يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Will Analyst Optimism on ONEOK (OKE) Earnings Reshape Perceptions of Its Long-Term Growth Story?

ONEOK, Inc. OKE | 73.04 | -0.74% |

- ONEOK recently experienced heightened market attention after its shares saw movement ahead of the company's upcoming earnings release, which is anticipated to show a substantial increase in year-over-year earnings per share and revenue growth.

- Market interest has also been influenced by analyst estimate revisions, suggesting both positive business trends and some uncertainty regarding near-term expectations.

- We'll explore how investor anticipation around ONEOK's earnings potential may shape the outlook for its investment narrative.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

ONEOK Investment Narrative Recap

Investors considering ONEOK typically focus on the company’s exposure to U.S. natural gas and NGL infrastructure, as well as disciplined capital deployment toward growth projects and shareholder returns. The recent news spotlighted analyst estimate revisions and a dip in ONEOK’s share price ahead of earnings, but these movements have not significantly altered the core catalyst of sustained demand for U.S. energy exports, nor the ongoing risk tied to commodity price spread compression, which could influence net margins and revenue volatility in the near term. ONEOK's involvement in the Eiger Express Pipeline project, announced in August 2025, stands out as highly relevant for shaping future volume growth. This expansion illustrates the company's focus on strengthening its midstream network in high-demand regions, which could help offset short-term margin pressures by capturing more fee-based revenue as new capacity comes online. Yet, for investors, it's worth remembering that while project growth may buffer some risks, the continued uncertainty around commodity price spreads could…

ONEOK's outlook forecasts $34.0 billion in revenue and $4.2 billion in earnings by 2028. Achieving this would require annual revenue growth of 6.7% and a $1.1 billion increase in earnings from the current $3.1 billion.

Uncover how ONEOK's forecasts yield a $96.11 fair value, a 34% upside to its current price.

Exploring Other Perspectives

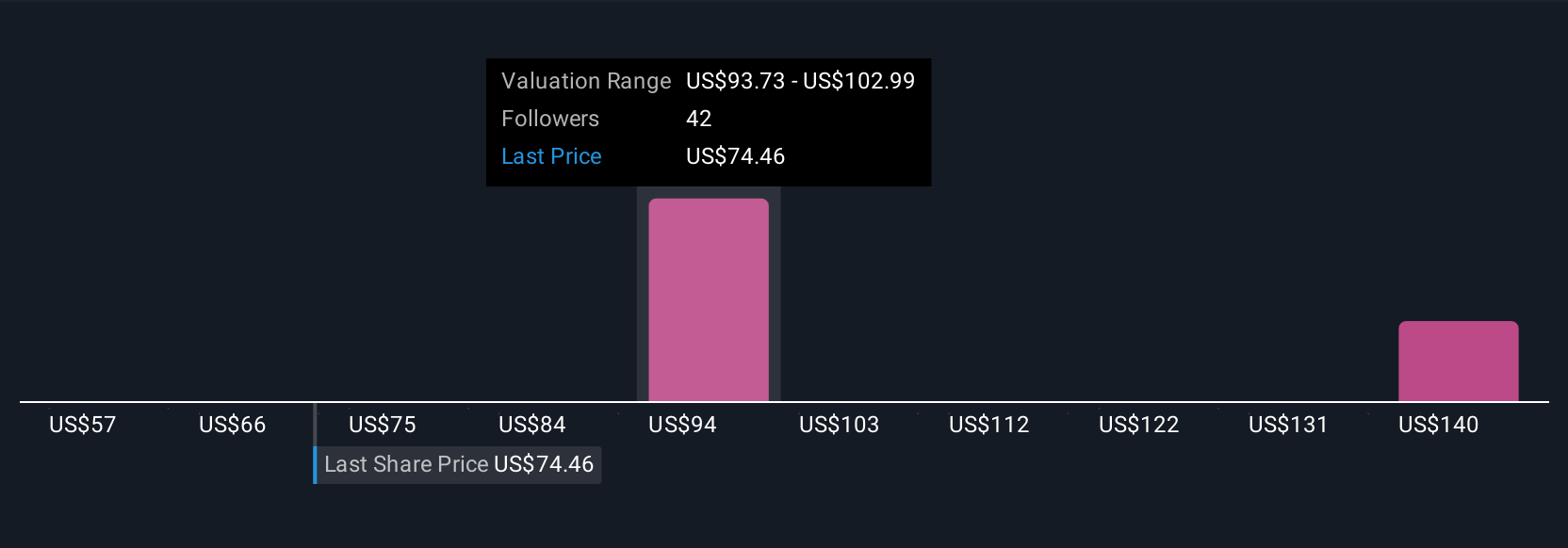

Seven members of the Simply Wall St Community estimate fair values for ONEOK ranging from US$70 to US$146. Some expect capacity expansions to boost returns, but concentrated risks around commodity spread compression could shape outcomes well beyond headline earnings trends.

Explore 7 other fair value estimates on ONEOK - why the stock might be worth just $70.00!

Build Your Own ONEOK Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ONEOK research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free ONEOK research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ONEOK's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.