يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

While shareholders of Blue Bird (NASDAQ:BLBD) are in the black over 3 years, those who bought a week ago aren't so fortunate

Blue Bird Corporation BLBD | 51.16 | +1.58% |

Generally speaking, investors are inspired to be stock pickers by the potential to find the big winners. Mistakes are inevitable, but a single top stock pick can cover any losses, and so much more. Take, for example, the Blue Bird Corporation (NASDAQ:BLBD) share price, which skyrocketed 327% over three years. On top of that, the share price is up 27% in about a quarter. But this could be related to the strong market, which is up 20% in the last three months.

Although Blue Bird has shed US$83m from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

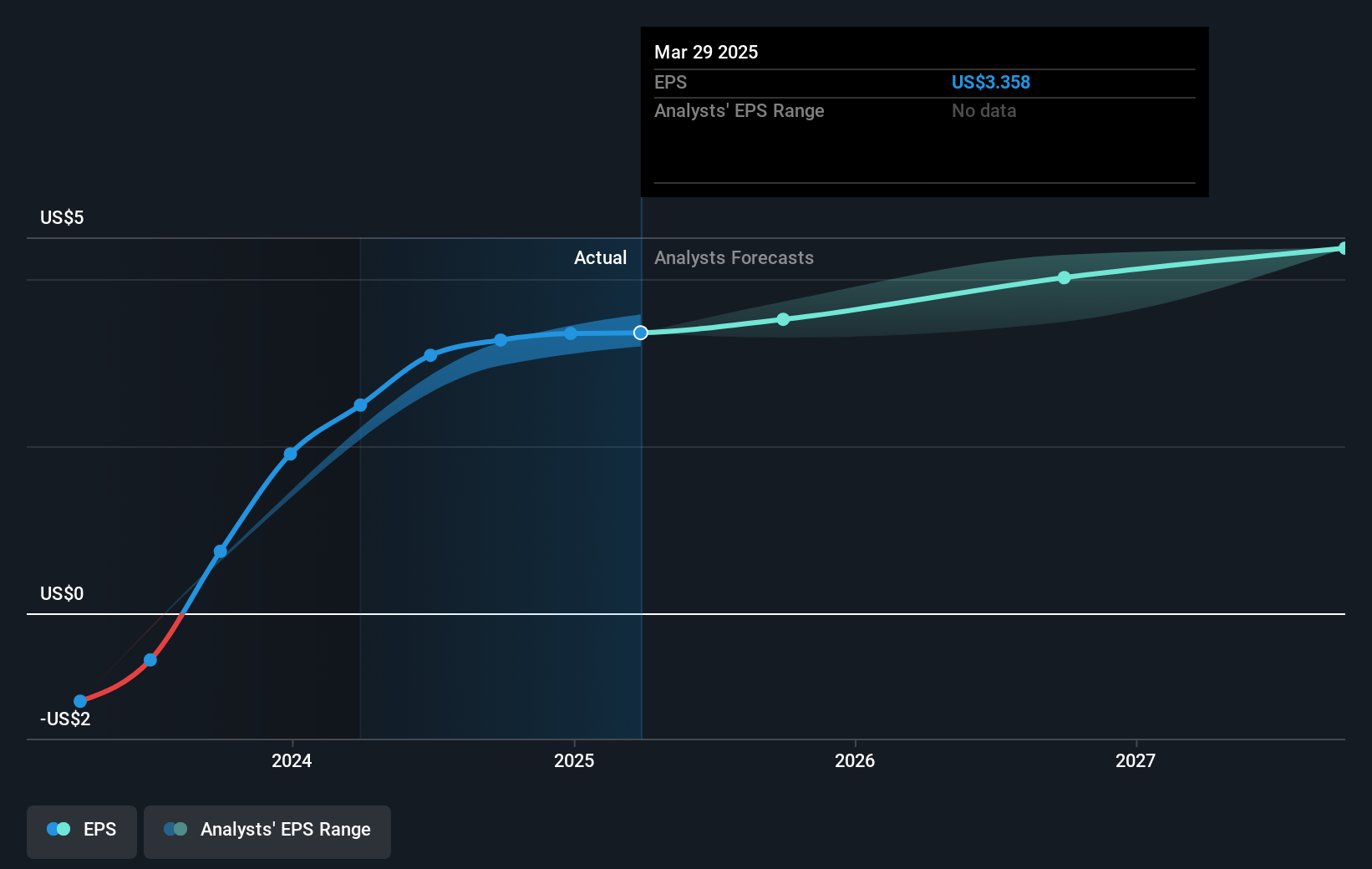

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During three years of share price growth, Blue Bird moved from a loss to profitability. Given the importance of this milestone, it's not overly surprising that the share price has increased strongly.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

A Different Perspective

While the broader market gained around 16% in the last year, Blue Bird shareholders lost 15%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Longer term investors wouldn't be so upset, since they would have made 27%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. If you would like to research Blue Bird in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.