يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

United Fire Group (UFCS) Combined Ratio Of 92.3% Reinforces Underwriting Discipline Narrative

United Fire Group, Inc. UFCS | 38.53 | +1.18% |

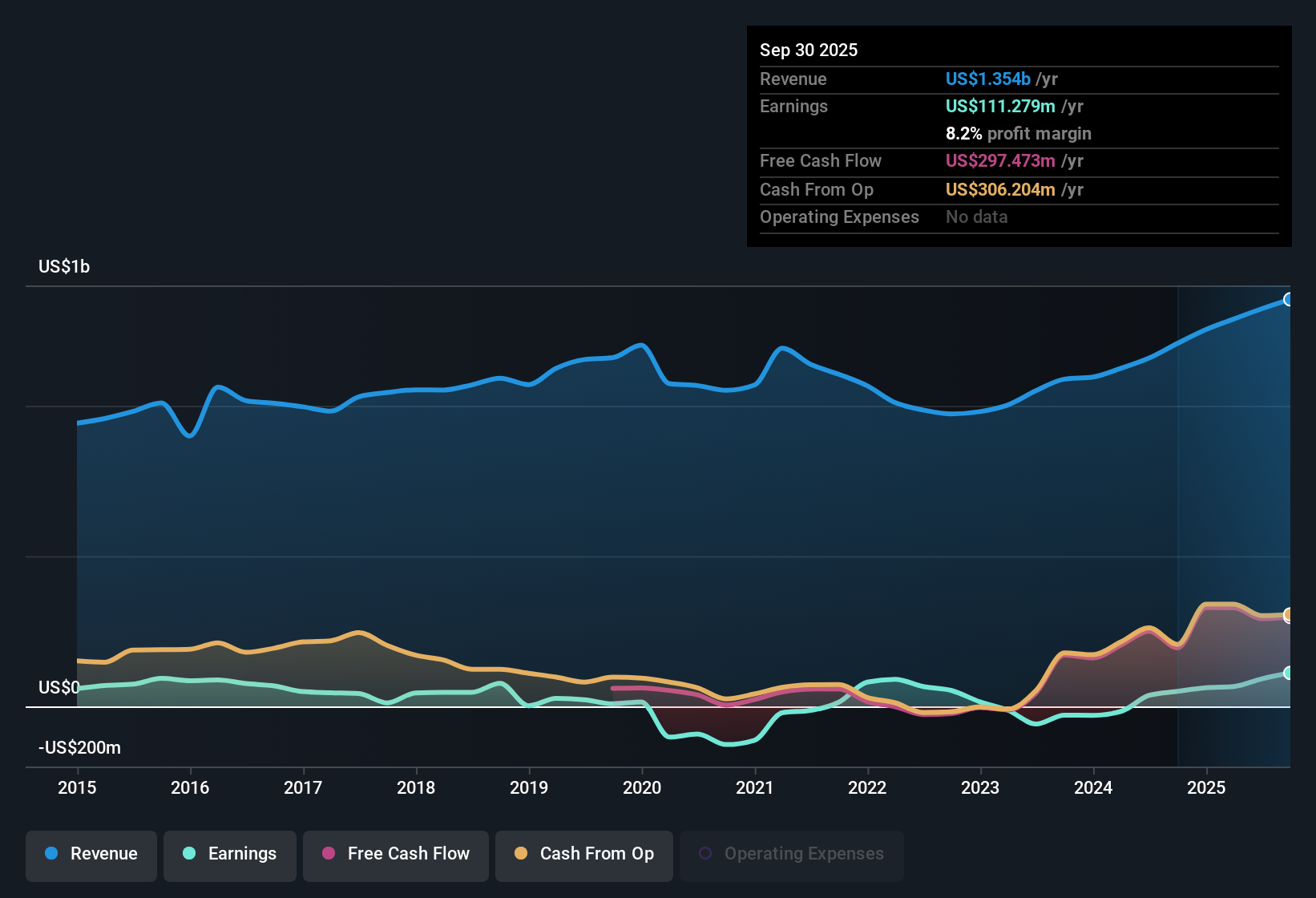

United Fire Group (UFCS) just closed out FY 2025 with fourth quarter revenue of US$365.8 million, Basic EPS of US$1.50 and net income of US$38.4 million, capped by a combined ratio of 92.3% that anchors the quality of those earnings. Over the past few quarters, the company has seen revenue move from US$333.2 million and EPS of US$1.24 in Q4 2024 to US$331.1 million and EPS of US$0.70 in Q1 2025. This was followed by mid year levels of US$335.5 million and EPS of US$0.90, before reaching US$354.0 million and EPS of US$1.54 in Q3 2025. With trailing 12 month EPS of US$4.63, revenue of about US$1.4 billion and a combined ratio of 94.8%, investors now have a clearer view of how underwriting discipline is feeding into margins.

See our full analysis for United Fire Group.With the headline numbers set, the next step is to see how this earnings run rate lines up with the big narratives around United Fire Group, from growth expectations to the durability of its profitability story.

94.8% combined ratio keeps underwriting tight

- On a trailing 12 month basis, United Fire Group recorded a combined ratio of 94.8% alongside net income of US$118.2 million on US$1.4b of revenue.

- Analysts' consensus narrative links this tighter underwriting and expense control to investments in underwriting technology and risk management, yet also flags that greater climate and catastrophe risks and higher reinsurance costs could pressure future loss ratios and make it harder to keep the combined ratio near current levels.

- Current catastrophe and compliance concerns sit against a backdrop where the combined ratio has been below 100% across all four quarters of 2025, ranging from 91.9% to 99.4%.

- That record lines up with the consensus view that underwriting discipline is supporting profits, even while exposure to catastrophe prone lines and higher reinsurance cost expectations remain a key theme.

TTM margin at 8.5% backs earnings story

- Trailing 12 month net profit margin stands at 8.5%, compared with 4.9% in the prior year, alongside Basic EPS of US$4.63 over the same period.

- Supporters of the bullish narrative point to this higher margin and 90.8% trailing earnings growth as evidence that investments in underwriting analytics, tighter catastrophe risk management and expense control are feeding into higher quality earnings, while still acknowledging that higher reinsurance and compliance costs could limit how far margins go from here.

