يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Will Floor & Decor’s (FND) Leadership Change Shape Its Path to 500 Stores?

Floor & Decor FND | 68.99 | +4.34% |

- In the past week, Floor & Decor Holdings announced third-quarter results showing increased sales and net income, alongside updated full-year earnings guidance and a planned CEO transition, with President Bradley Paulsen set to become CEO in December 2025 as the current CEO moves to Executive Chair.

- The leadership change, paired with continued growth in quarterly performance, highlights a focus on both operational continuity and the company's targets for long-term expansion toward 500 warehouse stores.

- We'll now examine how Floor & Decor’s leadership transition and updated outlook influence its long-term investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Floor & Decor Holdings Investment Narrative Recap

Floor & Decor’s long-term story is built on becoming a dominant national player through aggressive store expansion and increased pro-customer engagement. The updated earnings guidance, which now calls for a decline in comparable store sales of 1.0 to 2.0 percent for the full year, leaves the major near-term risk, weak housing turnover and consumer caution, firmly in play, while not materially altering expectations for a recovery in transaction growth as market conditions evolve.

The company’s freshly announced CEO transition stands out as the most directly relevant news, with President Bradley Paulsen set to take the leadership reins in late 2025. This move signals a clear intent to maintain operational stability during a period of challenging market conditions and ongoing expansion, but doesn’t directly impact the short-term sales catalyst most investors are watching.

However, against this backdrop, one key risk investors should keep in mind is how rapid expansion plans could challenge store-level economics if...

Floor & Decor Holdings is projected to reach $6.0 billion in revenue and $296.9 million in earnings by 2028. This outlook requires annual revenue growth of 9.0% and an $85.7 million increase in earnings from the current $211.2 million level.

Uncover how Floor & Decor Holdings' forecasts yield a $81.55 fair value, a 32% upside to its current price.

Exploring Other Perspectives

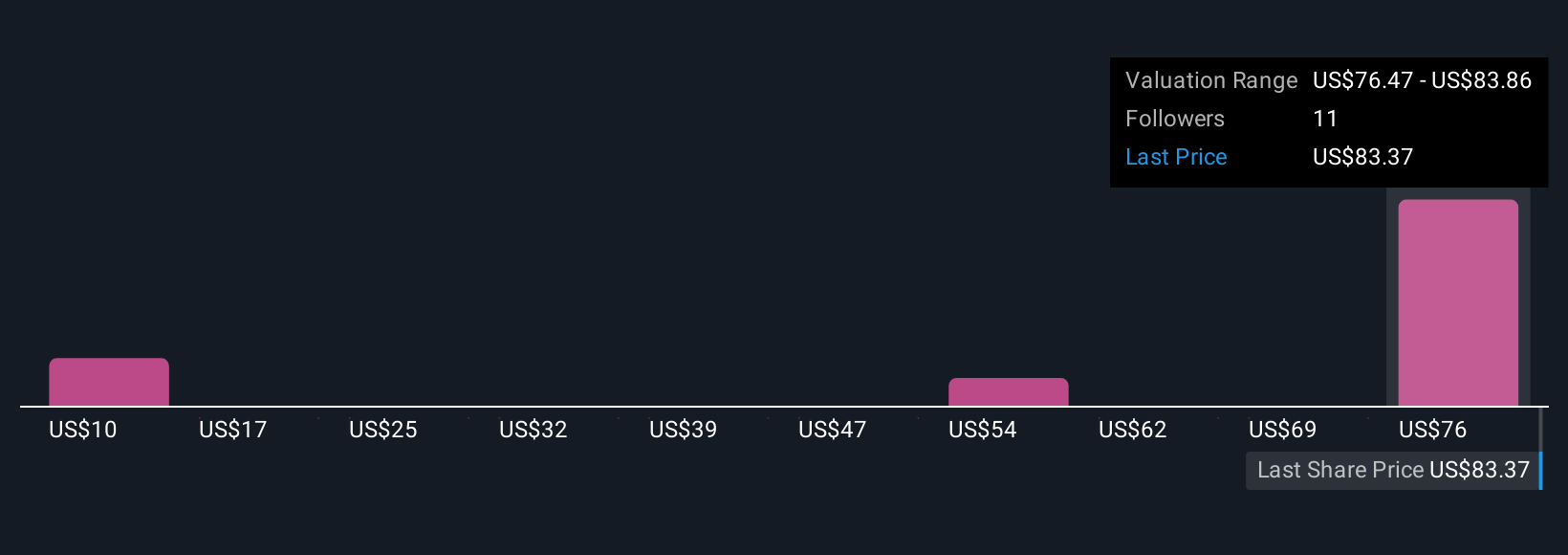

Simply Wall St Community members have shared five fair value estimates for Floor & Decor that range widely, from US$24.65 to US$81.55 per share. With the company poised for ongoing store growth but facing near-term comparable sales headwinds, now is the time to compare different viewpoints and see what matters most to you.

Explore 5 other fair value estimates on Floor & Decor Holdings - why the stock might be worth as much as 32% more than the current price!

Build Your Own Floor & Decor Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Floor & Decor Holdings research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Floor & Decor Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Floor & Decor Holdings' overall financial health at a glance.

No Opportunity In Floor & Decor Holdings?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.