يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Why We Like The Returns At Xponential Fitness (NYSE:XPOF)

Xponential Fitness, Inc. Class A XPOF | 8.29 | -0.48% |

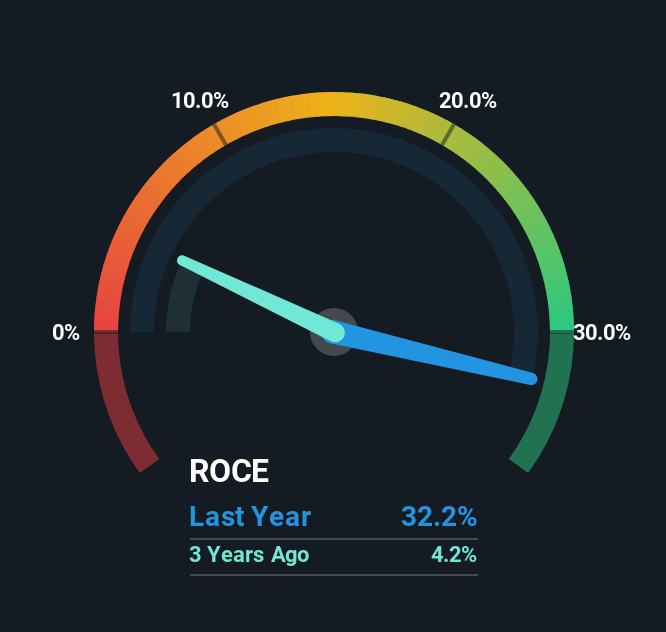

Did you know there are some financial metrics that can provide clues of a potential multi-bagger? Typically, we'll want to notice a trend of growing return on capital employed (ROCE) and alongside that, an expanding base of capital employed. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. And in light of that, the trends we're seeing at Xponential Fitness' (NYSE:XPOF) look very promising so lets take a look.

What Is Return On Capital Employed (ROCE)?

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. Analysts use this formula to calculate it for Xponential Fitness:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.32 = US$84m ÷ (US$355m - US$93m) (Based on the trailing twelve months to September 2025).

So, Xponential Fitness has an ROCE of 32%. In absolute terms that's a great return and it's even better than the Hospitality industry average of 11%.

In the above chart we have measured Xponential Fitness' prior ROCE against its prior performance, but the future is arguably more important. If you'd like to see what analysts are forecasting going forward, you should check out our free analyst report for Xponential Fitness .

What Can We Tell From Xponential Fitness' ROCE Trend?

We're delighted to see that Xponential Fitness is reaping rewards from its investments and has now broken into profitability. The company was generating losses five years ago, but has managed to turn it around and as we saw earlier is now earning 32%, which is always encouraging. On top of that, what's interesting is that the amount of capital being employed has remained steady, so the business hasn't needed to put any additional money to work to generate these higher returns. With no noticeable increase in capital employed, it's worth knowing what the company plans on doing going forward in regards to reinvesting and growing the business. So if you're looking for high growth, you'll want to see a business's capital employed also increasing.

What We Can Learn From Xponential Fitness' ROCE

As discussed above, Xponential Fitness appears to be getting more proficient at generating returns since capital employed has remained flat but earnings (before interest and tax) are up. Given the stock has declined 68% in the last three years, this could be a good investment if the valuation and other metrics are also appealing. With that in mind, we believe the promising trends warrant this stock for further investigation.

High returns are a key ingredient to strong performance, so check out our free list ofstocks earning high returns on equity with solid balance sheets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.