يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Why Xeris Biopharma Holdings (XERS) Is Up 5.3% After Raising 2025 Revenue Guidance and Ambitions

XERIS PHARMACEUTICALS INC XERS | 7.17 | +2.28% |

- In August 2025, Xeris Biopharma Holdings reported record second-quarter revenue of US$71.5 million, rising 49% year-over-year and highlighted by a very large increase in Recorlev sales.

- The company raised its full-year 2025 revenue guidance and outlined a long-term vision for reaching US$750 million in revenue by 2030 and US$1–3 billion in peak net revenue from XP-8121 by 2035, reflecting expanded ambitions based on recent performance.

- We'll now examine how the upgrade to Xeris Biopharma's 2025 revenue guidance influences its investment narrative and future prospects.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 28 companies in the world exploring or producing it. Find the list for free.

Xeris Biopharma Holdings Investment Narrative Recap

To be a shareholder in Xeris Biopharma Holdings, you need confidence in the company’s ability to extend its strong commercial momentum, most notably with Recorlev, while effectively managing its concentration risk and keeping expenses in check. The recent surge in quarterly revenue and the raised full-year guidance reinforce short-term optimism but do not fully offset the largest near-term risk, the heavy dependence on a narrow product set, which could expose the company to steep revenue swings if key franchise sales falter.

The August 2025 announcement of increased revenue guidance to US$280–290 million is particularly relevant, as it directly reflects improved Recorlev performance and suggests management’s heightened expectations for sustained high demand. This move, while promising, further amplifies the importance of commercial execution and product lifecycle management as primary growth catalysts for Xeris in the months ahead.

On the other hand, investors should be aware of the concentration risk in Xeris’s portfolio and...

Xeris Biopharma Holdings is projected to reach $429.4 million in revenue and $77.3 million in earnings by 2028. This outlook assumes annual revenue growth of 20.4% and an earnings increase of $109.3 million from the current -$32.0 million.

Uncover how Xeris Biopharma Holdings' forecasts yield a $9.00 fair value, a 16% upside to its current price.

Exploring Other Perspectives

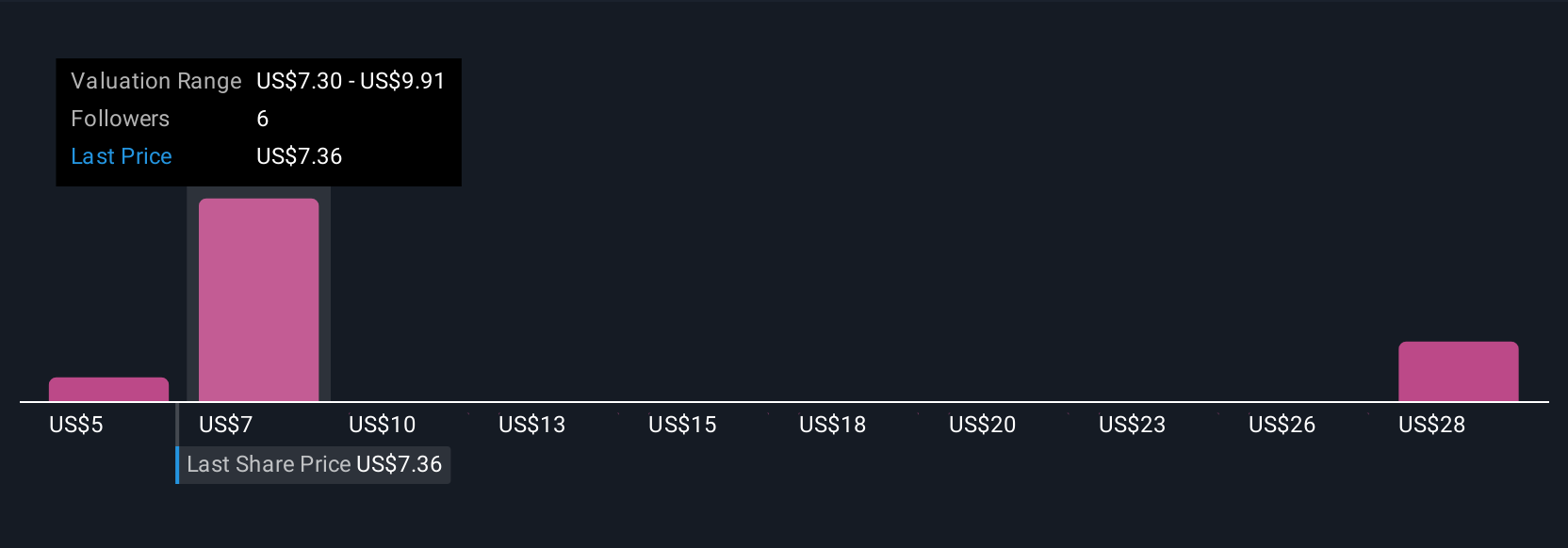

Simply Wall St Community members estimate Xeris’s fair value anywhere from US$4.69 to US$30.79 (three perspectives). While sales growth appears robust recently, concentration in a handful of products remains a central focus for future results. Explore more viewpoints in the community.

Explore 3 other fair value estimates on Xeris Biopharma Holdings - why the stock might be worth over 3x more than the current price!

Build Your Own Xeris Biopharma Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Xeris Biopharma Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Xeris Biopharma Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Xeris Biopharma Holdings' overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.