يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

أرباح شركة Tower Semiconductor للعام المالي 2024: ربحية السهم الواحد تفوق التوقعات

Tower Semiconductor Ltd TSEM | 128.47 | +2.07% |

نتائج شركة تاور سيميكوندكتور ( ناسداك: TSEM ) للعام 2024

أهم النتائج المالية

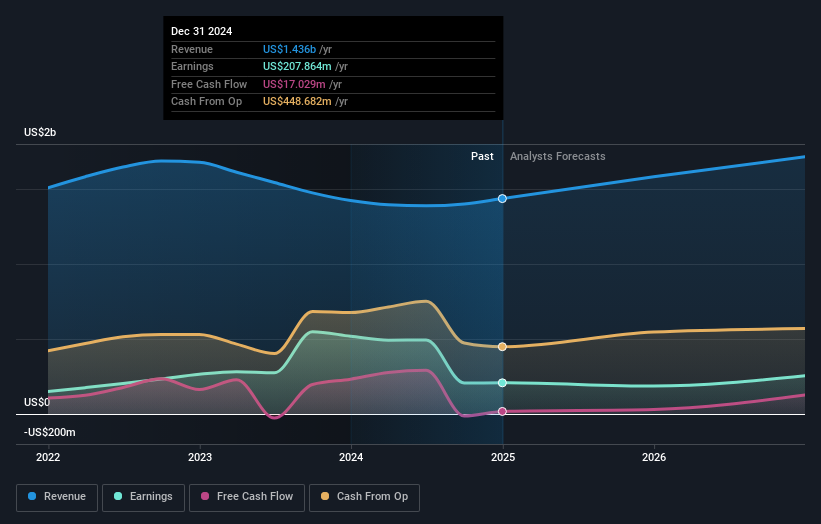

- الإيرادات: 1.44 مليار دولار أمريكي (ثابتة مقارنة بالسنة المالية 2023).

- صافي الدخل: 207.9 مليون دولار أمريكي (بانخفاض 60٪ عن السنة المالية 2023).

- هامش الربح: 14% (انخفاضاً من 36% في السنة المالية 2023).

- ربح السهم: 1.87 دولار أمريكي (انخفاضًا من 4.70 دولار أمريكي في السنة المالية 2023).

جميع الأرقام الموضحة في الرسم البياني أعلاه تخص فترة الاثني عشر شهرًا الماضية (TTM).

شركة تاور لأشباه الموصلات تتجاوز التوقعات في أرباحها الأولية للسهم

كانت الإيرادات متوافقة مع تقديرات المحللين. وتجاوزت ربحية السهم الواحد تقديرات المحللين بنسبة 1.5%.

وبالنظر إلى المستقبل، من المتوقع أن تنمو الإيرادات بنسبة 8.9٪ سنوياً في المتوسط خلال العامين المقبلين، مقارنة بتوقعات نمو بنسبة 17٪ لصناعة أشباه الموصلات في الولايات المتحدة.

انخفضت أسهم الشركة بنسبة 4.9% مقارنة بالأسبوع الماضي.

تحليل المخاطر

ينبغي عليك التعرف على علامة التحذير الوحيدة التي رصدناها في شركة تاور سيميكوندكتور .

هذا المقال من Simply Wall St ذو طبيعة عامة. نقدم تعليقاتنا بناءً على البيانات التاريخية وتوقعات المحللين فقط، باستخدام منهجية محايدة، ولا يُقصد بمقالاتنا أن تكون نصائح مالية. لا يُشكل هذا المقال توصيةً بشراء أو بيع أي سهم، ولا يأخذ في الاعتبار أهدافك أو وضعك المالي. نهدف إلى تزويدك بتحليلات طويلة الأجل مدفوعة بالبيانات الأساسية. يُرجى ملاحظة أن تحليلنا قد لا يأخذ في الاعتبار آخر إعلانات الشركات الحساسة للسعر أو المعلومات النوعية. لا تمتلك Simply Wall St أي أسهم في أي من الشركات المذكورة.