يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

لماذا ارتفع سهم Guardant Health (GH) بنسبة 7.8% بعد ارتفاع قوي في الإيرادات وتوسيع نطاق الوصول إلى اختبار Shield

Guardant Health GH | 105.34 | +3.43% |

- في سبتمبر 2025، أعلنت شركة Guardant Health عن زيادة في الإيرادات بنسبة 30.9٪ على أساس سنوي، ورفعت توقعات الإيرادات للعام بأكمله، وأعلنت عن شراكات توسع نطاق الوصول إلى اختبار الدم Shield المعتمد من إدارة الغذاء والدواء الأمريكية للكشف عن سرطان القولون والمستقيم، مع إضافة وزير الصحة والخدمات الإنسانية السابق أليكس عازار إلى مجلس إدارتها.

- تُسلط هذه التطورات الضوء على الزخم المتسارع لشركة Guardant Health في مجال تشخيص السرطان، حيث تستفيد من ابتكار الاختبارات، والتوزيع الأوسع، والقيادة ذات الخبرة لتعزيز مكانتها في السوق.

- سندرس كيف يمكن أن يؤثر التبني السريع والتوزيع الأوسع لاختبار الدم Shield على توقعات النمو طويل الأجل لشركة Guardant Health.

تُعدّ المعادن الأرضية النادرة عنصرًا أساسيًا في معظم الأجهزة عالية التقنية، والأنظمة العسكرية والدفاعية، والمركبات الكهربائية. ويتنافس العالم بشدة لتأمين إمدادات هذه المعادن الحيوية. اكتشف أفضل 30 شركة في مجال المعادن الأرضية النادرة، من بين الشركات القليلة التي تستخرج هذا المورد الاستراتيجي المهم.

ملخص سرد استثمار شركة Guardant Health

تتمحور قصة استثمار شركة Guardant Health حول التوسع في استخدام تقنيات تشخيص السرطان غير الجراحية القائمة على تحليل الدم، وخاصةً اختبار Shield لسرطان القولون والمستقيم. وقد تُسهم أخبار سبتمبر 2025، التي تُسلط الضوء على التوسع السريع لاختبار Shield وتعزيز مجلس الإدارة، في تسريع المحفز الرئيسي للشركة على المدى القريب: وهو زيادة اعتماد شركات التأمين الصحي واستخدامها. ومع ذلك، يبقى خطر استمرار استنزاف السيولة النقدية بشكل كبير وعدم تحقيق الربحية قائمًا، ولم تُعالج هذه التطورات هذا الخطر، لذا ينبغي على المستثمرين مراقبة الأداء المالي للشركة عن كثب.

من بين الإعلانات الأخيرة، تبرز شراكة Guardant مع PathGroup لأهميتها البالغة، إذ توسّع نطاق Shield ليشمل أكثر من 250 مستشفى ونظامًا صحيًا، ما يُعالج مباشرةً المحرك الرئيسي لنمو الإيرادات على المدى القريب، ألا وهو توسيع نطاق الوصول السريري وزيادة حجم الاختبارات. ومن المتوقع أن تُسهّل سهولة دمج Shield عبر الأنظمة الرقمية لـ PathGroup إزالة معوقات سير العمل أمام مقدمي الخدمات، ما قد يُسهم في تسريع اعتمادها سريريًا، مع العلم أن تحويلها إلى إيرادات لا يزال يعتمد على تغطية تأمينية قوية من شركات التأمين والتزامها بالمعايير الإرشادية.

لكن في حين أن توسع نطاق شركة شيلد واضح، فإن استمرار ارتفاع معدل الخسائر الصافية وخطر التخفيف المستقبلي من...

تتوقع شركة Guardant Health تحقيق إيرادات بقيمة 1.5 مليار دولار وأرباح بقيمة 82.1 مليون دولار بحلول عام 2028. ويتطلب ذلك نموًا سنويًا في الإيرادات بنسبة 22.5٪ وزيادة في الأرباح بقيمة 495.9 مليون دولار مقارنة بالأرباح الحالية البالغة -413.8 مليون دولار.

اكتشف كيف أن توقعات شركة Guardant Health تؤدي إلى قيمة عادلة تبلغ 61.33 دولارًا ، أي بزيادة قدرها 4٪ عن سعرها الحالي.

