Book Grows Toward US$2.5b

- Total loans moved from US$2,306.8 million in Q1 2025 to US$2,491.8 million by Q3 2025, with trailing twelve month revenue at US$149.2 million alongside EPS of US$3.19 across that period.

- Supporters of the bullish view point to this larger loan base sitting alongside trailing twelve month net income of US$42.3 million and a 28.4% net profit margin, and they argue this combination of scale and profitability can underpin the forecast earnings growth of about 6.9% per year.

- What stands out for that bullish angle is that one year earnings growth of 4.4% is above the 0.3% per year five year average, which is used as evidence of a stronger recent earnings profile.

- At the same time, the bank is paying a 2.69% dividend yield on a share price of US$37.13, so bulls often see income and loan growth pulling in the same direction.

Margins Hold Near 28.4%

- Across the trailing twelve months, the bank reports a 28.4% net profit margin, slightly above 27.6% a year earlier, while quarterly net interest margin figures in 2025 ranged from 3.68% to 3.78%.

- Investors who lean bullish highlight that this margin profile, together with trailing twelve month net income of US$42.3 million, supports the view of high quality earnings, and they contrast that with only modest five year earnings growth of 0.3% per year to argue that recent results may be a step up in earnings power.

- The pattern of quarterly net income in 2025, from US$9.1 million in Q1 to US$12.9 million in Q4, is used to show how earnings over the year line up with that stronger trailing margin.

- Forecast revenue growth of around 6.3% per year is also used in that bullish argument to suggest that maintaining margins near current levels would keep a sizeable share of those extra revenues flowing through to profit.

Valuation Signals Pull Both Ways

- At a share price of US$37.13, the stock trades on a P/E of about 11.7x, very close to the 11.7x US banks industry average, while the DCF fair value is given as US$46.49, which is about 20.1% above the current price.

- Critics focus on the forecast earnings growth rate of about 6.9% per year and revenue growth of about 6.3% per year, both described as slower than broader US market averages, and they argue that a P/E roughly in line with peers means the key difference in the story is the DCF fair value gap rather than a clear advantage on simple multiples.

- Because the P/E is only slightly above the peer average of 11.6x, bears question whether the roughly 20.1% discount to the DCF fair value is enough on its own to offset those slower growth forecasts.

- On the other hand, the combination of that DCF gap plus the 2.69% dividend yield is seen by some as a reason to still consider the shares when comparing to other banks with similar growth and P/E profiles.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Sierra Bancorp's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Some investors are uneasy that Sierra Bancorp's forecast earnings and revenue growth rates are described as slower than broader US market averages while its P/E sits close to peers.

If that slower growth profile gives you pause, use our CTA_SCREENER_STABLE_GROWTH to quickly focus on companies with more consistent revenue and earnings trends across different conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.