يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Will Higher Earnings and a Dividend Boost Change Hercules Capital’s (HTGC) Investment Narrative?

Hercules Capital, Inc. HTGC | 18.72 | +0.29% |

- Hercules Capital recently reported its second quarter 2025 financial results, showing revenue of US$137.46 million and net income of US$78.89 million, both higher than the same period last year, and announced a total quarterly cash distribution of US$0.47 per share, including a supplemental dividend.

- This combination of higher earnings and an additional dividend could signal strong operational performance and continued confidence in the company’s ability to return capital to shareholders.

- With this step-up in quarterly net income and dividend payouts, we'll assess how these developments could influence Hercules Capital's investment narrative.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Hercules Capital Investment Narrative Recap

For investors considering Hercules Capital, the big picture centers on the company’s role as a significant venture lender to technology and life sciences, with the potential for robust revenue and earnings growth if these sectors maintain momentum. The solid second quarter results, showing increased revenue and net income versus last year, may help counter investor concern over short term margin pressure from competition, though sector concentration risk, exposure to just a few industries, remains a key factor to monitor and is not eliminated by the recent earnings beat.

Among the recent announcements, the declaration of a US$0.47 per share cash distribution for the second quarter, including a US$0.07 supplemental dividend, is especially relevant. This move highlights Hercules Capital’s continued distribution focus, supporting the company’s narrative as a reliable income provider for shareholders, and aligns with one of the catalysts: well-covered and consistent investor payouts enhancing appeal, even as ongoing competition challenges yield strength. But, in contrast, shareholders should be aware that the risk of outsized credit losses due to sector concentration remains, particularly if there are sudden downturns in these industries...

Hercules Capital's outlook anticipates $677.4 million in revenue and $455.0 million in earnings by 2028. This projection is based on an annual revenue growth rate of 10.4% and a $198.4 million increase in earnings from the current $256.6 million.

Uncover how Hercules Capital's forecasts yield a $21.22 fair value, a 9% upside to its current price.

Exploring Other Perspectives

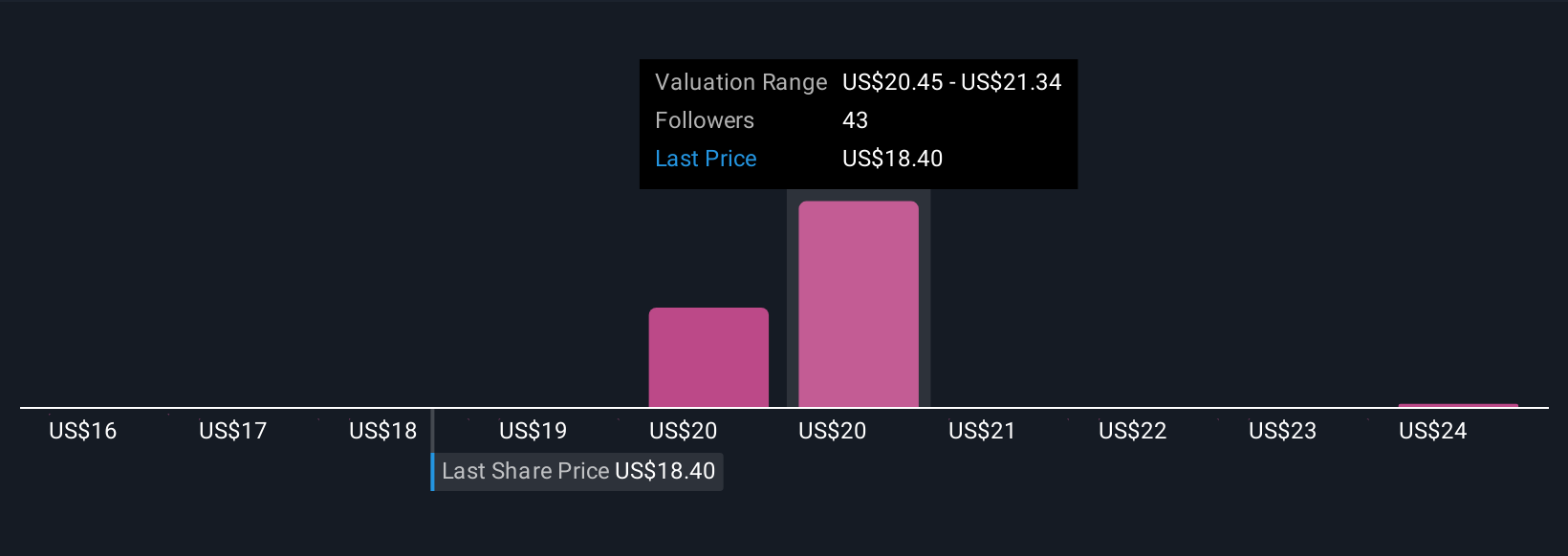

Five fair value estimates from the Simply Wall St Community range from US$16 to US$24.67 per share. While investor opinions are diverse, sector concentration risk in technology and life sciences could affect performance more broadly than recent quarterly gains suggest.

Explore 5 other fair value estimates on Hercules Capital - why the stock might be worth as much as 27% more than the current price!

Build Your Own Hercules Capital Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hercules Capital research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Hercules Capital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hercules Capital's overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.