يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

SiteOne Revenue Growth Tests Margin Story As Earnings Per Share Slip

SiteOne Landscape Supply, Inc. SITE | 151.40 | +0.65% |

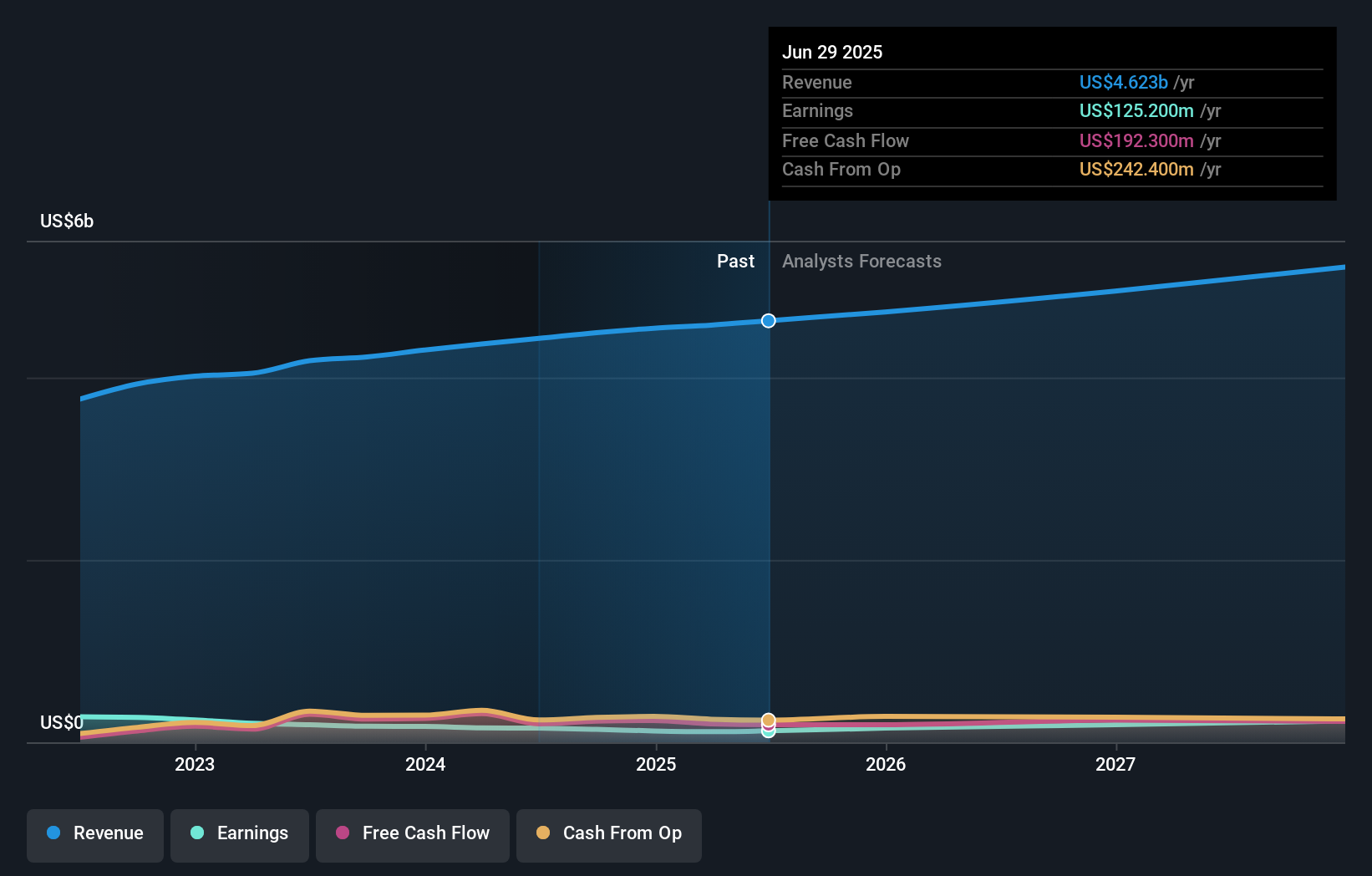

- SiteOne Landscape Supply (NYSE:SITE) is reporting organic sales growth alongside declining earnings per share.

- This disconnect is putting a spotlight on how the business converts revenue into profit.

- Management is signaling that operational changes or potential mergers and acquisitions could be on the table.

For investors watching NYSE:SITE, the current share price of $147.09 comes with a mixed picture. The stock is up 17.6% over the past month and 17.6% year to date, yet the 3-year return of a 4.4% decline and 5-year return of a 13.3% decline point to a tougher longer-term journey.

The tension between higher sales and softer earnings per share suggests the business may be entering a decision point for how it grows next. Investors may want to watch whether management focuses on efficiency changes, acquisitions, or a mix of both, as those moves could reshape the risk and return profile of NYSE:SITE over time.

Stay updated on the most important news stories for SiteOne Landscape Supply by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on SiteOne Landscape Supply.

Organic sales growth alongside a 4.9% annual fall in earnings per share over the past two years suggests SiteOne is bringing in more revenue but getting less profit out of each extra dollar. For a distributor that competes with names like Pool Corporation and Builders FirstSource, that points squarely to cost discipline, pricing, mix of products, and acquisition integration as key pressure points to watch.

SiteOne Landscape Supply Narrative in Focus

The existing bullish and bearish narratives on SiteOne both focus heavily on margin improvement from branch upgrades, acquisitions, and digital sales. This makes the current gap between revenue and earnings a useful real world test of those storylines. If management can translate organic growth into better profitability through its focus-branch programs, digital tools, and category mix, that would align more with the constructive narrative. Prolonged margin strain would lean toward the cautious view built around regulatory and competitive headwinds.

Risks and rewards investors should weigh

- ⚠️ Earnings per share declining while revenue rises points to pressure on margins or cost structure, which could limit profit growth if not addressed.

- ⚠️ Integration risk from past and future acquisitions may keep returns on invested capital in check if acquired branches do not reach group profit levels quickly.

- 🎁 Resilient maintenance-related demand and organic sales growth provide a base of revenue that can support improvement efforts if efficiency gains take hold.

- 🎁 Company initiatives around branch performance and digital sales, if effective, create room for earnings to better reflect top-line trends over time.

What to watch next

From here, it is worth tracking whether SiteOne’s future updates show earnings catching up with sales through better branch economics, tighter cost control, or more selective M&A. If you want a broader mix of views on how this could play out, check community narratives on SiteOne’s dedicated page to see how different investors are framing the risk and reward trade off.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.