يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

SPX Technologies (SPXC): تحليل التقييم بعد عام قوي للأسهم

SPX Technologies, Inc. SPXC | 222.32 | +1.97% |

شهدت أسهم شركة SPX Technologies (SPXC) تحركات مثيرة للاهتمام مؤخراً. وقد يتساءل المستثمرون المتابعون للقطاع الصناعي عن أداء الشركة، لا سيما في ضوء مكاسبها القوية منذ بداية العام والتي بلغت 40%، وعائدها البالغ 23% خلال العام الماضي.

بعد ارتفاع قوي إلى 205.32 دولارًا، باتت شركة SPX Technologies محط أنظار المستثمرين، محققةً عائدًا على سعر السهم بنسبة 40% منذ بداية العام، وعائدًا إجماليًا بنسبة 23% على مدار اثني عشر شهرًا. ورغم تراجع الزخم خلال الأسبوع الماضي، إلا أن الأداء طويل الأجل يشير إلى استمرار التفاؤل بشأن آفاق الشركة.

إذا كنت مهتمًا باكتشاف أسماء بارزة ذات اتجاهات نمو وملكية مماثلة، فهذا وقت رائع لتوسيع منظورك واكتشاف الأسهم سريعة النمو ذات الملكية الداخلية العالية.

مع اقتراب الأسهم من مستويات قياسية وتجاوز المكاسب الأخيرة لمعظم القطاع، يتساءل المستثمرون عما إذا كانت أسهم شركة SPX Technologies تتداول بسعر مغرٍ أم أن التقييم الحالي يعكس بالفعل كل النمو المتوقع.

الرواية الأكثر شيوعًا: 10% أقل من قيمتها الحقيقية

تُقدّر معظم الروايات المتداولة قيمة أسهم شركة SPX Technologies بـ 229 دولارًا، أي بزيادة قدرها 10% عن سعر إغلاقها الأخير البالغ 205.32 دولارًا. وهذا يُمهّد الطريق لتوقعات إيجابية تستند إلى نمو الأرباح، والمشاريع القادمة، والمكانة المتميزة للشركة في السوق.

إن التوسع في حلول تبريد مراكز البيانات، والذي يتجلى في إطلاق جهاز OlympusV Max الجديد، والذي يلبي الطلب المتزايد بسرعة على البنية التحتية لمراكز البيانات واسعة النطاق والموفرة للطاقة، يضع شركة SPX في موقع يسمح لها بتوسيع سوقها المستهدف بشكل كبير وزيادة إيراداتها مع تسارع مشاريع مراكز البيانات فائقة السرعة حتى عام 2026. وهذا يدعم تحسين الإيرادات والأرباح على حد سواء بفضل تميز المنتجات ومتطلبات الهندسة العالية.

هل تريد معرفة سبب حصول شركة SPX Technologies على هذا التقييم المرتفع؟ يكمن السر في معيار أساسي واحد ضمن هذه التوقعات: معدل نمو طموح وتوقعات ربحية تنافس الشركات الرائدة في القطاع. ما الذي يقف وراء هذه التوقعات الطموحة للأرباح والمبيعات؟ اكتشف التفاصيل الكاملة لهذا التقييم واطلع على ما يبرر هذه القيمة العادلة المرتفعة.

النتيجة: القيمة العادلة 229 دولارًا (أقل من القيمة الحقيقية)

ومع ذلك، فإن تأخيرات المشاريع أو مشاكل التكامل الناتجة عن عمليات الاستحواذ الأخيرة قد تتحدى التوقعات القوية لشركة SPX Technologies وتدفع المحللين إلى إعادة النظر في توقعاتهم المتفائلة.

