يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Vita Coco (COCO): Evaluating Valuation After Q2 Earnings Beat and Analyst Upgrades

Vita Coco Company, Inc. COCO | 58.96 | +3.46% |

Vita Coco Company (COCO) has caught the market’s attention this week, reporting earnings and revenue for the second quarter of 2025 that pulled ahead of analyst expectations. Investors have been quick to respond, especially with positive sentiment still swirling from recent analyst ratings upgrades and confidence in long-term growth potential. Even with some high-profile insider selling as shares approached their 52-week high, the headline here is Vita Coco’s ability to keep outpacing forecasts and roll out new innovations alongside its Major League Hydration line. This combination has fueled plenty of buzz.

All this comes on the heels of a significant rally in Vita Coco’s stock price. Over the past month, shares have climbed 21%, contributing to strong momentum over the year and helping push the total twelve-month return to 39%. Whether it is earnings growth, reinvestment of profits rather than dividends, or new product launches, the company seems to be building on a foundation that encourages investors to look past short-term moves like insider sales. The stock has shown both resilience and growth potential, a trend that has continued as markets react to the latest round of strong financial results.

So the real question for investors is, does Vita Coco’s recent run mean there is still a bargain to be had, or is the market already factoring in all of its future upside?

Most Popular Narrative: 4.4% Undervalued

According to the most widely followed valuation narrative, Vita Coco Company is seen as modestly undervalued by around 4%. Analysts are basing this view on consensus expectations for sustained growth and profitability over the next few years.

Ongoing expansion into new product adjacencies (such as Vita Coco Treats and coconut milk-based beverages) is creating new consumption occasions and diversifying revenue streams. This is supporting topline growth and potentially enhancing gross margins with premium offerings. Heightened investment in international markets (notably Europe) is resulting in accelerating sales growth and market share gains. Management expects international revenues to ultimately rival the Americas business, which could significantly impact consolidated revenues and earnings power.

Curious what’s powering this valuation? The narrative hinges on bold expectations about how fast the company can grow earnings, widen profit margins and justify a premium multiple compared to its peers. Want to see which financial drivers make the biggest impact on fair value? Take a closer look at the numbers and forecasts shaping this story.

Result: Fair Value of $41.56 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing volatility in freight costs and uncertainty around tariffs could pressure margins and challenge the bullish growth narrative for Vita Coco's future.

Find out about the key risks to this Vita Coco Company narrative.Another View: Is the Stock Too Pricey?

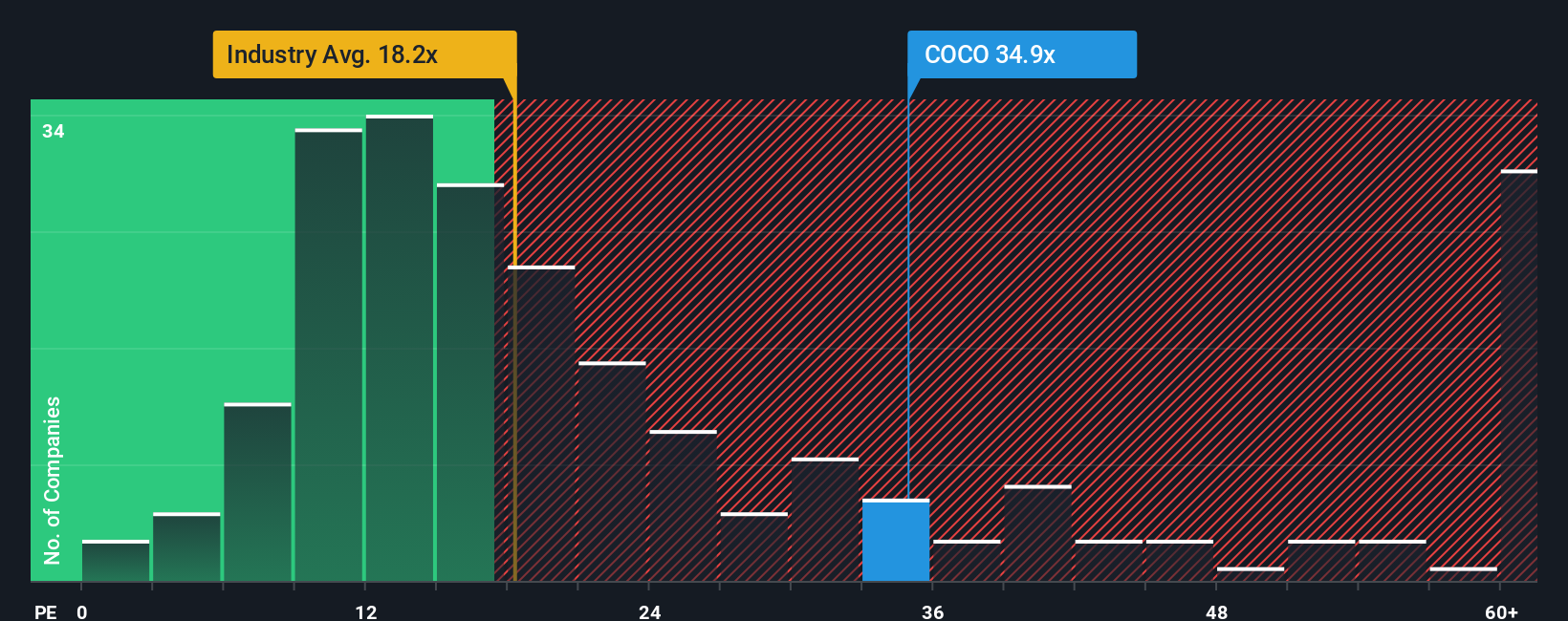

Switching the lens from long-term growth to standard valuation ratios, Vita Coco appears expensive compared to the global beverage sector. This raises the question: are investors paying up for too much future potential, or is a premium warranted?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Vita Coco Company Narrative

If you want to dig into the numbers yourself, you can use our tools to craft your own perspective on Vita Coco in just a few minutes. Do it your way

A great starting point for your Vita Coco Company research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Why settle for one great stock when countless opportunities are waiting? Guide your next move with targeted stock lists designed to give your portfolio an edge.

- Spot under-the-radar companies that offer real value by using our list of undervalued stocks based on cash flows. Discover what bargains the market is missing.

- Explore the future of medicine by checking out fast-growing innovators among healthcare AI stocks. See how artificial intelligence is reshaping healthcare.

- Take advantage of surging market trends as cryptocurrency and blockchain stocks reveals businesses leading the blockchain and cryptocurrency revolution.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.