يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Verra Mobility (VRRM): Evaluating Current Valuation as Investors Weigh Future Growth Prospects

Verra Mobility Corporation - Class A Common Stock VRRM | 22.01 22.01 | +1.01% 0.00% Pre |

Verra Mobility (VRRM) shares have drifted modestly over the past month, moving alongside broader trends in the commercial services sector. Many investors are now assessing whether the company’s long-term track record still offers attractive value at current prices.

Verra Mobility’s share price has seen minor ups and downs lately, but momentum appears subdued with a 1-year total shareholder return of -10.6% despite steady long-term gains. The five-year total return still sits at an impressive 125%. Short-term price changes seem to reflect shifting sentiment on the company’s future growth versus broader market risks.

If you’re watching sector trends and want to see what else is attracting investor attention lately, it might be time to explore fast growing stocks with high insider ownership.

With shares trading around a 12 percent discount to their estimated intrinsic value and analysts targeting even higher prices, the key question emerges: is Verra Mobility an undervalued play, or has the market already priced in future growth?

Most Popular Narrative: 16.8% Undervalued

At $24.26 per share, Verra Mobility trades below the widely followed narrative fair value estimate of $29.17. Analysts and investors are watching closely as the company’s strategic growth plans and financial projections set expectations.

Recent legislation in Colorado and Nevada authorizing new photo enforcement programs, along with enabling legislation across the U.S. (including California), is expanding the total addressable market for automated traffic enforcement. This creates multi-year visibility and potential double-digit revenue growth in Government Solutions as new contracts convert to recurring ARR and begin contributing to top-line results.

Curious how ambitious profit margin targets and declining share count figure into this story? The narrative hints at bold earnings acceleration and shrinking valuation multiples. Dive into the full breakdown to uncover exactly what powers this bullish price target.

Result: Fair Value of $29.17 (UNDERVALUED)

However, persistent macroeconomic headwinds or setbacks in major contract renewals could pose challenges to Verra Mobility’s growth narrative and may prompt investor caution in the months ahead.

Another View: Earnings Multiple Sends a Different Signal

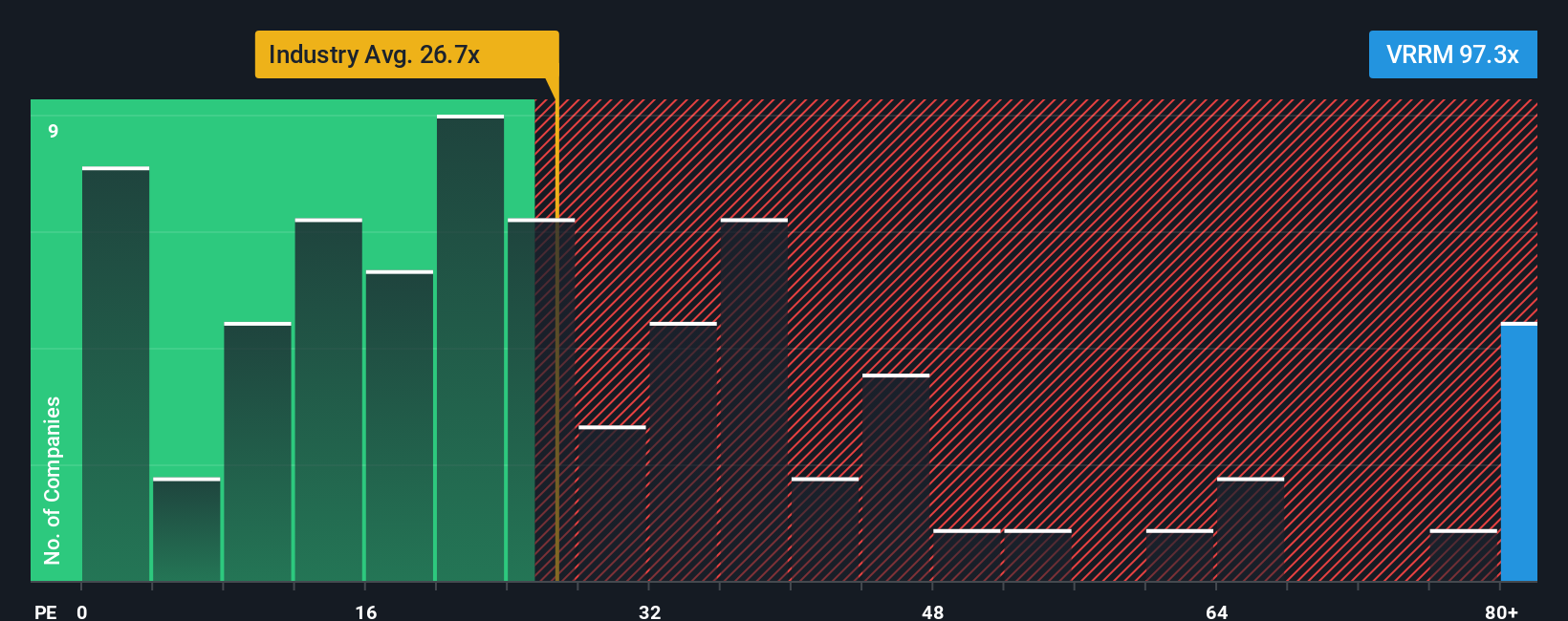

While the analyst fair value suggests upside, Verra Mobility actually trades at a lofty price-to-earnings ratio of 99.3x, which is far higher than the US industry average of 24.9x or the peer average of 17.3x. The fair ratio is just 41.5x, highlighting considerable valuation risk if profits disappoint. Does the market see something others do not?

Build Your Own Verra Mobility Narrative

If you think there’s more to the story or want to interpret the numbers yourself, it’s easy to build your custom view in just a few minutes. Do it your way.

A great starting point for your Verra Mobility research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let the best opportunities pass you by. See what other high-potential stocks you might be overlooking by tapping into the power of the Simply Wall Street Screener.

- Tap into potential market leaders by scouting these 24 AI penny stocks with serious momentum in artificial intelligence, transforming industries and unlocking new competitive advantages.

- Strengthen your portfolio with income powerhouses by spotting these 18 dividend stocks with yields > 3% boasting yields over 3 percent and consistent payout histories.

- Capitalize on undervalued gems by targeting these 877 undervalued stocks based on cash flows that show promising cash flow metrics and attractive pricing right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.