يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Sphere Entertainment (SPHR) EPS Loss Rekindles Profitability Concerns Despite Growth Narratives

Sphere Entertainment Co. Class A SPHR | 114.24 | -0.91% |

Sphere Entertainment (SPHR) has just posted its FY 2025 third quarter numbers, with revenue of US$262.5 million and a basic EPS loss of US$2.80, alongside a net income loss of US$101.2 million, setting a cautious tone around profitability. Over the past six reported quarters, revenue has moved between US$227.9 million and US$321.3 million, while basic EPS has ranged from a loss of US$2.95 to a gain of US$4.18, giving investors a mixed picture on earnings power. With trailing 12 month results still pointing to sizeable losses, the latest release keeps the focus squarely on whether margins can eventually turn the corner rather than on headline growth.

See our full analysis for Sphere Entertainment.With the quarter now on the books, the next step is to see how these numbers compare with the most widely held narratives about Sphere Entertainment, and which of those stories hold up under closer scrutiny.

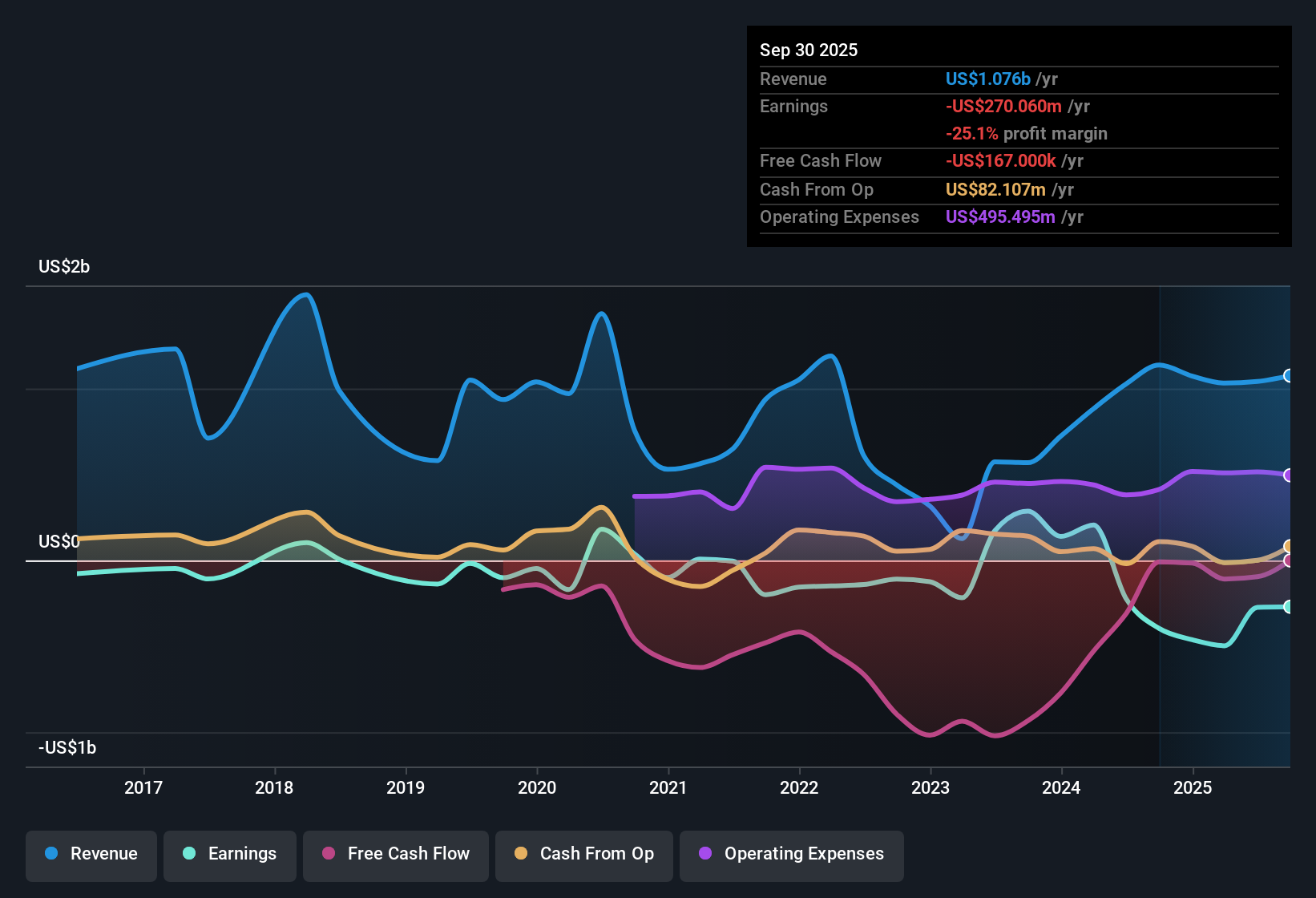

Losses Persist Despite US$1.1b In TTM Revenue

- Over the last twelve months, Sphere generated US$1.1b in revenue and reported a net income loss of US$270.1 million, with basic EPS at a loss of US$7.43.

- Consensus narrative sees scalable, higher margin earnings over time from international Spheres and proprietary tech. However, the current trailing 12 month loss of US$270.1 million and a five year trend of losses worsening at about 24.6% a year show that margin pressure is still very real.

- Analysts are assuming revenue growth of about 6.5% a year in their consensus view. By contrast, the separate forecast set in the risk summary points to a modest revenue decline of 0.08% a year, so the top line path investors are using can differ from what trailing data suggests.

- The idea of future 9.4% industry level profit margins contrasts with the current loss making profile, where none of the trailing margin data is positive. As a result, the numbers today do not yet resemble the industry template that the consensus view is built around.

Premium P/S Multiple With DCF Upside Signal

- Sphere trades on a P/S of 3.8x compared with a peer average of 2.2x and a US Entertainment industry average of 1.5x. The current share price of US$115.72 sits below the DCF fair value estimate of US$193.96.

