يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Why Genius Sports (GENI) Is Up 20.2% After Exclusive Serie A Data Deal and Global Partnerships

Genius Sports Limited Ordinary Shares GENI | 10.66 | 0.00% |

- In the past week, Genius Sports Limited secured an exclusive partnership with Serie A, granting it the sole rights to capture, distribute, and commercialize official data and low latency betting video streams from Italy’s top football competitions through the 2028/29 season, alongside similar multi-year agreements with the European Leagues Association and PMG.

- This series of partnerships expands Genius Sports' reach across global football data rights and enhances its position in in-play betting and next-generation advertising technologies, signaling a shift toward deeper integration with sportsbooks and innovative fan engagement platforms.

- We'll now explore how Genius Sports' exclusive control of Serie A data and video streams could shape the company’s investment narrative going forward.

These 19 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Genius Sports Investment Narrative Recap

To be a Genius Sports shareholder, you need to believe that exclusive global data rights and continual tech innovation can drive recurring, high-margin growth, and that these advantages outweigh risks from contract renewals or unpredictable media revenue. The recent Serie A partnership strengthens Genius Sports’ European data position and is highly material to the near-term revenue narrative, as it both expands high-value exclusivity and bolsters product differentiation. However, the company’s future performance still hinges on successfully renewing and extending major league agreements.

Genius Sports' outlook anticipates $872.8 million in revenue and $89.2 million in earnings by 2028. This projection assumes a 17.7% annual revenue growth rate and a $134.9 million increase in earnings from the current level of -$45.7 million.

Uncover how Genius Sports' forecasts yield a $12.88 fair value, a 5% upside to its current price.

Exploring Other Perspectives

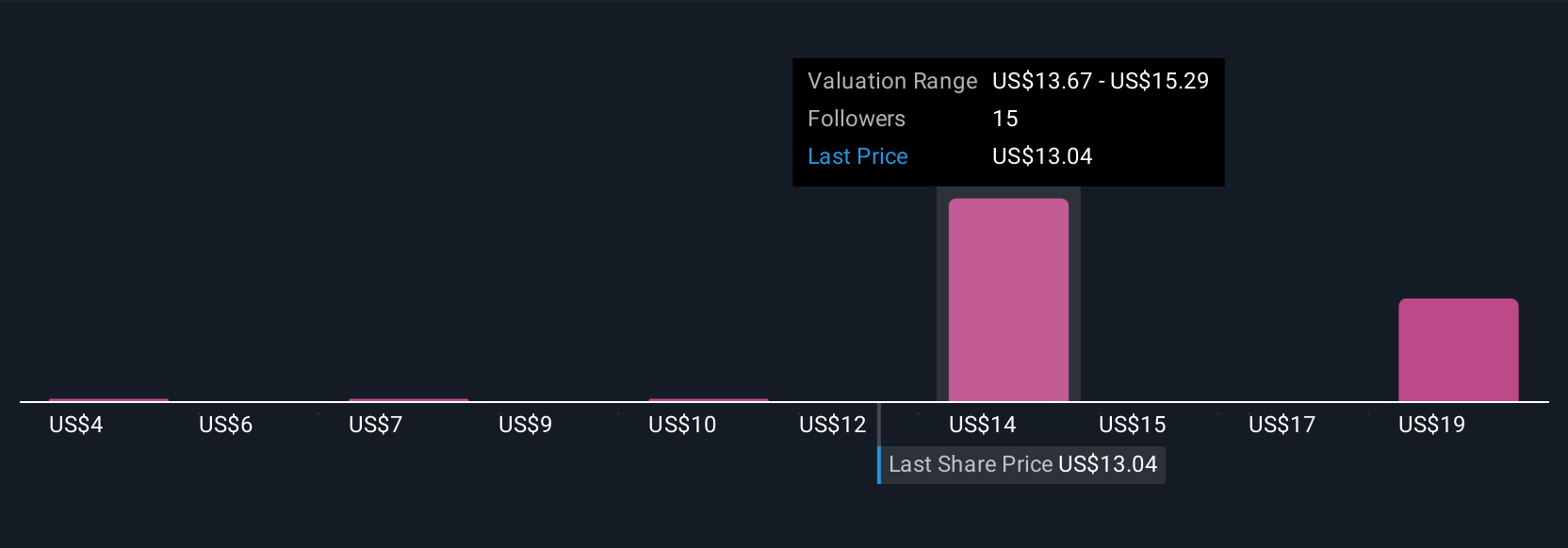

Six fair value estimates from the Simply Wall St Community span a wide US$3.97 to US$20.14 range. While many see global data rights as a catalyst, your opinion on renewal risk could shape a very different outlook.

Explore 6 other fair value estimates on Genius Sports - why the stock might be worth as much as 65% more than the current price!

Build Your Own Genius Sports Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Genius Sports research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Genius Sports research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Genius Sports' overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.