يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

The total return for Legacy Housing (NASDAQ:LEGH) investors has risen faster than earnings growth over the last five years

Legacy Housing LEGH | 20.43 | 0.00% |

If you buy and hold a stock for many years, you'd hope to be making a profit. Furthermore, you'd generally like to see the share price rise faster than the market. But Legacy Housing Corporation (NASDAQ:LEGH) has fallen short of that second goal, with a share price rise of 58% over five years, which is below the market return. However, more recent buyers should be happy with the increase of 39% over the last year.

While the stock has fallen 8.1% this week, it's worth focusing on the longer term and seeing if the stocks historical returns have been driven by the underlying fundamentals.

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

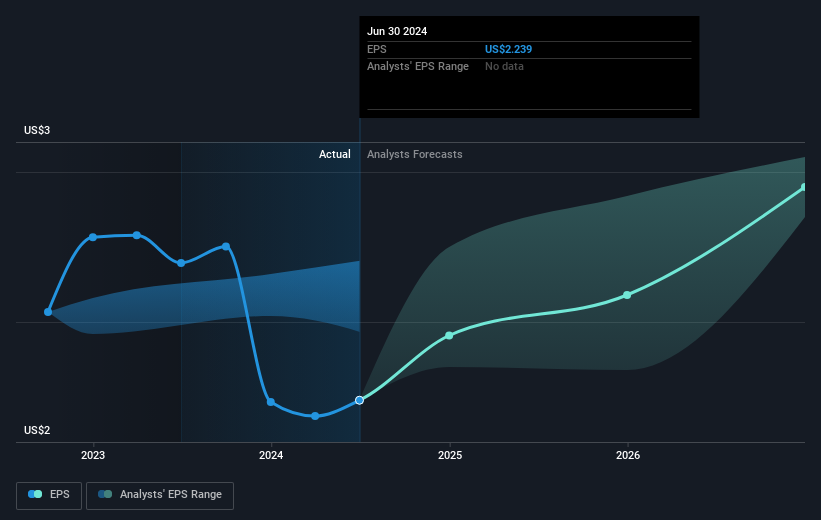

Over half a decade, Legacy Housing managed to grow its earnings per share at 15% a year. The EPS growth is more impressive than the yearly share price gain of 10% over the same period. So one could conclude that the broader market has become more cautious towards the stock. The reasonably low P/E ratio of 11.23 also suggests market apprehension.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. Dive deeper into the earnings by checking this interactive graph of Legacy Housing's earnings, revenue and cash flow.

A Different Perspective

Legacy Housing's TSR for the year was broadly in line with the market average, at 39%. That gain looks pretty satisfying, and it is even better than the five-year TSR of 10% per year. Even if the share price growth slows down from here, there's a good chance that this is business worth watching in the long term. Investors who like to make money usually check up on insider purchases, such as the price paid, and total amount bought. You can find out about the insider purchases of Legacy Housing by clicking this link.

Legacy Housing is not the only stock that insiders are buying. For those who like to find lesser know companies this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.