يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

What Globus Medical (GMED)'s CEO Transition Amid Trade Tensions Means For Shareholders

Globus Medical Inc Class A GMED | 90.59 | -0.36% |

- Globus Medical recently saw its President and CEO, Daniel Scavilla, resign to pursue another opportunity, with Keith Pfeil named as his successor.

- This leadership change, combined with escalating US-China trade tensions affecting technology and medical device sectors, has increased investor uncertainty around the company's near-term outlook.

- We'll look at how the CEO transition may influence Globus Medical's potential to maintain growth and margin expansion in the coming years.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Globus Medical Investment Narrative Recap

To be a shareholder in Globus Medical, you have to believe in the company's ability to sustain innovation and deliver revenue growth in spine and orthopedic solutions, even in the face of executive turnover and shifting macroeconomic factors such as US-China trade tensions. The recent CEO transition may introduce near-term uncertainty, but the most important immediate catalyst remains continued integration of recent acquisitions, while the ongoing risk centers on unpredictable sales cycles and international market performance. As things currently stand, the leadership change is notable, yet its impact on core business drivers appears manageable in the short term.

One relevant development is the recent Q2 earnings report showing strong revenue and profit growth year-over-year, alongside the reaffirmed full-year revenue guidance. This momentum provides a degree of reassurance amidst the management changes, reinforcing attention on the execution of cross-selling and cost synergies from the NuVasive and Nevro acquisitions as central to near-term performance. But as international expansion and supply chain resilience remain critical to future growth...

Globus Medical's narrative projects $3.4 billion in revenue and $538.8 million in earnings by 2028. This requires 9.0% yearly revenue growth and a $182.2 million increase in earnings from the current $356.6 million.

Uncover how Globus Medical's forecasts yield a $80.30 fair value, a 40% upside to its current price.

Exploring Other Perspectives

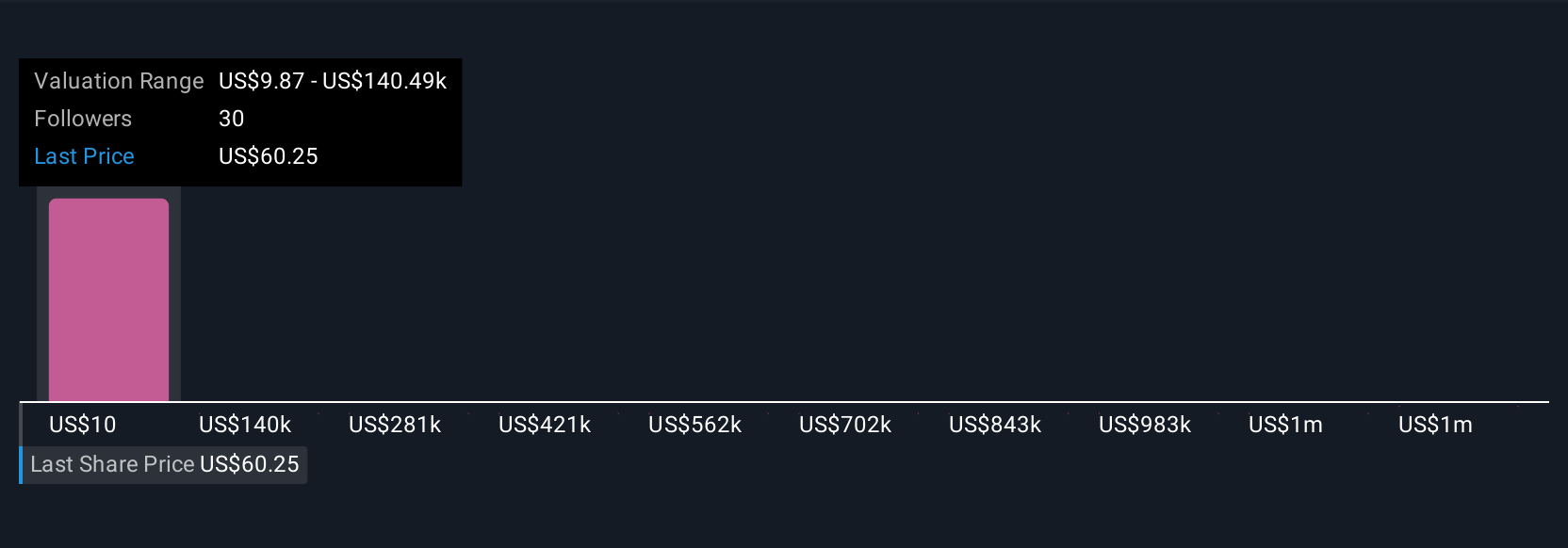

Simply Wall St Community members provided fair value estimates ranging from US$10 to more than US$1,404,794, with 5 independent perspectives represented. Opinions vary widely as some focus on risks from unpredictable enabling technology sales cycles that could impact future growth potential.

Explore 5 other fair value estimates on Globus Medical - why the stock might be worth less than half the current price!

Build Your Own Globus Medical Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Globus Medical research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Globus Medical research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Globus Medical's overall financial health at a glance.

No Opportunity In Globus Medical?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.