يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

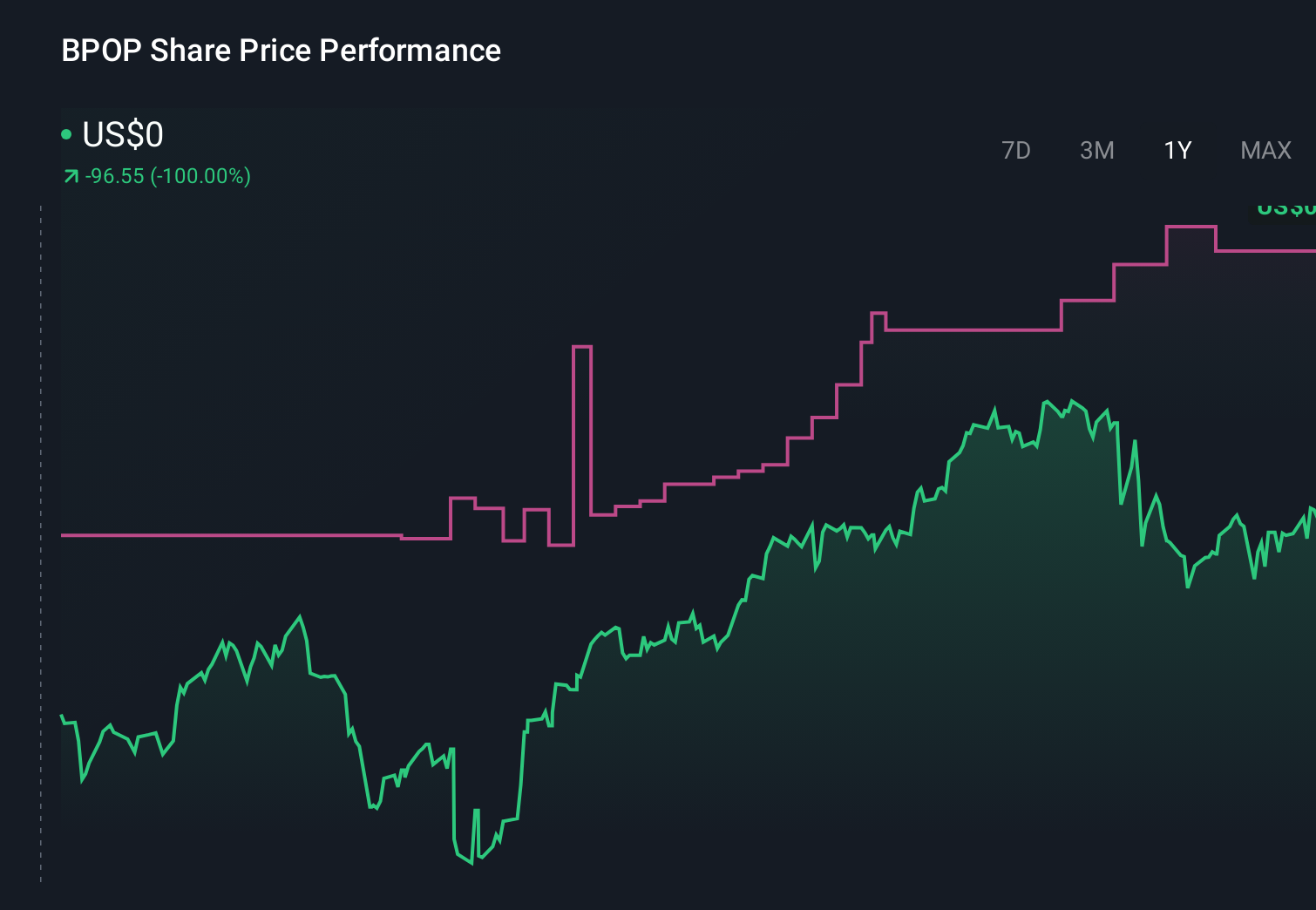

Why Popular (BPOP) Is Up 9.3% After Strong 2025 Earnings And Share Buybacks

Popular, Inc. BPOP | 147.56 | +2.58% |

- Popular, Inc. recently reported full-year 2025 results showing higher net interest income of US$2,541.2 million and net income of US$833.16 million, and it also disclosed lower quarterly net charge-offs alongside ongoing preferred and trust preferred dividend payments.

- The company further reinforced shareholder returns by completing a share repurchase of 1,847,274 shares for US$218.83 million while continuing regular income distributions on its hybrid securities.

- With earnings strength and disciplined share repurchases at the forefront, we’ll now examine how this shapes Popular’s broader investment narrative.

Capitalize on the AI infrastructure supercycle with our selection of the 33 best 'picks and shovels' of the AI gold rush converting record-breaking demand into massive cash flow.

What Is Popular's Investment Narrative?

For Popular to make sense in a portfolio, you have to be comfortable owning a bank that is leaning on solid net interest income, disciplined credit costs and active capital return instead of rapid growth. The latest full-year numbers, with higher net interest income of US$2,541.2 million and net income of US$833.16 million, reinforce that story, while lower quarterly net charge-offs suggest credit quality is currently manageable. Completing a US$218.83 million buyback and keeping preferred and trust preferred dividends flowing, including the March 2026 distributions just declared, signal a commitment to returning cash to investors rather than hoarding it. These moves do not radically change the near term catalysts, but they do tighten the focus on execution risk, regulatory scrutiny and how sustainable this pace of capital return really is.

However, investors should also weigh how much room Popular really has to keep returning capital at this clip. Popular's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 3 other fair value estimates on Popular - why the stock might be worth 13% less than the current price!

Build Your Own Popular Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Popular research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Popular research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Popular's overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find 52 companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are the new gold rush. Find out which 29 stocks are leading the charge.

- The future of work is here. Discover the 28 top robotics and automation stocks leading the charge in AI-driven automation and industrial transformation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.