يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Stagnant Sales And EPS Declines Might Change The Case For Investing In ePlus (PLUS)

ePlus inc. PLUS | 81.95 | -0.98% |

- Over the past two years, ePlus has reported stagnant sales, a forecast 2.1% revenue decline over the next 12 months, and a 5.5% annual drop in earnings per share, raising fresh concerns about its growth outlook.

- This combination of flat top-line performance and consistent earnings pressure points to deeper challenges in sustaining demand and profitability across the business.

- We’ll now explore how ePlus’s stagnating sales shape its investment narrative and what this could mean for investors weighing its prospects.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 23 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is ePlus' Investment Narrative?

To own ePlus today, you have to believe that a relatively mature, profitable IT solutions business can re-ignite growth while managing through a period of pressure on both revenue and earnings. The recent update pointing to flat sales over two years, a forecast 2.1% revenue decline in the next 12 months, and a 5.5% annual drop in EPS sharpens the focus on near term catalysts: execution on higher margin services, disciplined acquisitions, and ongoing buybacks and dividends. These were already central to the story, but the new data suggests they may now be doing more work just to hold the line rather than drive expansion. At the same time, it brings existing risks into sharper relief, especially the possibility that demand softness and shrinking profitability persist longer than investors expect.

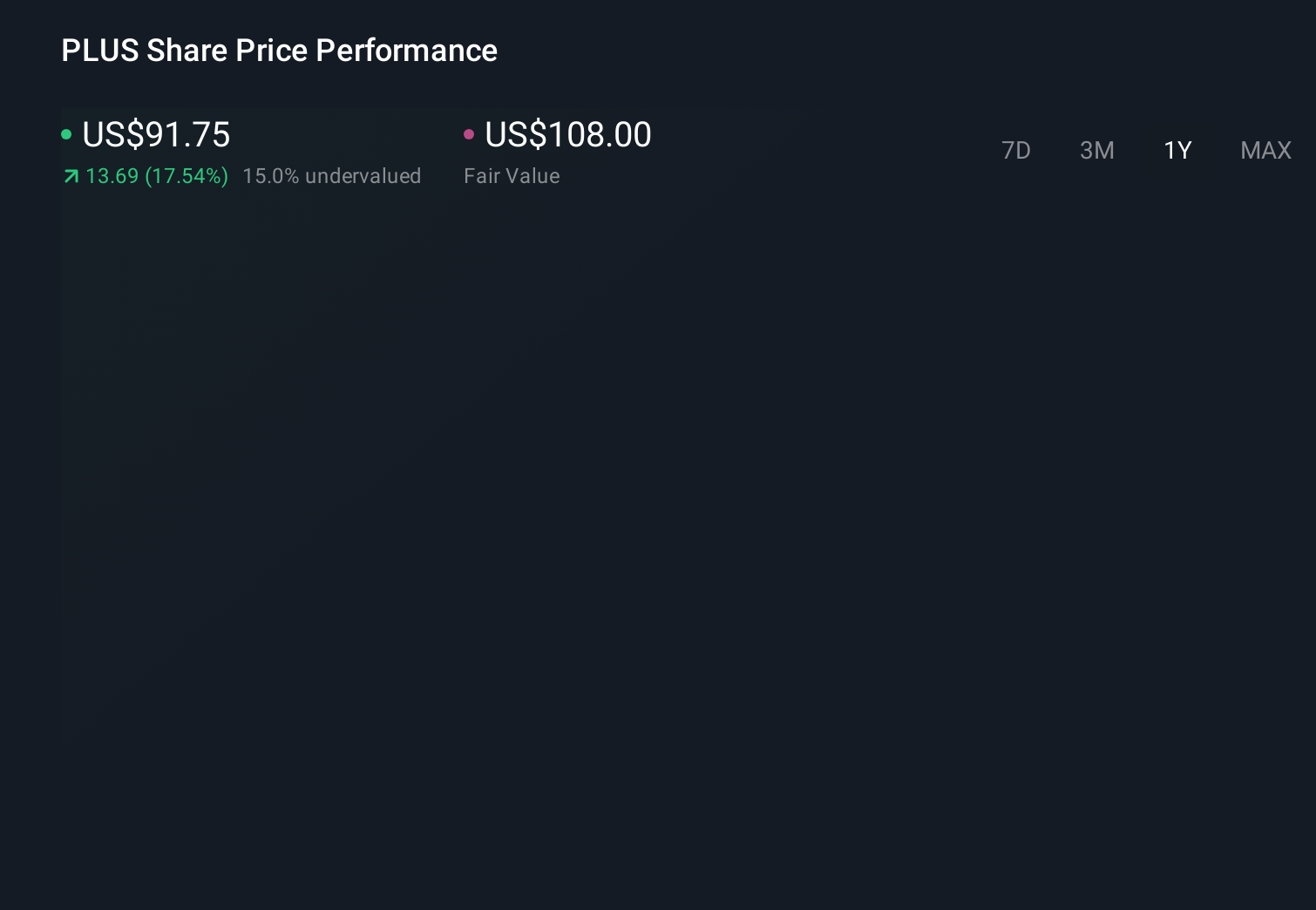

However, one risk in particular now looks more pressing than it did before this update. ePlus' share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore 2 other fair value estimates on ePlus - why the stock might be worth as much as 24% more than the current price!

Build Your Own ePlus Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ePlus research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free ePlus research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ePlus' overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 109 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.