يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

What Workiva (WK)'s Activist Board Reform Push Means For Shareholders

Workiva, Inc. Class A WK | 87.33 | +1.81% |

- In late September 2025, Irenic Capital Management launched a campaign pushing Workiva Inc. to overhaul its board, collapse its dual-class share structure, and consider a possible sale, citing frustration with financial performance and governance.

- Irenic's demands for board changes highlight growing investor concerns around long-serving directors and potential undervaluation compared to application software peers.

- We'll now explore how heightened activist pressure for board reform and strategic review could influence Workiva's long-term investment outlook.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

Workiva Investment Narrative Recap

To be a shareholder in Workiva right now, you’d need to believe in the long-term demand for digital reporting and compliance solutions, and the company’s ability to convert that demand into improving financial performance. The recent campaign by Irenic Capital Management, calling for board reform and a possible sale, may not impact the near-term catalyst, the upcoming Q3 earnings report and the company's ongoing focus on revenue growth through international expansion. However, this rising activist pressure increases the short-term risk related to board composition and governance, as management could face distractions or changes that alter strategic direction.

The most recent and relevant announcement is Workiva’s upcoming Q3 2025 results scheduled for November 5, which will be closely watched in light of Irenic’s calls for better performance and potential undervaluation. Investors may focus on whether the reported numbers and forward guidance reflect improving growth and margin trends, all while the company manages heightened external scrutiny and potential board changes. In contrast, investors should also be aware of the longer-term regulatory uncertainties in key European markets like...

Workiva's narrative projects $1.4 billion revenue and $37.9 million earnings by 2028. This requires 20.6% yearly revenue growth and an increase of $104.5 million in earnings from the current -$66.6 million.

Uncover how Workiva's forecasts yield a $97.60 fair value, a 12% upside to its current price.

Exploring Other Perspectives

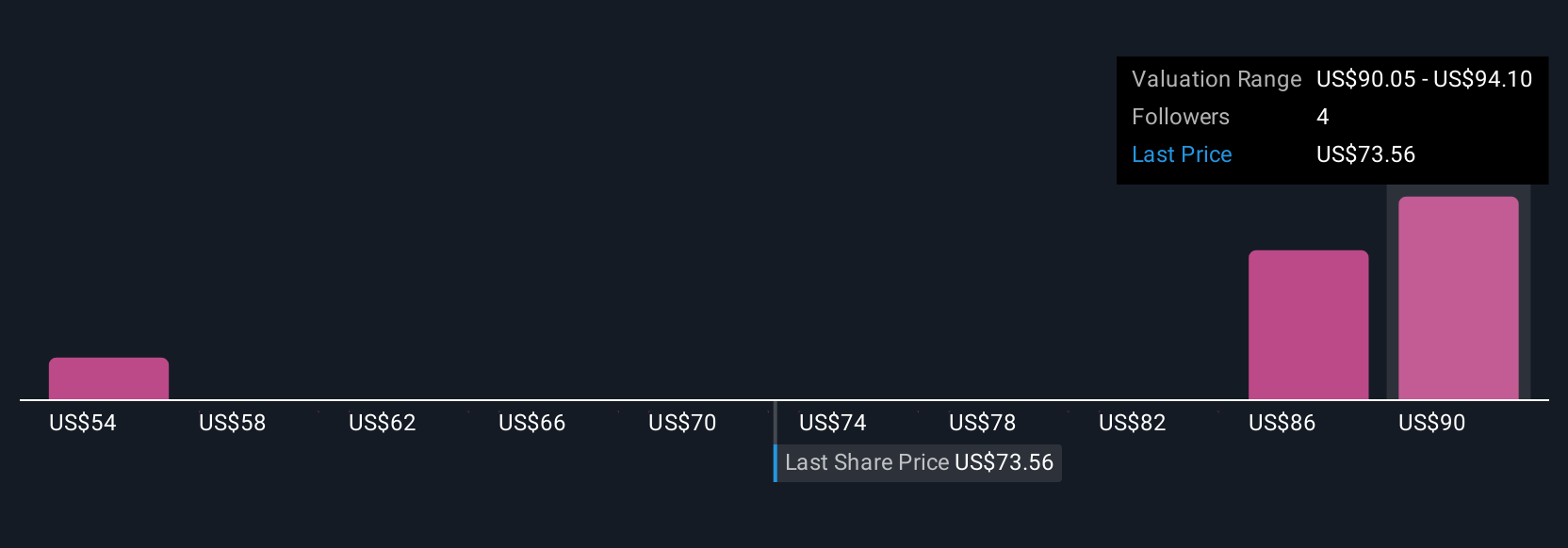

Simply Wall St Community members submitted three fair value estimates for Workiva Inc., with targets spanning from US$53.57 to US$105.65. As investors consider a broad spectrum of outcomes, the current debate over board structure and governance reform could have meaningful implications on future company performance.

Explore 3 other fair value estimates on Workiva - why the stock might be worth as much as 21% more than the current price!

Build Your Own Workiva Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Workiva research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Workiva research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Workiva's overall financial health at a glance.

No Opportunity In Workiva?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.