يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Sterling Infrastructure (STRL) Is Up 16.4% After Earnings Revisions and Expansion Plans Fuel Growth Outlook

Sterling Construction Company, Inc. STRL | 322.91 | +2.46% |

- Sterling Infrastructure recently drew analyst and investor attention following upward earnings estimate revisions, an expected 41.6% increase in quarterly EPS, and optimism over strong demand for infrastructure projects.

- This focus on high-value markets such as data centers and manufacturing facilities, along with plans for an acquisition to boost its electrical and mechanical services, further highlights the company's growth ambitions and multi-year revenue visibility.

- With analysts highlighting upward earnings revisions, we'll explore how this shapes Sterling Infrastructure's broader investment case.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Sterling Infrastructure Investment Narrative Recap

To be a shareholder in Sterling Infrastructure, you need to believe in the durability of booming e-infrastructure demand and Sterling's execution in data center and manufacturing projects. While upward EPS revisions and analyst optimism point to positive momentum, the most important short-term catalyst remains sustained project backlog conversion, and the biggest risk is any slowdown in hyperscale tech capital expenditure or mega-project awards. The latest news confirms continued earnings strength but does not materially shift these fundamental drivers.

Among recent developments, Sterling's raised full-year 2025 guidance stands out, reflecting confidence in demand and revenue visibility. This aligns with increased analyst expectations for quarterly EPS growth and supports revenue forecasts tied to ongoing infrastructure and e-commerce trends. Continued positive estimate revisions and profitability, highlighted by both corporate and market sources, underpin the company's key catalysts at this time.

However, if hyperscale data center spend slows or mega-project awards become less frequent, investors should be alert to the...

Sterling Infrastructure is projected to reach $2.6 billion in revenue and $276.4 million in earnings by 2028. This outlook is based on expected annual revenue growth of 6.9% and a decrease in earnings of $8.6 million from the current $285.0 million.

Uncover how Sterling Infrastructure's forecasts yield a $355.00 fair value, a 5% downside to its current price.

Exploring Other Perspectives

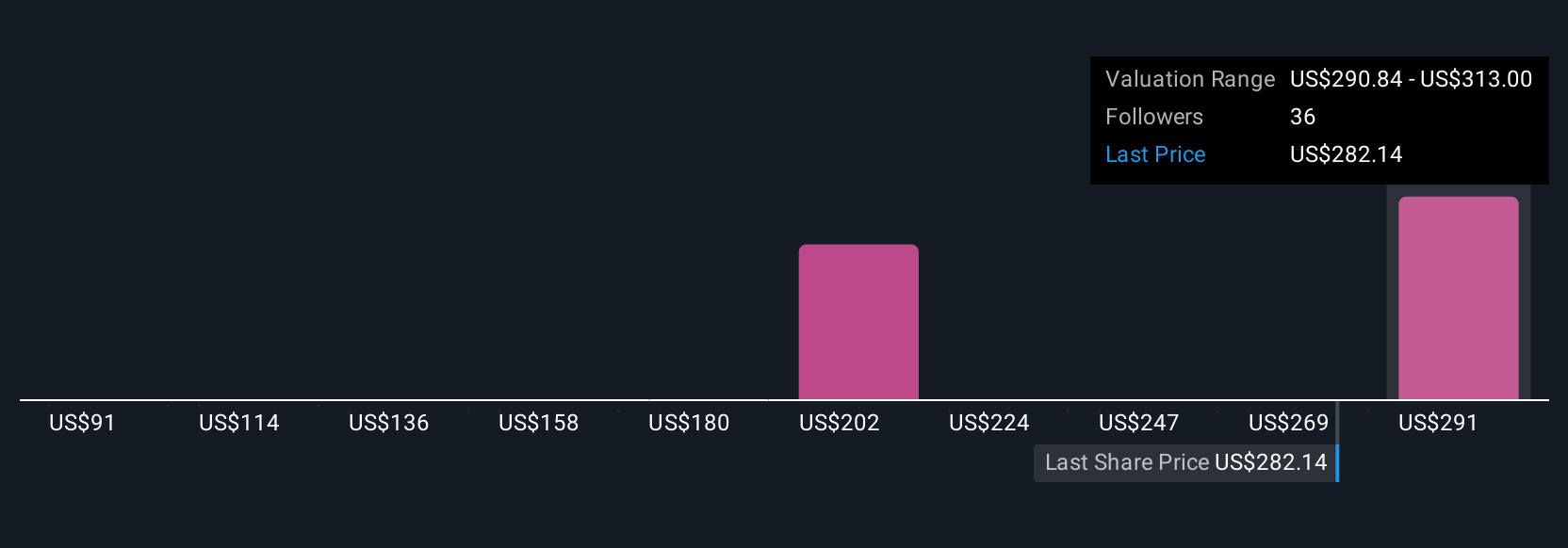

Community fair value estimates for Sterling Infrastructure range widely from US$113.55 to US$372.64, based on six analyses from the Simply Wall St Community. With most estimates below the current share price, consider how sustained backlogs and strong EPS forecasts tie into these different outlooks and what they could mean for future expectations.

Explore 6 other fair value estimates on Sterling Infrastructure - why the stock might be worth as much as $372.64!

Build Your Own Sterling Infrastructure Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sterling Infrastructure research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Sterling Infrastructure research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sterling Infrastructure's overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- Rare earth metals are the new gold rush. Find out which 31 stocks are leading the charge.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.