يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Will DHT Holdings’ (DHT) Time Charter Focus Reshape Its Long-Term Resilience and Earnings Outlook?

DHT Holdings, Inc. DHT | 14.89 14.86 | +0.13% -0.22% Post |

- Earlier this week, DHT Holdings reported enhanced operational efficiency and a stronger focus on time charter agreements to stabilize costs and margins, highlighting continued resilience in a shifting shipping market.

- An increased emphasis on time charters over spot rates, along with prudent debt management and robust free cash flow, is aimed at supporting stable returns for shareholders.

- We'll examine how DHT's shift toward stable time charter contracts may influence its long-term earnings outlook and business resilience.

We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

DHT Holdings Investment Narrative Recap

Owning DHT Holdings means believing in the durability of global crude oil transport and the potential for predictable income through stable, long-term charter contracts. The latest operational update, focused on cost control and a greater reliance on time charters, supports the company’s effort to reduce earnings fluctuations, even as sector-wide spot market volatility remains a key short-term risk. At this stage, the news reinforces DHT’s approach to managing short-term earnings visibility, though it does not eliminate market rate pressures entirely.

The most relevant recent announcement is DHT’s updated second-quarter 2025 earnings, showing net income grew to US$56.1 million even as revenue declined year over year. This result supports management’s narrative that improved operational efficiency and disciplined contract strategy can help cushion against a softer rate environment, partly offsetting fluctuations from spot market exposure and sector oversupply risks.

But despite these improvements, persistent industry-wide oversupply and uncertainties around vessel scrapping remain factors that investors should...

DHT Holdings' outlook anticipates $497.7 million in revenue and $281.4 million in earnings by 2028. This reflects a 3.7% annual revenue decline and a $91 million increase in earnings from the current $190.4 million.

Uncover how DHT Holdings' forecasts yield a $14.32 fair value, a 25% upside to its current price.

Exploring Other Perspectives

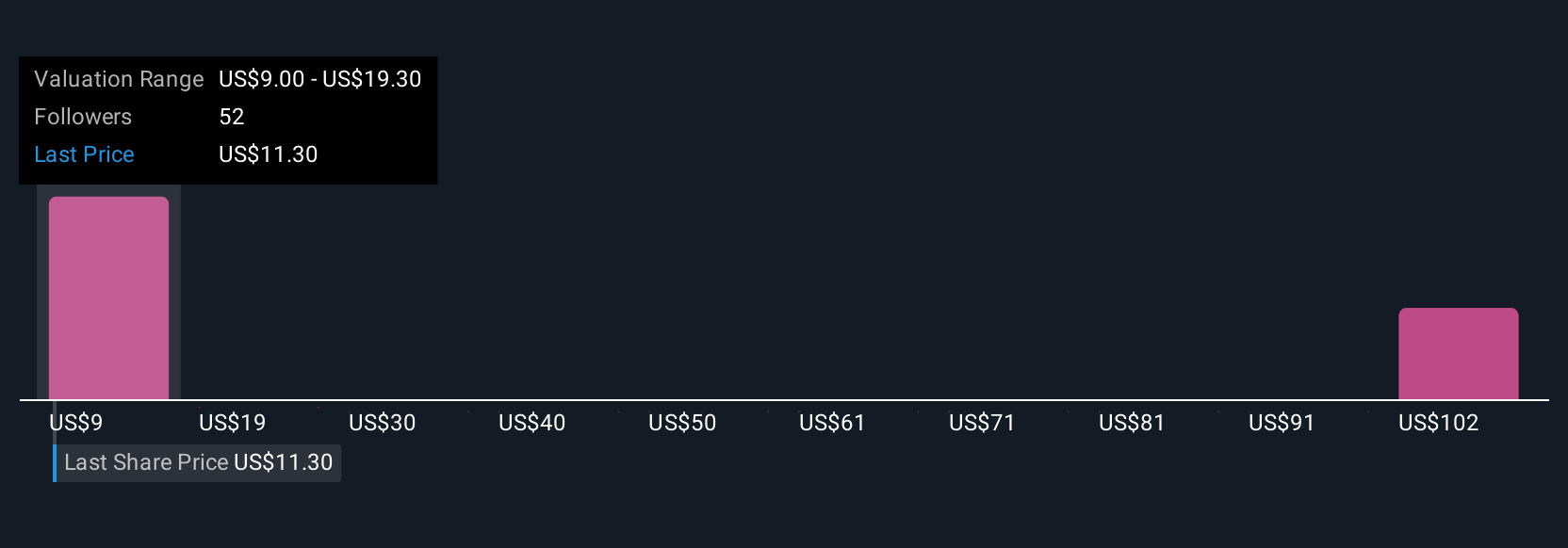

Seven members of the Simply Wall St Community provided fair value estimates for DHT Holdings, ranging from US$9 to US$125.89 per share. With continued growth in time charter contracts cited as a stabilizing catalyst, consider how differing views on reliable cash flows impact opinions on long-term value.

Explore 7 other fair value estimates on DHT Holdings - why the stock might be a potential multi-bagger!

Build Your Own DHT Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DHT Holdings research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free DHT Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DHT Holdings' overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.