- Bulls argue that asset light global expansion and proprietary immersive tech justify a premium, and the 40.3% gap to the DCF fair value supports that view. At the same time, the higher P/S versus peers means the market already prices in stronger revenue or margin potential than the sector overall.

- The DCF framework uses that US$193.96 fair value. Investors who focus on discounted cash flows may see room between that figure and US$115.72, while those focused on multiples will notice the 3.8x sales mark relative to 2.2x peers.

- Because the company is unprofitable and is not expected to reach profitability in the next three years in the risk summary, traditional P/E based comparisons are less helpful right now. This pushes more attention onto sales based metrics and model based fair value estimates.

Growing Loss Trend Fuels Bear Concerns

- Trailing 12 month losses have expanded at about 24.6% a year over the past five years, and the latest annualised figure shows a loss of US$270.1 million alongside revenue expectations of a 0.08% annual decline in the risk summary.

- Bears highlight that heavy capital needs, rising costs and competition could cap future profitability. The combination of a growing loss trend with forecasts that still do not show profitability within three years aligns closely with that cautious view.

- The FY 2025 quarterly pattern, with losses in Q1 and Q3 and only one profitable quarter in Q2, sits beside the negative trailing 12 month EPS of US$7.43. This is a long way from the positive earnings figures used in both bullish and bearish 2028 scenarios.

- With revenue of just over US$1.0b in the latest trailing 12 month data and no positive margin metrics in the inputs, the concern that fixed costs and venue economics could keep net income under pressure is grounded in the reported figures, not just in opinion.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Sphere Entertainment on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? If this data points you in another direction, you can shape that view into your own narrative in just a few minutes, starting with Do it your way.

A great starting point for your Sphere Entertainment research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Explore Alternatives

Sphere Entertainment is still posting sizeable losses, with a US$270.1 million trailing 12 month net loss and no positive margin metrics yet in sight.

If you want ideas with less earnings uncertainty and a calmer risk profile, check out 84 resilient stocks with low risk scores and see how they compare to Sphere today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.