استكشاف وجهات نظر أخرى

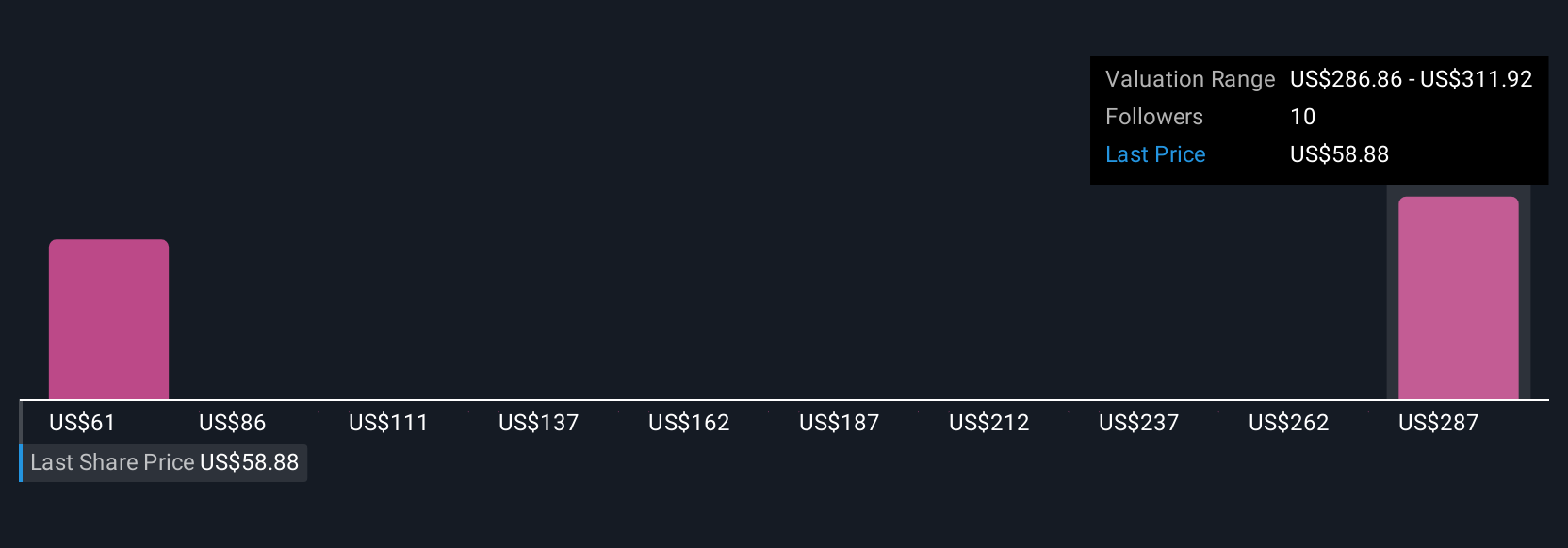

تتراوح تقديرات القيمة العادلة لشركة Guardant Health، وفقًا لثلاثة مصادر من Simply Wall St Community، على نطاق واسع بين 61 دولارًا أمريكيًا وأكثر من 311 دولارًا أمريكيًا للسهم الواحد. ومع تسارع اعتماد خدمة Shield وتوسع تغطية شركات التأمين الصحي، لا تزال توقعات المستثمرين منقسمة حول مدى سرعة تحول هذه الفوائد إلى ربحية مستدامة.

استكشف 3 تقديرات أخرى للقيمة العادلة لشركة Guardant Health - لماذا قد تكون قيمة السهم 61.33 دولارًا فقط!

قم ببناء سردك الصحي الخاص بالحماية

هل تخالف الروايات السائدة؟ أنشئ روايتك الخاصة في أقل من 3 دقائق - نادراً ما تأتي عوائد الاستثمار الاستثنائية من اتباع القطيع.

- تُعد تحليلاتنا التي تسلط الضوء على مكافأتين رئيسيتين و3 علامات تحذيرية مهمة قد تؤثر على قرارك الاستثماري نقطة انطلاق رائعة لأبحاثك حول شركة Guardant Health.

- يقدم تقريرنا البحثي المجاني لشركة Guardant Health تحليلاً أساسياً شاملاً مُلخصاً في شكل مرئي واحد - ندفة الثلج - مما يسهل تقييم الوضع المالي العام لشركة Guardant Health بنظرة سريعة.

هل تبحث عن فرص بديلة؟

تكشف عمليات المسح اليومية لدينا عن أسهم ذات إمكانات نمو هائلة. لا تفوّت هذه الفرصة:

- اكتشف الفرصة الكبيرة القادمة مع أسهم البنسات ذات الوضع المالي الجيد والتي توازن بين المخاطر والعوائد .

- استكشف 26 شركة رائدة في مجال الحوسبة الكمومية تقود ثورة تكنولوجيا الجيل القادم وتشكل المستقبل من خلال تحقيق اختراقات في الخوارزميات الكمومية، والبتات الكمومية فائقة التوصيل، والأبحاث المتطورة.

- نجت هذه الشركات الإحدى عشرة وازدهرت بعد جائحة كوفيد-19، وتمتلك المقومات اللازمة لتجاوز تعريفات ترامب الجمركية . اكتشف السبب قبل أن تتأثر محفظتك الاستثمارية سلبًا بالحرب التجارية.

هذا المقال من Simply Wall St ذو طبيعة عامة. نقدم تعليقاتنا بناءً على البيانات التاريخية وتوقعات المحللين فقط، باستخدام منهجية محايدة، ولا يُقصد بمقالاتنا أن تكون نصائح مالية. لا يُشكل هذا المقال توصيةً بشراء أو بيع أي سهم، ولا يأخذ في الاعتبار أهدافك أو وضعك المالي. نهدف إلى تزويدك بتحليلات طويلة الأجل مدفوعة بالبيانات الأساسية. يُرجى ملاحظة أن تحليلنا قد لا يأخذ في الاعتبار آخر إعلانات الشركات الحساسة للسعر أو المعلومات النوعية. لا تمتلك Simply Wall St أي أسهم في أي من الشركات المذكورة.