يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Soleno Therapeutics (SLNO): Valuation in Focus After Scorpion Capital Report and Legal Probes on VYKAT XR

Soleno Therapeutics Inc SLNO | 50.80 | -2.31% |

After a critical report from Scorpion Capital cast doubt on the safety and data integrity of Soleno Therapeutics’ sole drug, VYKAT XR, shares in Soleno Therapeutics (SLNO) quickly declined. The news also triggered legal investigations from law firms including Hagens Berman and Bragar Eagel & Squire, which put investor confidence to the test.

It’s been a volatile year for Soleno Therapeutics, with dramatic swings driven by both bullish clinical expectations and recent controversy around VYKAT XR’s safety. While the latest sharp drop reflects renewed risk concerns, the 39% year-to-date share price return and 16% total shareholder return over the past twelve months still point to longer-term momentum, especially in light of its remarkable 4,693% three-year total shareholder return.

If news-driven moves in biotech have you reconsidering your watchlist, now is a great time to broaden your scope and discover See the full list for free.

With Soleno shares still trading at a steep discount to analyst price targets despite headline risks, the question now is whether this creates a compelling buying opportunity or if the market has already accounted for the company’s future growth potential.

Price-to-Book of 14.1x: Is it justified?

Soleno Therapeutics trades with a price-to-book ratio of 14.1x, sharply higher than peers and the US Biotechs industry average. This suggests investors are paying a premium for the stock despite its current unprofitability.

The price-to-book ratio compares a company’s market value to its book value and provides a quick gauge of how the market values its assets. For biotech firms, which often have little in the way of tangible assets during development stages, high price-to-book ratios are not uncommon. However, they may signal high growth expectations or investor enthusiasm regarding future milestones.

Soleno’s ratio of 14.1x is more than five times the US Biotechs industry average of 2.6x, and it also exceeds the peer group average of 10.4x. This significant premium points to the market factoring in optimism around Soleno’s pipeline, but also highlights that the market’s valuation sits well above historic sector norms.

Result: Price-to-Book of 14.1x (OVERVALUED)

However, regulatory challenges or further negative news flow around VYKAT XR’s safety could quickly undermine the bullish outlook for Soleno Therapeutics.

Another View: Discounted Cash Flow Perspective

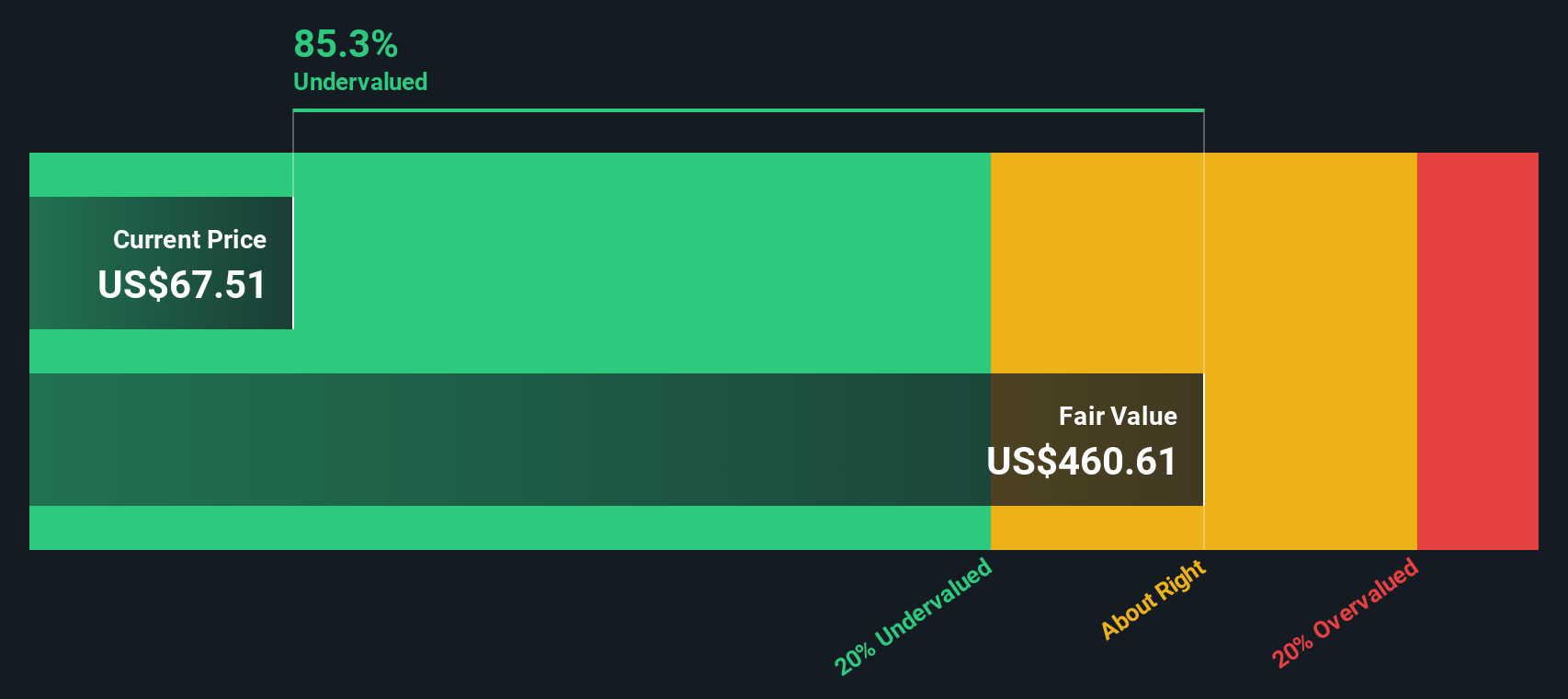

While the market is assigning a steep premium to Soleno based on its high price-to-book ratio, our DCF model estimates the company's fair value at $466.24 per share, which is around 86% higher than the current price. This stark undervaluation presents a very different scenario compared to what simple multiples suggest. Could the pessimism around recent headlines be masking a deeper opportunity?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Soleno Therapeutics for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Soleno Therapeutics Narrative

If you want to take a hands-on approach and reach your own conclusions, you can assemble your own narrative from the data in just a few minutes. Do it your way

A great starting point for your Soleno Therapeutics research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Stay ahead of the market by acting now. The best opportunities rarely wait, so don’t miss your chance to find companies on the verge of major growth.

- Uncover hidden potential with these 899 undervalued stocks based on cash flows to spot stocks trading below their true worth before they attract wider attention.

- Earn consistent income with these 19 dividend stocks with yields > 3%, which features companies offering high yields and solid fundamentals that could strengthen your portfolio.

- Tap into the future of digital finance as you track these 79 cryptocurrency and blockchain stocks, which is poised for major breakthroughs in blockchain and cryptocurrency innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.