يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Vulcan Materials (VMC): Assessing the Current Valuation After Recent Share Gains

Vulcan Materials Company VMC | 295.94 | -1.11% |

Vulcan Materials has quietly built momentum, with a 1-month share price return of 1.1% and a strong 15.6% gain so far this year. That positive trend is also evident in its total shareholder returns, which have surged nearly 95% over three years. This signals growing confidence in the company’s long-run prospects amid steady fundamentals.

If building momentum is on your radar, now’s the perfect time to discover fast growing stocks with high insider ownership

But with shares up over 15% this year and trading just below analyst targets, the key question is whether Vulcan Materials is undervalued or if the market has already priced in its growth story and potential upside.

Most Popular Narrative: 4.3% Undervalued

Vulcan Materials last closed at $295.35, while the narrative’s fair value estimate comes in at $308.50, suggesting room for modest upside. The difference reflects analysts’ outlooks for multi-year growth driven by resilient demand and operational improvements, as well as the latest sector reassessment.

Accelerating infrastructure spending, driven by the ongoing rollout of IIJA funding, major state initiatives in core Southern and Sunbelt markets, and increasing local spending, is visibly expanding Vulcan's backlogs and contract awards. With over 60% of IIJA funds still to be spent and awards up over 20% in Vulcan-served regions, this points to multi-year growth in volumes and more predictable, compounding revenue.

Ready to discover the secret behind Vulcan's valuation jump? The formula is more than optimism; it is a bold financial play powered by future revenue growth, rising profit margins, and a profit multiple that beats the industry standard. Which daring forecasts are truly driving this price? Find out by reading the full narrative!

Result: Fair Value of $308.50 (UNDERVALUED)

However, persistent delays in residential construction or unexpected disruptions from severe weather could limit Vulcan’s near-term revenue growth and challenge the positive outlook.

Another View: High Market Multiple Raises Eyebrows

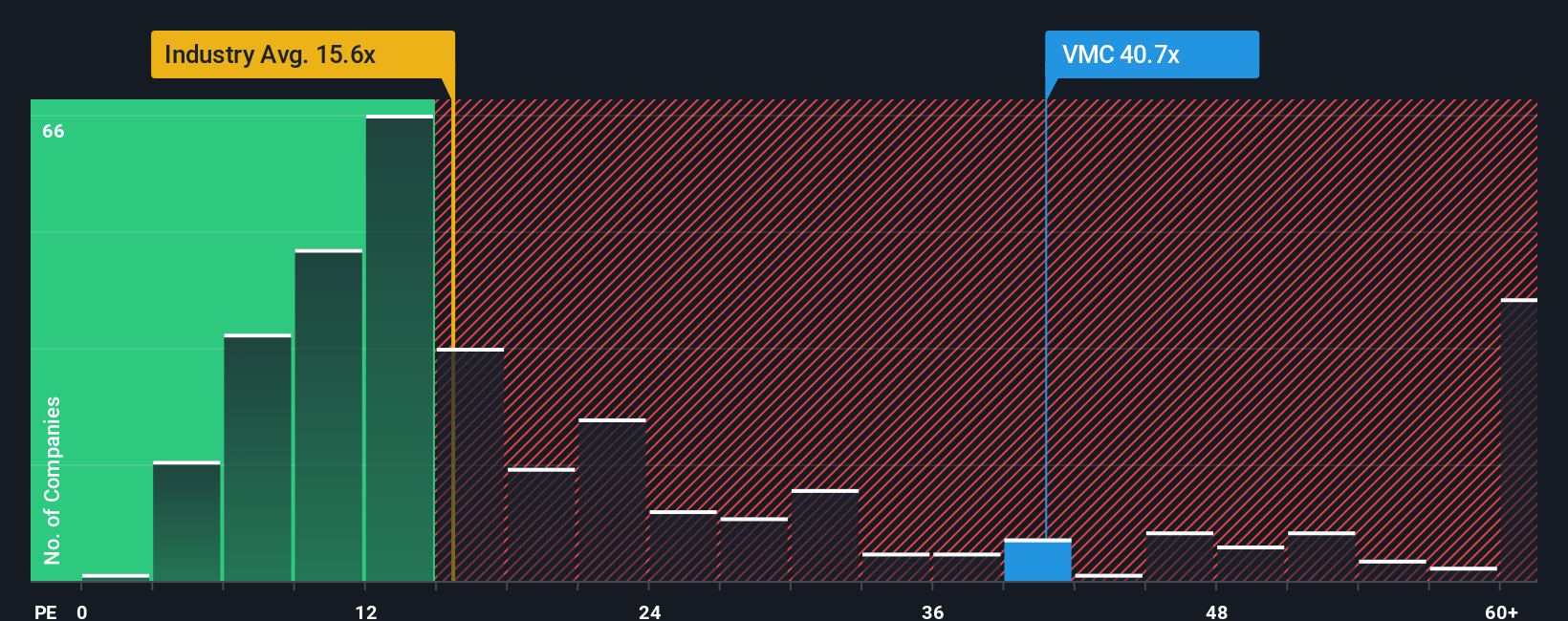

Taking a step back from future cash flow models, Vulcan Materials is valued by the market at a price-to-earnings ratio of 40.7x. This is much higher than both the global basic materials industry average of 15.6x and its peer group average of 24.9x, and well above our fair ratio of 24.1x. Such a wide gap suggests investors are paying a premium for Vulcan’s growth and resilience, but does it expose buyers to greater downside risk if expectations miss?

Build Your Own Vulcan Materials Narrative

If you think there is more to the story or want to dig into the numbers yourself, it only takes a few minutes to build your own perspective. Do it your way

A great starting point for your Vulcan Materials research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Plenty of other compelling opportunities are just a click away. Get ahead of the market by uncovering these handpicked strategies that could change your investment trajectory.

- Unlock higher growth potential by scanning these 24 AI penny stocks with a proven edge in artificial intelligence, automation, and transforming industries worldwide.

- Boost your long-term income by tapping into these 18 dividend stocks with yields > 3%, featuring companies offering healthy yields and a reliable stream of passive returns.

- Seize value opportunities by checking out these 878 undervalued stocks based on cash flows to spot stocks trading below their true worth before everyone else catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.