- The combined ratio moving from 99.2% on a trailing basis in Q4 2024 to 94.8% by Q4 2025 aligns with claims that underwriting profits and lower catastrophe loss ratios are helping margins.

- At the same time, the consensus view still highlights rising regulatory and reserve related expenses as an ongoing drag, which is why margin expectations in external forecasts are lower than the recent 8.5% outcome.

Bulls argue that the 8.5% trailing margin and 90.8% earnings growth could mark a turning point for UFCS, while skeptics still focus on catastrophe and cost pressures that could cap future profitability. 🐂 United Fire Group Bull Case

Low 8.4x P/E versus DCF fair value

- UFCS trades on a P/E of 8.4x, below the peer average of 9x and the US insurance industry at 12.6x, yet the current share price of US$38.72 sits above the DCF fair value of US$12.35 and the analyst price target of US$37.50.

- Bears highlight this gap to the DCF fair value and the lower projected revenue growth rate of 8.2% per year versus the cited US market rate of 10.4% per year as signs that, even with a lower P/E, the stock may not be cheap once slower growth and an unstable dividend history are taken into account.

- The share price of US$38.72 is about 3.3% above the US$37.50 analyst price target, which is a small premium to a level analysts describe as roughly fair.

- At the same time, the large gap between the share price and the DCF fair value of US$12.35 is a key part of the cautious narrative, especially when combined with revenue growth lagging the 10.4% US market rate and a dividend track record that is described as unstable.

Skeptics point to the gap between the US$38.72 share price and the US$12.35 DCF fair value as a reason to question how durable the recent earnings run rate will be. 🐻 United Fire Group Bear Case

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for United Fire Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? If this earnings story sparks a different angle for you, shape that view into a full narrative in minutes, Do it your way.

A great starting point for your United Fire Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

United Fire Group’s story mixes tighter underwriting with concerns around slower projected revenue growth, a share price above DCF fair value and an unstable dividend record.

If those payout concerns and valuation questions give you pause, shift your attention to income ideas with 13 dividend fortresses and see how steadier cash returns could fit your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.