يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

What Sunstone Hotel Investors (SHO)'s Strategic Review Push Means For Shareholders

Sunstone Hotel Investors, Inc. SHO | 9.38 | +2.80% |

- On September 12, 2025, Tarsadia Capital publicly urged Sunstone Hotel Investors’ board to immediately pursue either a full sale or asset liquidation of the company, citing concerns over its continued undervaluation and the need for urgent board changes.

- This activist campaign highlights pending shareholder pressure for a thorough review of strategic alternatives, which could lead to significant corporate restructuring or leadership overhaul.

- We’ll explore how Tarsadia Capital’s call for a formal strategic review could influence Sunstone’s growth outlook and future direction.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Sunstone Hotel Investors Investment Narrative Recap

To be a shareholder in Sunstone Hotel Investors, you need to believe in the resilience and recovery of high-end urban and resort hotels, particularly as travel demand rebounds. The recent public push from Tarsadia Capital for a sale or asset liquidation raises the likelihood of significant near-term board and strategic changes, but does not immediately alter the core short-term catalyst: improving operating performance at key properties. The most pressing risk remains the company’s vulnerability to underperformance at concentrated, high-value assets.

The upcoming third-quarter earnings release, scheduled for November 7, 2025, provides the next key company update. This report is especially relevant in light of recent activist demands, as financial results and management’s commentary could either reinforce support for a strategic review or highlight ongoing operational challenges impacting Sunstone’s market value.

However, investors should also be aware that local volatility at Sunstone’s largest properties could quickly shift the risk/reward profile if...

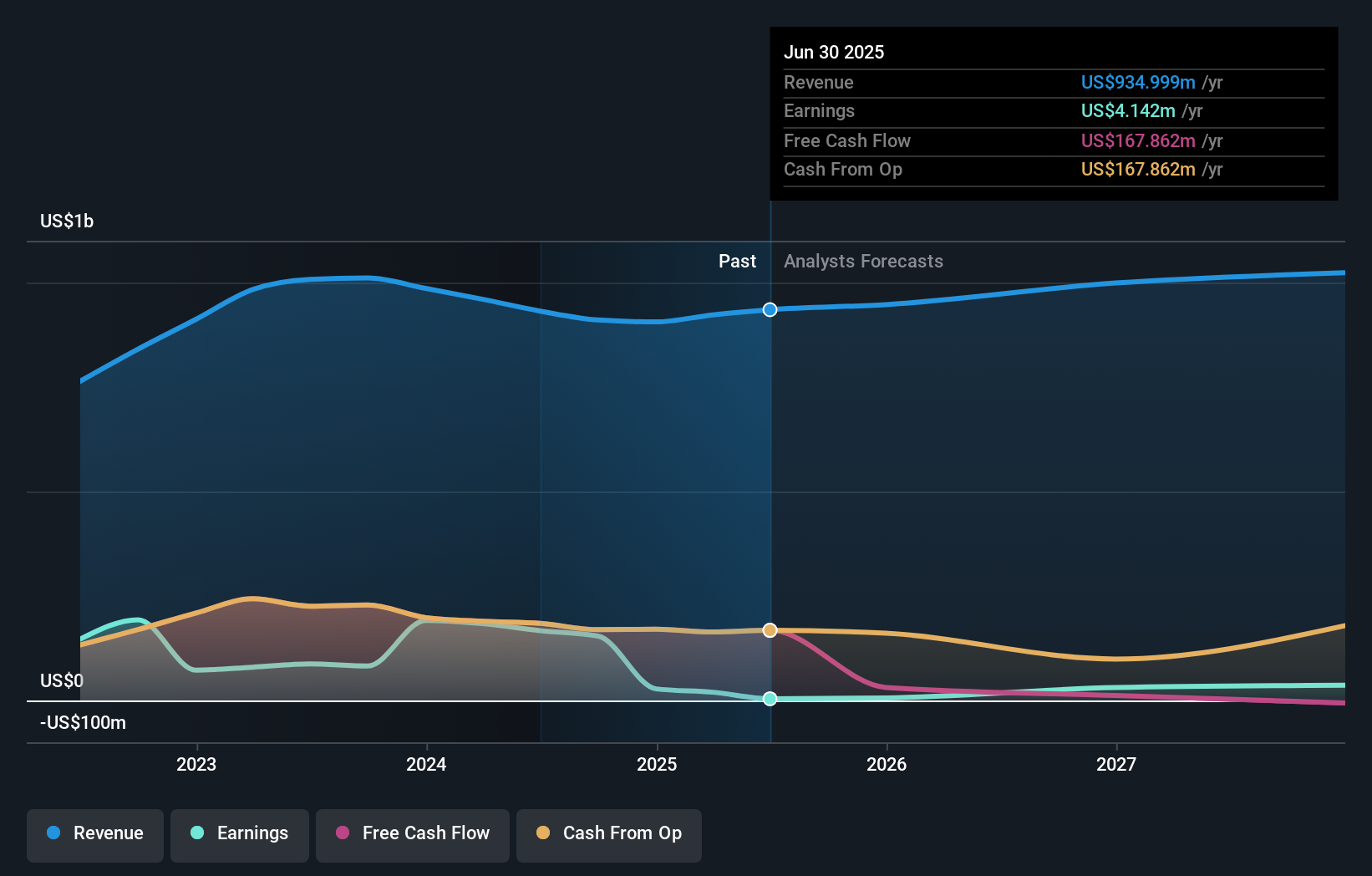

Sunstone Hotel Investors’ narrative projects $1.1 billion revenue and $67.9 million earnings by 2028. This requires 4.0% yearly revenue growth and a $63.8 million increase in earnings from the current $4.1 million.

Uncover how Sunstone Hotel Investors' forecasts yield a $9.64 fair value, in line with its current price.

Exploring Other Perspectives

Only one private investor in the Simply Wall St Community estimates Sunstone’s fair value at US$6.44 per share. In contrast, the heightened focus on asset sales and board changes adds another layer of uncertainty worth considering in your own outlook.

Explore another fair value estimate on Sunstone Hotel Investors - why the stock might be worth 34% less than the current price!

Build Your Own Sunstone Hotel Investors Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sunstone Hotel Investors research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Sunstone Hotel Investors research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sunstone Hotel Investors' overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 31 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.