يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

What Golar LNG (GLNG)'s Board Appointment of Energy Veteran Stephen Schaefer Means For Shareholders

Golar LNG Limited GLNG | 36.99 | +0.38% |

- Golar LNG Limited has announced that Mr. Stephen J. Schaefer, a long-standing leader in the natural gas and electricity sectors, joined its Board of Directors on August 1, 2025.

- Mr. Schaefer's appointment introduces deep sector expertise and extensive boardroom experience, which could influence Golar LNG's strategic direction within a rapidly evolving energy landscape.

- We’ll explore how Mr. Schaefer’s energy background may inform Golar LNG’s investment outlook amid growing demand for floating LNG solutions.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Golar LNG Investment Narrative Recap

To be a Golar LNG shareholder today, you need conviction in the long-term demand for floating LNG as key energy markets seek flexible, lower-carbon solutions. The appointment of Stephen J. Schaefer to Golar’s board, while promising in terms of sector expertise, does not materially move the needle on near-term catalysts such as execution on long-term FLNG contracts or address the single-asset risks inherent in Golar’s portfolio.

Among recent announcements, the FLNG Hilli’s 20-year charter to Argentina stands out; this deal secures $13.7 billion in backlog, anchoring the company’s earning visibility and underlining the importance of contract stability. This development ties directly to investor focus on Golar’s contract execution as the critical short-term catalyst, with risks concentrated around operational delivery and Argentina-specific exposures.

However, with Argentina’s volatile regulatory environment and macroeconomic conditions, investors should be aware of...

Golar LNG's narrative projects $456.3 million revenue and $141.5 million earnings by 2028. This requires 20.9% yearly revenue growth and a $137.7 million earnings increase from $3.8 million today.

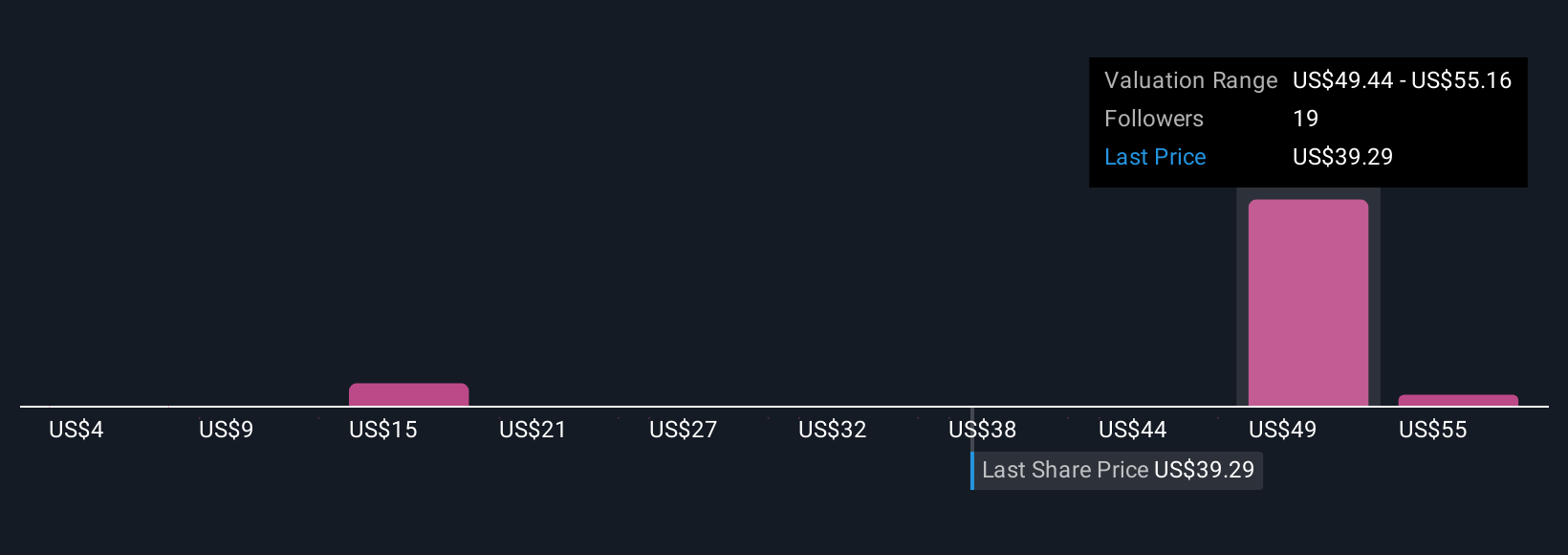

Uncover how Golar LNG's forecasts yield a $49.30 fair value, a 19% upside to its current price.

Exploring Other Perspectives

Three Simply Wall St Community members estimate Golar LNG’s fair value between US$20.50 and US$60.87 per share, reflecting a wide range of potential outlooks. Contrast this dispersion with baseline concerns that contract, operational, and country risks may significantly impact long-term value, encouraging you to consider multiple viewpoints.

Explore 3 other fair value estimates on Golar LNG - why the stock might be worth as much as 47% more than the current price!

Build Your Own Golar LNG Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Golar LNG research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Golar LNG research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Golar LNG's overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.