يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Why PJT (PJT) Pairing Record Earnings With a Dividend Raise Tests Its Profitability Story

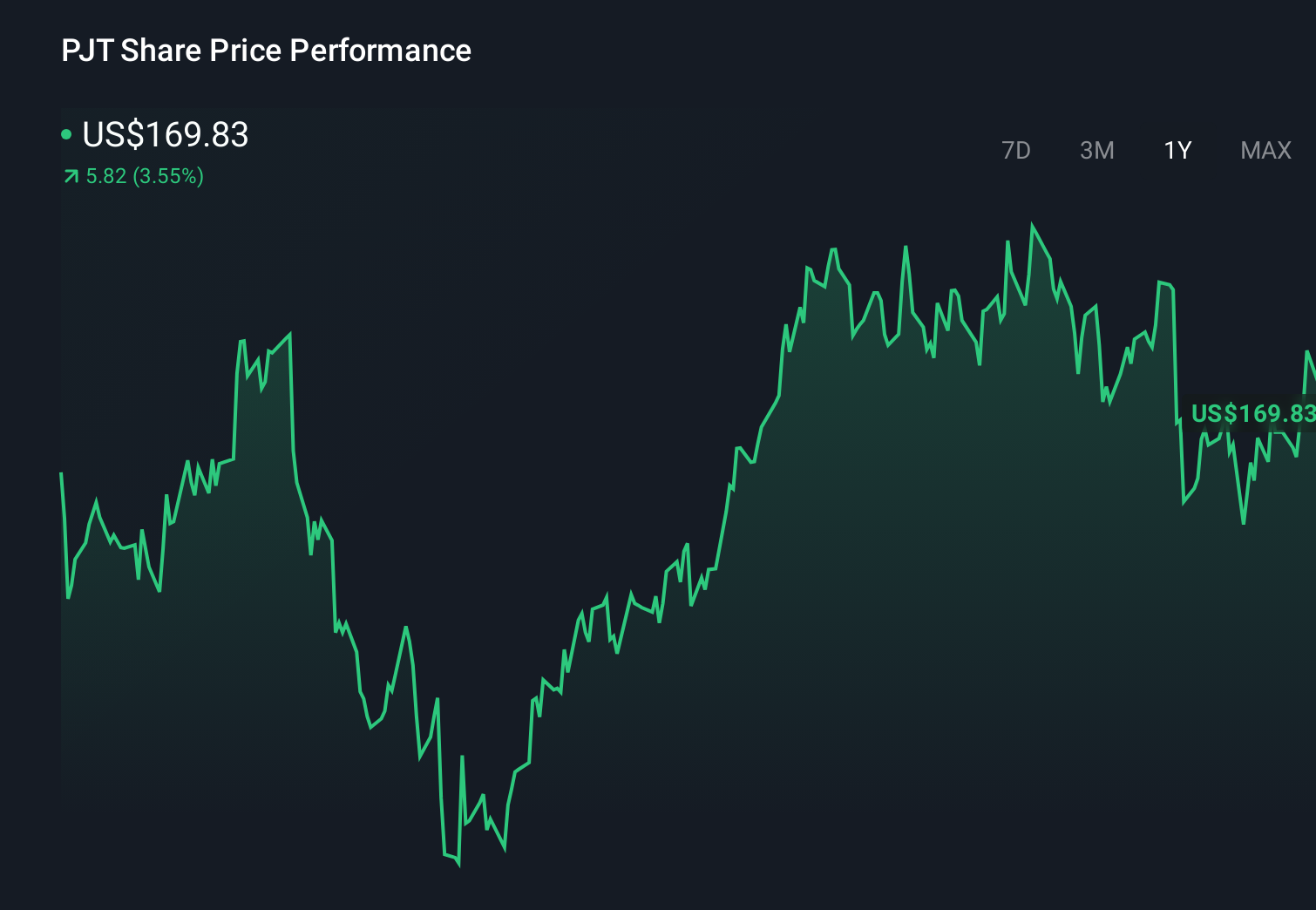

PJT Partners, Inc. Class A PJT | 151.63 | -0.76% |

- PJT Partners reported its fourth-quarter and full-year 2025 results on February 3, 2026, posting higher year-on-year revenue and earnings while its board declared a US$0.25 per share quarterly dividend payable on March 18, 2026 to Class A shareholders of record on March 4, 2026.

- The quarter delivered record annual financial results yet came with a revenue shortfall versus expectations, even as earnings per share exceeded analyst forecasts, highlighting strong profitability alongside questions about the firmness of top-line growth.

- We’ll now examine how this mix of a revenue miss and stronger-than-expected earnings shapes PJT Partners’ investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is PJT Partners' Investment Narrative?

To own PJT Partners, you need to be comfortable with an advisory-driven business where deal volumes, restructurings and capital-raising cycles drive results, and where talent retention and payouts matter as much as headline revenue. The latest quarter delivered record annual numbers and an earnings beat, but the revenue miss and subsequent share price pullback suggest that, at least near term, the market is more sensitive to top-line momentum than to profitability alone. That slightly reframes the key catalysts: investors may focus more on evidence that the deal pipeline is translating into realized fees, while also watching how the firm balances hiring, compensation and capital returns such as the US$0.25 dividend and buybacks. The big risk here is that expectations remain high just as deal timing proves harder to predict.

PJT Partners' share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Three fair value estimates from the Simply Wall St Community span roughly US$27 to US$177 per share, showing how differently individual investors are thinking about PJT. Set that against the recent revenue miss and share price pullback, and you can see why many will want to weigh competing views on how resilient the advisory pipeline really is.

Explore 3 other fair value estimates on PJT Partners - why the stock might be worth as much as 8% more than the current price!

Build Your Own PJT Partners Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PJT Partners research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free PJT Partners research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PJT Partners' overall financial health at a glance.

No Opportunity In PJT Partners?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 107 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 33 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.