وجهة نظر أخرى: التقييم بمضاعفات الأرباح

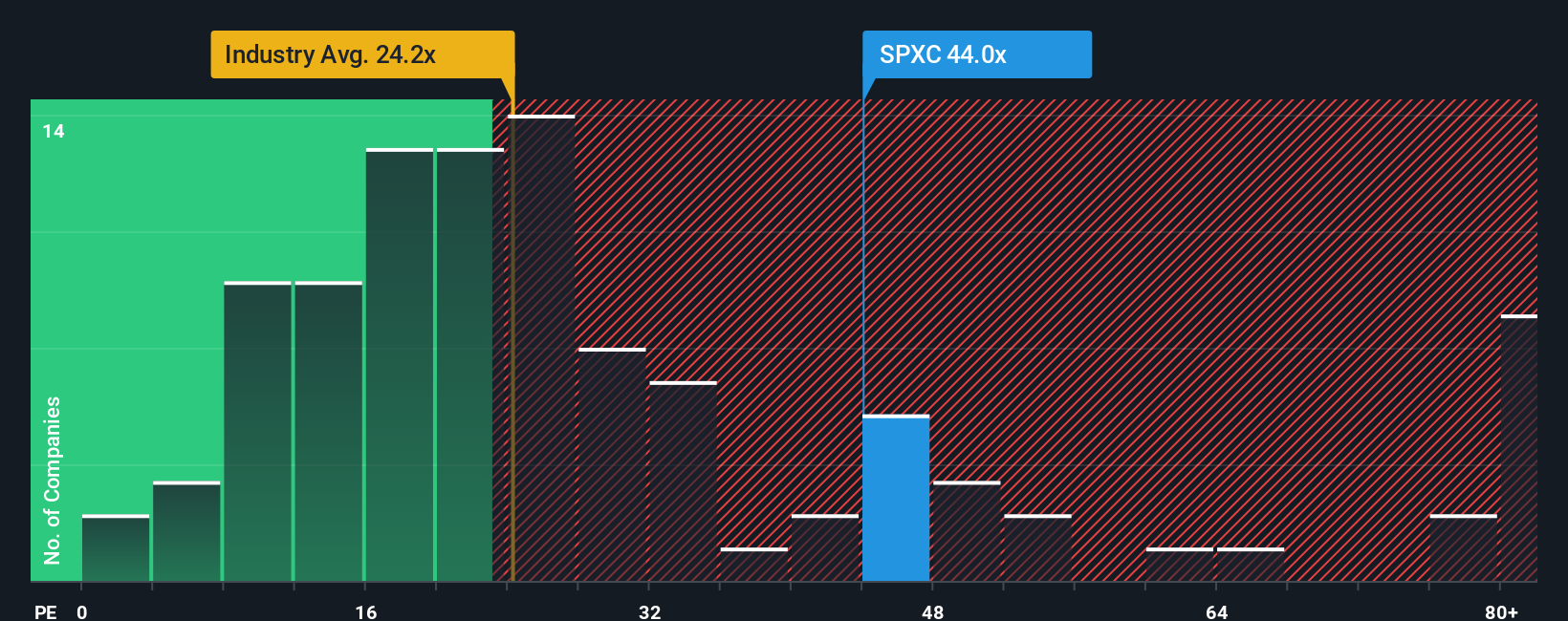

يُقدّم تحليل تقييم الشركة من خلال نسبة السعر إلى الأرباح منظورًا مختلفًا. تُتداول أسهم شركة SPX Technologies عند 45.7 ضعف الأرباح، وهو أعلى بكثير من متوسط قطاع الآلات في الولايات المتحدة البالغ 23.2 ضعف، وأعلى من نسبتها العادلة البالغة 29.3 ضعف. هذه الزيادة الكبيرة في السعر لا تترك مجالًا كبيرًا للخطأ في حال تعثّر نمو الشركة. فهل يُبرّر هذا المضاعف المرتفع للسهم، أم أنه ببساطة يتجاوز المؤشرات الأساسية؟

قم ببناء سردك الخاص بتقنيات SPX

إذا كنت ترى الأمور بشكل مختلف أو ترغب في التعمق في البيانات بنفسك، فمن السهل أكثر من أي وقت مضى إنشاء وجهة نظرك الخاصة في دقائق معدودة، فلماذا لا تفعل ذلك على طريقتك؟

تُعد نقطة البداية الجيدة هي تحليلنا الذي يسلط الضوء على 3 مكافآت رئيسية يتفاءل بها المستثمرون فيما يتعلق بشركة SPX Technologies.

هل تبحث عن المزيد من أفكار الاستثمار؟

لماذا تحصر نفسك في فرصة واحدة فقط بينما قد تفوتك فرص استثمارية أخرى واعدة؟ دع أداة الفرز من Simply Wall Street تُظهر لك ما يفوتك الآن.

- استغل إمكانات التدفق النقدي القوية وحقق أقصى قدر من العوائد طويلة الأجل من خلال مراجعة هذه الأسهم الـ 897 المقومة بأقل من قيمتها الحقيقية بناءً على التدفقات النقدية للكشف عن الشركات التي لم يقدرها السوق بشكل كامل بعد.

- انطلق في ثورة الذكاء الاصطناعي وابقَ في الطليعة من خلال الاطلاع على هذه الأسهم الـ 27 الرخيصة التي تقود الاختراقات في مجال الأتمتة والبيانات وتكنولوجيا الجيل القادم.

- عزز استراتيجية دخلك السلبي من خلال فرص موثوقة ذات عائد مرتفع في هذه الأسهم الخمسة عشر التي توزع أرباحاً بنسبة تزيد عن 3% ، مما يساعد أموالك على العمل بجدية أكبر من أجلك.

هذا المقال من Simply Wall St ذو طبيعة عامة. نقدم تعليقاتنا بناءً على البيانات التاريخية وتوقعات المحللين فقط، باستخدام منهجية محايدة، ولا يُقصد بمقالاتنا أن تكون نصائح مالية. لا يُشكل هذا المقال توصيةً بشراء أو بيع أي سهم، ولا يأخذ في الاعتبار أهدافك أو وضعك المالي. نهدف إلى تزويدك بتحليلات طويلة الأجل مدفوعة بالبيانات الأساسية. يُرجى ملاحظة أن تحليلنا قد لا يأخذ في الاعتبار آخر إعلانات الشركات الحساسة للسعر أو المعلومات النوعية. لا تمتلك Simply Wall St أي أسهم في أي من الشركات المذكورة.