يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

What Innoviva (INVA)'s Analyst Upgrades and Earnings Beat Mean for Shareholders

Innoviva, Inc. INVA | 21.84 | +0.97% |

- Innoviva (NASDAQ:INVA) was recently upgraded by several research analysts, with Wall Street Zen raising its rating from "buy" to "strong-buy," while Cantor Fitzgerald, Oppenheimer, and HC Wainwright also issued positive outlooks following Innoviva's quarterly earnings report that surpassed consensus EPS and revenue estimates.

- The combination of analyst upgrades and stronger-than-expected financial results points to renewed analyst confidence in Innoviva's operational execution and near-term prospects.

- We'll explore how Innoviva's recent outperformance relative to analyst expectations shapes the company's investment narrative going forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Innoviva's Investment Narrative?

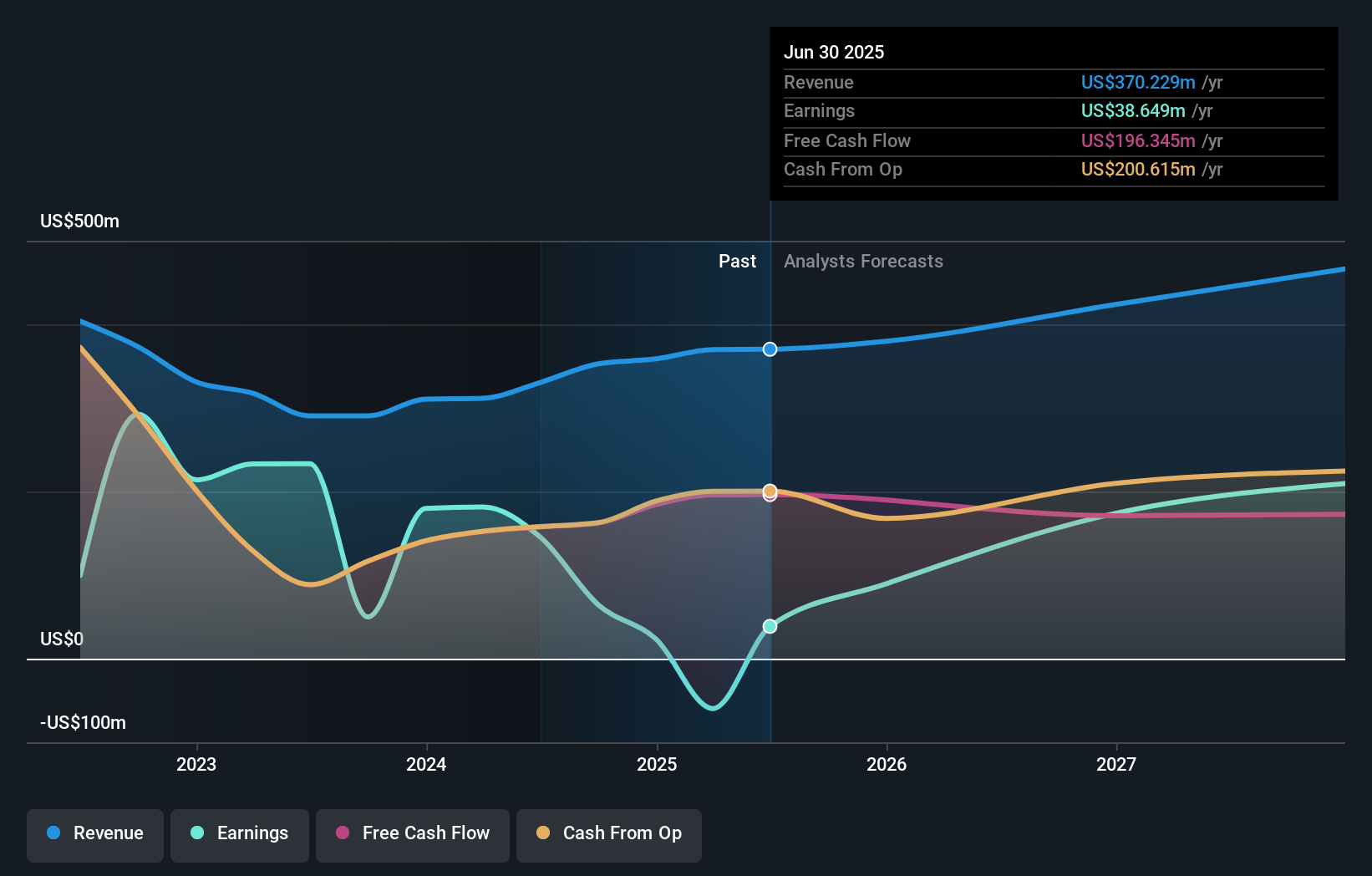

To be an Innoviva shareholder, optimism about its ability to execute on new drug launches, sustain revenue growth, and navigate shifts in the pharmaceutical sector is key. The recent wave of analyst upgrades, following quarterly results that topped expectations, appears to validate renewed faith in management and operational strategy, possibly shifting some near-term catalysts higher on the list. Previously, inconsistent earnings and heavy reliance on a few products were top concerns, alongside a less seasoned management team and questions about the quality of past earnings due to sizable one-off items. The improved earnings picture and upbeat analyst sentiment may ease some pressure, yet the company still faces an expensive valuation, profit margin variability, and the need for ongoing product success. This recent bullish momentum might temper earlier worries, but long-term risks remain relevant.

However, margin swings and ongoing dependence on new product launches still matter for anyone watching INVA.

Exploring Other Perspectives

Explore another fair value estimate on Innoviva - why the stock might be worth just $41.00!

Build Your Own Innoviva Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Innoviva research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Innoviva research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Innoviva's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.