يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

United Therapeutics (UTHR): Assessing Valuation After Breakthrough TETON-2 Trial Success for Tyvaso in IPF

United Therapeutics Corporation UTHR | 501.29 | +0.20% |

If you have been weighing up what to do with United Therapeutics (UTHR), the company just made a splash with its latest announcement. The successful completion of its pivotal Phase 3 TETON-2 trial for nebulized Tyvaso in idiopathic pulmonary fibrosis (IPF) is a major development. Investors are now trying to parse what this could mean for future growth and whether the new data has shifted the risk-reward balance.

The market’s response has been swift, with shares up by 33% over the month and momentum carrying over into the past three months. This reflects renewed enthusiasm around the commercial prospects for Tyvaso in IPF. These returns cap off a strong year and build on United Therapeutics’ reputation for long-term gains, with recent company presentations and insider activity adding further layers to the story. The combination of strong trial data and fresh attention on the IPF opportunity is clearly resonating with investors, even as some insiders have chosen to sell shares into the move.

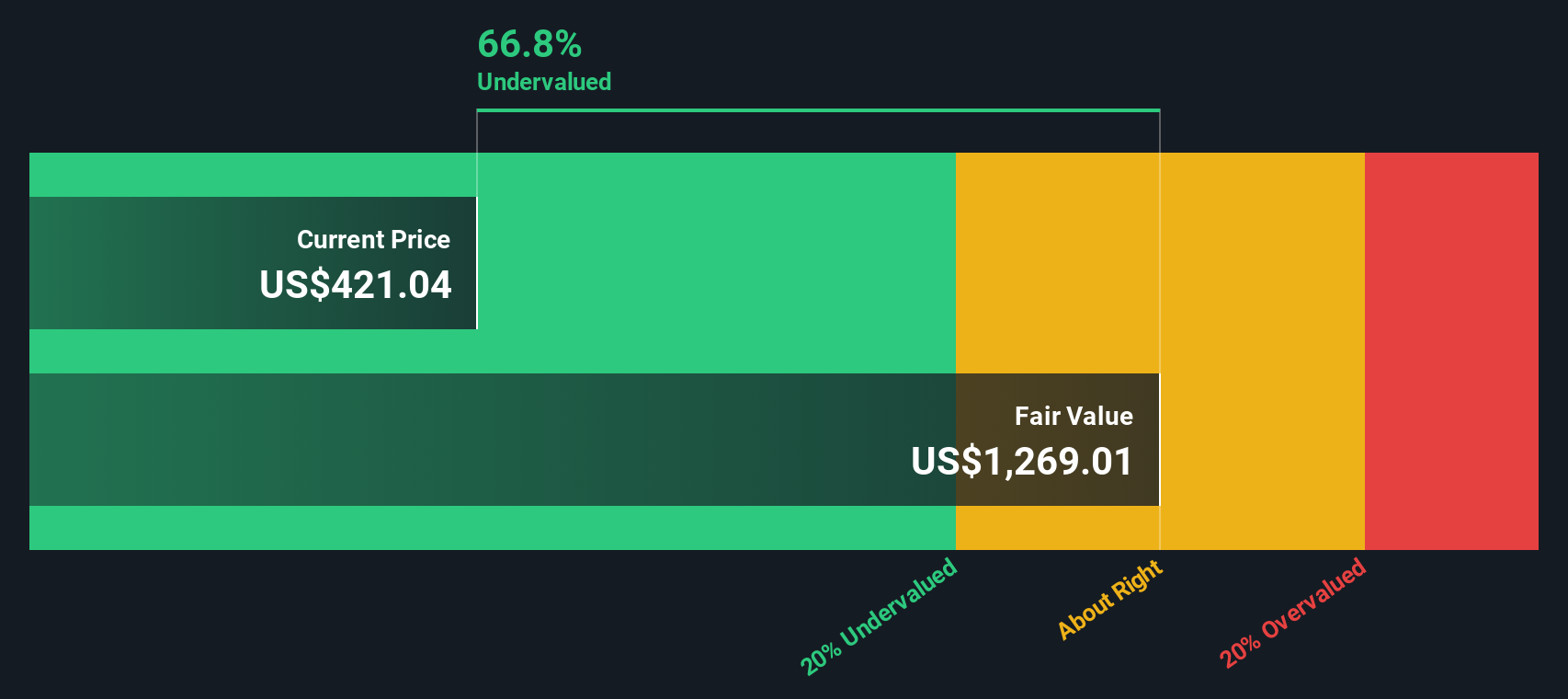

So after this run, are you looking at an undervalued biotech leader before its next growth phase, or is the market already pricing in all the upside?

Most Popular Narrative: 11.2% Undervalued

The most widely followed narrative for United Therapeutics contends that the stock trades at a meaningful discount to its calculated fair value, with room for upside based on projected growth and recent clinical momentum.

The company's innovation wave pipeline, including studies in progressive fibrosis, next-generation delivery platforms (oral, implantable), and organ manufacturing (xenotransplant/3D printing), positions United Therapeutics to benefit from the expanding focus on personalized and regenerative medicine. This can create new revenue streams and margin expansion opportunities as these long-horizon technologies approach clinical milestones and eventual commercialization.

Want to know why this narrative claims United Therapeutics is so undervalued? The story hinges on faster growth, robust profits, and a valuation multiple rarely seen outside high-flying sectors. Surprised? Dive into the narrative for the precise assumptions driving this eye-catching fair value.

Result: Fair Value of $466.82 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, the narrative could pivot if ongoing patent challenges succeed or if new competing therapies rapidly gain traction, which could pressure Tyvaso’s growth and pricing power.

Find out about the key risks to this United Therapeutics narrative.Another View: SWS DCF Model Weighs In

Looking beyond analyst targets, our DCF model paints a picture of United Therapeutics that also suggests the shares are undervalued. However, the question remains whether a cash flow-based approach can adequately account for all the clinical risks ahead.

Build Your Own United Therapeutics Narrative

If you think you see a different angle in the numbers or want to challenge the consensus, it's easy to build your own narrative around United Therapeutics in just a few minutes. Do it your way

A great starting point for your United Therapeutics research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let opportunity pass by. Simply Wall Street’s powerful screener tools uncover investment themes you might never have considered. Add an edge to your portfolio now by targeting the trends reshaping tomorrow’s markets:

- Spot overlooked potential with penny stocks boasting strong financials through our penny stocks with strong financials.

- Get ahead of the curve by targeting early winners in artificial intelligence with our AI penny stocks.

- Capture value by zeroing in on stocks trading below their cash flow potential using our undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.