يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

SmartStop Self Storage REIT (SMA) Valuation Check As Recent Trading Highlights A Possible Discount

SmartStop Self Storage REIT, Inc. SMA | 31.21 | -0.73% |

SmartStop Self Storage REIT (SMA) has been drawing attention after recent trading, with the stock last closing at $32.22. Short term returns are mixed, which has some investors revisiting fundamentals and valuation.

That recent 1-day share price return of 1.77% and 7-day share price return of 4.75% sit against a year to date share price return of 4.75%, while the 90-day share price return of 7.71% indicates that momentum has been fading since earlier in the quarter.

If this price action has you reassessing your options, it could be a good moment to broaden your search with fast growing stocks with high insider ownership for other ideas with strong insider alignment.

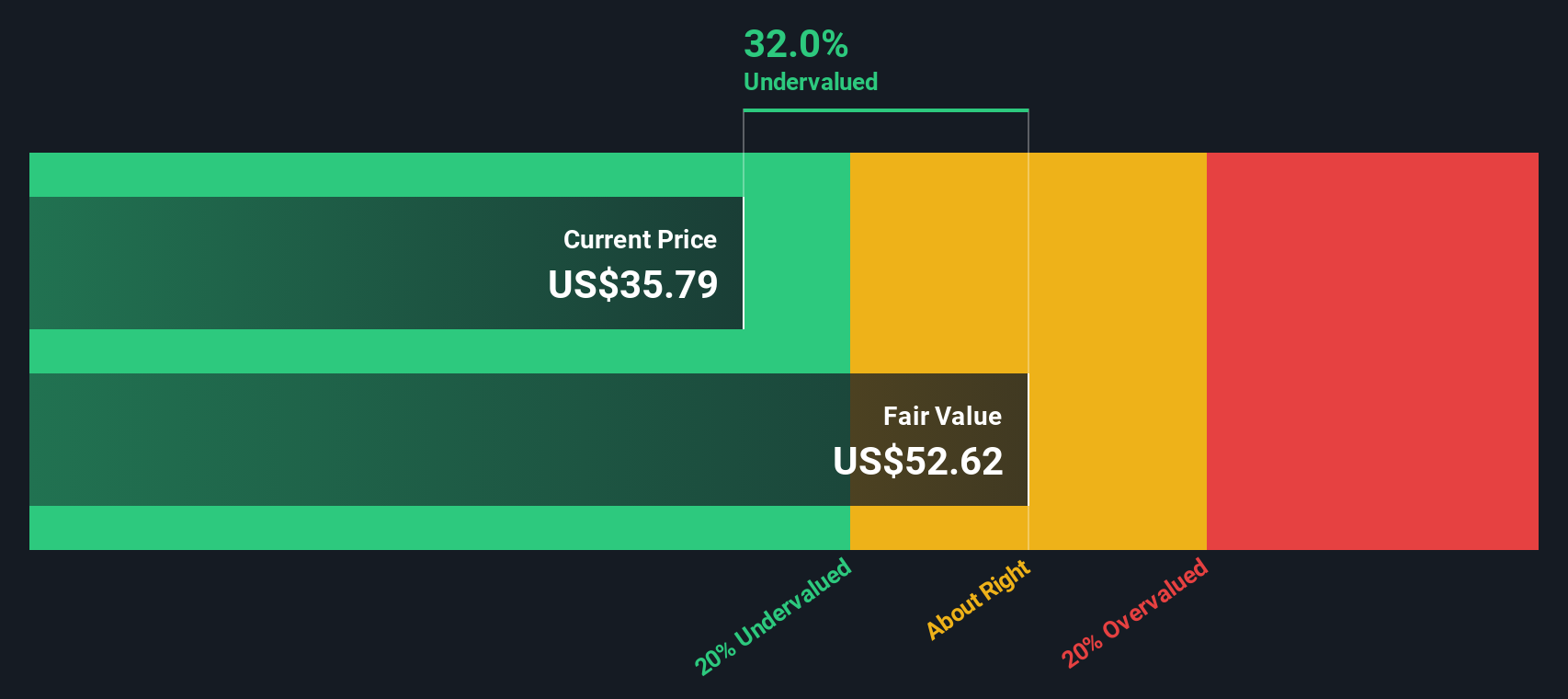

With SmartStop trading at $32.22 alongside a reported intrinsic discount of 47% and a roughly 19% gap to the latest analyst price target, it is fair to ask: is there genuine upside here, or is the market already accounting for future growth in the current price?

Price to Sales of 7x: Is it justified?

SmartStop Self Storage REIT is trading at a P/S of 7x, based on its current US$32.22 share price, which sits close to peers on this metric but above the level implied by some valuation checks.

The P/S ratio compares the company’s market value to its revenue, so for every dollar of sales, investors are currently paying about 7 times that amount. For self storage REITs, this kind of revenue based yardstick is often used because earnings can be distorted by property level accounting items and the timing of acquisitions or developments.

According to Simply Wall St, SmartStop is trading at 47% below an estimated fair value of US$60.80 using the SWS DCF model. However, its 7x P/S is described as expensive versus an estimated fair P/S of 4.6x. At the same time, that same 7x P/S is viewed as reasonable when set against a peer average of 7.5x and only slightly higher than the wider US Specialized REITs industry at 6.9x. This paints a mixed picture of how much optimism is already embedded in the current revenue multiple.

Against the US Specialized REITs industry average P/S of 6.9x, SmartStop’s 7x sits only a touch higher, suggesting investors are not paying a huge premium relative to the sector. However, compared with the estimated fair P/S of 4.6x, the current valuation implies a much richer multiple than the level quantitative fair value work points to as a potential anchor.

Result: Price-to-Sales of 7x (ABOUT RIGHT)

However, you still need to weigh risks such as the recent 90-day share price decline of 7.71% and the net income loss of US$15.8 million against any perceived discount.

Another View: DCF Points to a Deeper Discount

If you put the P/S ratio to one side and look at the SWS DCF model instead, you get a very different picture. On that view, SmartStop’s estimated fair value sits at US$60.80 per share, around 47% above the current US$32.22 price. This raises a simple question: is the market underestimating the cash generation story here?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out SmartStop Self Storage REIT for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 879 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own SmartStop Self Storage REIT Narrative

If you see the numbers differently or want to stress test your own assumptions against the data, you can build a personalised SmartStop thesis in just a few minutes by starting with Do it your way.

A great starting point for your SmartStop Self Storage REIT research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

If you are weighing what to do next, do not stop with a single REIT. Broaden your watchlist and let the data surface fresh possibilities.

- Start hunting for mispriced opportunities by reviewing these 879 undervalued stocks based on cash flows that may offer a different balance of price and fundamentals.

- Tap into the growth story around artificial intelligence with these 28 AI penny stocks that are tied to real business models, not just hype.

- Position yourself early in emerging themes by scanning these 79 cryptocurrency and blockchain stocks that sit at the intersection of listed equities and digital assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.