يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

The Bull Case For Millicom (TIGO) Could Change Following Strategic Exit From Africa And ColTel Merger Shift

Millicom International Cellular SA TIGO | 66.95 | +2.67% |

- In recent months, Millicom International Cellular has undertaken a significant transformation by exiting African operations, concentrating exclusively on Latin America, and arranging a major merger with ColTel in Colombia alongside a new EPM agreement.

- A key focus of this shift involves acquiring assets in dollarized economies, which may help Millicom reduce its exposure to currency risk across the region.

- We'll examine how Millicom's focus on Latin America and the proposed ColTel merger could alter its long-term investment outlook.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Millicom International Cellular Investment Narrative Recap

To own shares in Millicom International Cellular, I think you need to believe in the company's ability to successfully reshape its core business by focusing entirely on the Latin American telecom market, especially as it pursues the ColTel merger and reduces exposure to currency volatility by targeting dollarized assets. While these changes represent a meaningful strategic pivot, the most important short-term catalyst, regulatory clearance for the ColTel merger, remains, and the biggest risk right now, execution missteps or regulatory setbacks, doesn't appear to be materially altered by the recent news.

Among the latest company announcements, the most relevant is the decision to approve a substantial interim dividend of US$2.50 per share for 2025–2026. This move underscores Millicom's continued commitment to returning capital to shareholders, even as it makes major adjustments to its portfolio, and aligns with one of the key catalysts: efforts to communicate balance sheet strength and capital allocation progress as the Latin American focus intensifies.

By contrast, investors should also be aware of lingering uncertainties related to regulatory scrutiny, which could...

Millicom International Cellular is projected to generate $5.9 billion in revenue and $628.3 million in earnings by 2028. This scenario assumes annual revenue growth of 1.7%, but a decline in earnings of $326.7 million from the current $955.0 million.

Uncover how Millicom International Cellular's forecasts yield a $45.57 fair value, a 8% downside to its current price.

Exploring Other Perspectives

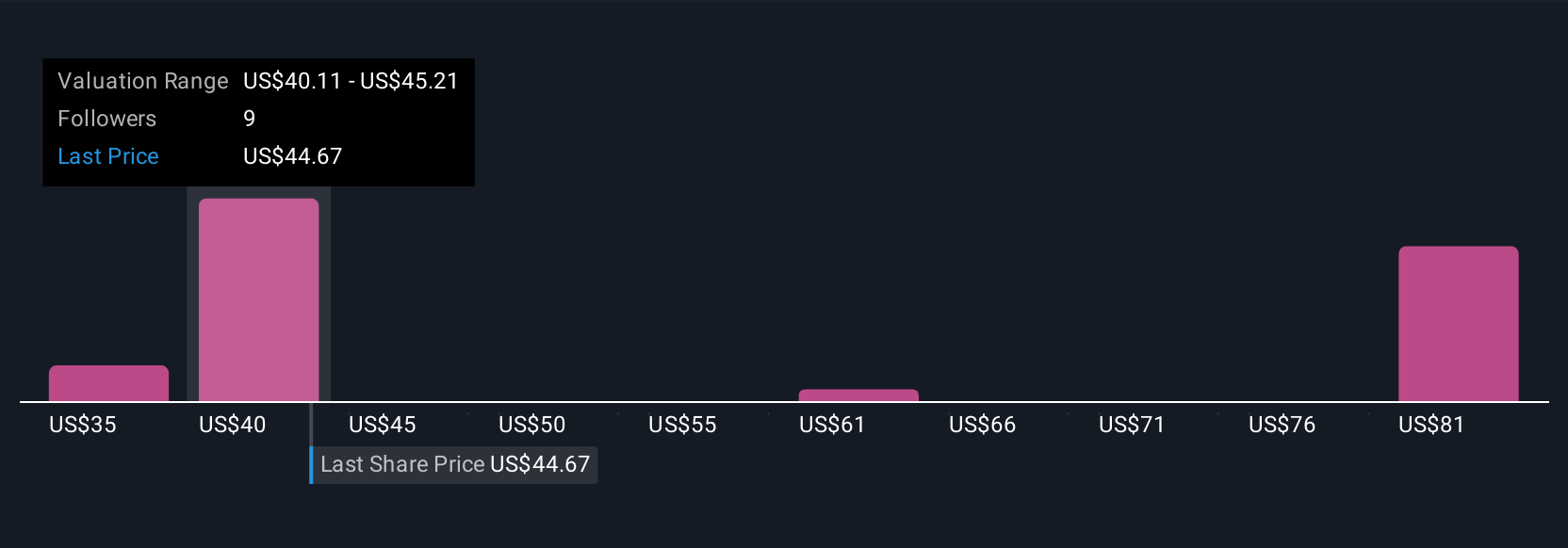

Seven retail investors in the Simply Wall St Community provided fair value estimates for Millicom, ranging from US$35 to US$88.65 per share. While opinions vary widely, these differing perspectives come as the company faces questions around elevated capital expenditure needs potentially outpacing revenue gains; consider reviewing multiple viewpoints before making decisions.

Explore 7 other fair value estimates on Millicom International Cellular - why the stock might be worth as much as 78% more than the current price!

Build Your Own Millicom International Cellular Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Millicom International Cellular research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Millicom International Cellular research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Millicom International Cellular's overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.