يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Timberland Bancorp (TSBK) Net Margin Strength Challenges Cautious Earnings Narratives

Timberland Bancorp, Inc. TSBK | 39.03 | +1.27% |

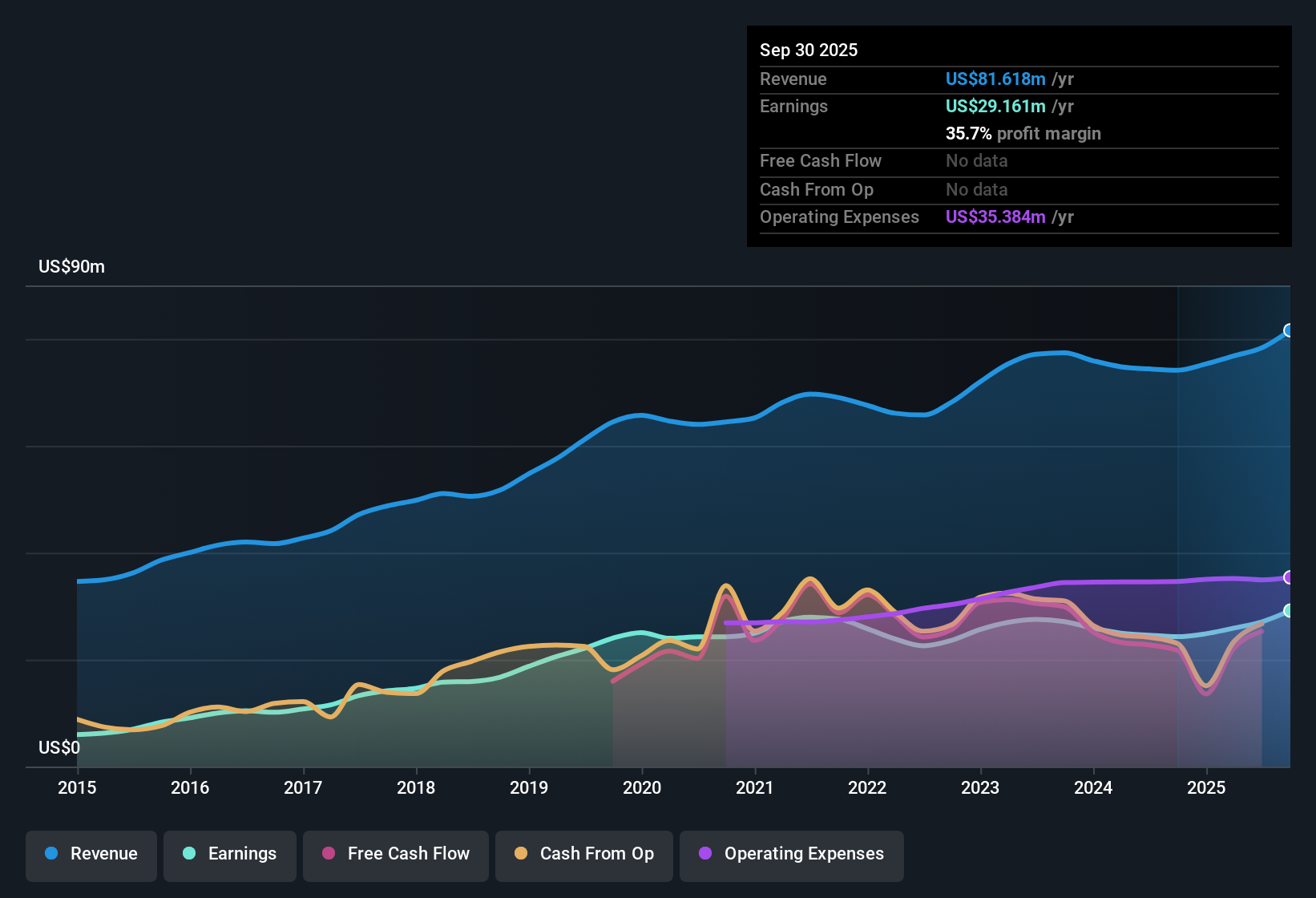

Timberland Bancorp (TSBK) opened fiscal 2026 with Q1 revenue of about US$21.7 million and basic EPS of roughly US$1.04, while trailing twelve month revenue stood at US$83.7 million and EPS at US$3.86, reflecting earnings growth of 22.8% over the past year. Over recent periods the company has seen quarterly revenue move from US$19.6 million in Q1 2025 to US$22.3 million in Q4 2025 before landing at US$21.7 million in Q1 2026, with basic EPS shifting from US$0.86 to US$1.07 and then to US$1.04 over the same stretch. With net profit margin at 36.4% and earnings described as accelerating relative to the five year trend, this set of results puts profitability at the center of how investors may read the latest quarter.

See our full analysis for Timberland Bancorp.With the numbers on the table, the next step is to see how this earnings profile lines up against the widely shared narratives around Timberland Bancorp and where those views might need a reset.

36.4% net margin puts profitability in focus

- Over the last 12 months Timberland Bancorp converted US$83.7 million of revenue into US$30.5 million of net income, which is consistent with the 36.4% net profit margin cited for the trailing period.

- What stands out for a bullish view is how this profitability lines up with the bank’s recent earnings track record, since trailing EPS of US$3.86 and 22.8% year over year earnings growth sit alongside a five year annualized earnings growth rate of 1.3%, which

- supports the idea that the most recent year looks stronger than the longer term average, based purely on the earnings figures given

- but also reminds you that the multi year pace, at 1.3% per year, has been much more modest than the latest 22.8% step up.

P/E of 9.7x and near 3% yield

- The trailing P/E of 9.7x sits below both the US Banks industry average of 11.8x and the peer average of 11.2x, while the trailing dividend yield stands at 2.99% based on the last 12 months.

- Supporters of a bullish angle often point to lower valuation multiples and income as a potential combination. In this case, the gap between Timberland Bancorp’s 9.7x P/E and the 11.8x industry marker, along with that 2.99% yield,

- leans toward the view that the market is applying a lower multiple than it does to the wider bank group based on the figures supplied

- yet still requires investors to judge whether the 1.3% five year annualized earnings growth rate justifies that discount even with the higher 22.8% earnings growth in the latest year.

Share price sits below DCF fair value

- The current share price of US$37.42 is described as trading about 39% below a DCF fair value estimate of US$61.38, based on the trailing 12 month cash flow inputs provided.

- For investors leaning bullish, the combination of a share price well below the US$61.38 DCF fair value and a 36.4% net margin

- supports the idea that the trailing financials alone paint a picture of earnings and margins that are stronger than the valuation gap might suggest

- while the 1.3% annualized earnings growth rate over five years gives a contrasting data point that some may weigh carefully against the implied upside in that DCF figure.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Timberland Bancorp's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Timberland Bancorp’s 1.3% five year annualized earnings growth rate sits well behind the latest 22.8% step up, raising questions about consistency.

If that uneven history makes you cautious, use our stable growth stocks screener (2180 results) to focus on companies that aim for steadier revenue and earnings progress through different periods.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.