يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Will Renewed Interest in Dynatrace’s (DT) AI Strategy Influence Its Long-Term Market Position?

Dynatrace Holdings DT | 44.17 | -0.47% |

- In recent weeks, the Renaissance Large Cap Growth Strategy added a position in Dynatrace, Inc., drawing attention to the company's growing relevance in cloud computing and AI-driven observability amid shifting market sentiment and cautious investor reactions to macroeconomic data.

- An interesting highlight is Dynatrace's significant growth in profitability, rising insider ownership, and decade-long experience leveraging AI to manage increasingly complex enterprise cloud environments, which aligns closely with current enterprise digital transformation priorities.

- We’ll explore how renewed investor focus on Dynatrace’s AI-powered cloud observability capabilities may influence its longer-term investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Dynatrace Investment Narrative Recap

For investors considering Dynatrace, a core belief is that the company can maintain its edge in AI-powered observability as cloud complexity grows and enterprises accelerate digital modernization. While recent buy activity from the Renaissance Large Cap Growth Strategy highlights confidence in Dynatrace's positioning, the market’s pullback following macroeconomic uncertainty did not cause a material shift in the primary near-term risk, the execution challenges and timing volatility tied to large, strategic enterprise deals.

The recent announcement of third-generation platform enhancements featuring expanded AI automation directly relates to Dynatrace’s key growth catalyst: embedding deeper into enterprise IT with differentiated, multi-product solutions. Continued product innovation strengthens its case to capture expanding digital transformation budgets, but also raises execution stakes as decision cycles lengthen and competition intensifies.

Yet, in contrast to product momentum, investors should be aware that customer concentration and timing risks from reliance on large strategic deals could mean...

Dynatrace's narrative projects $2.7 billion in revenue and $521.4 million in earnings by 2028. This requires 15.2% yearly revenue growth and a $28.4 million earnings increase from $493.0 million.

Uncover how Dynatrace's forecasts yield a $63.09 fair value, a 29% upside to its current price.

Exploring Other Perspectives

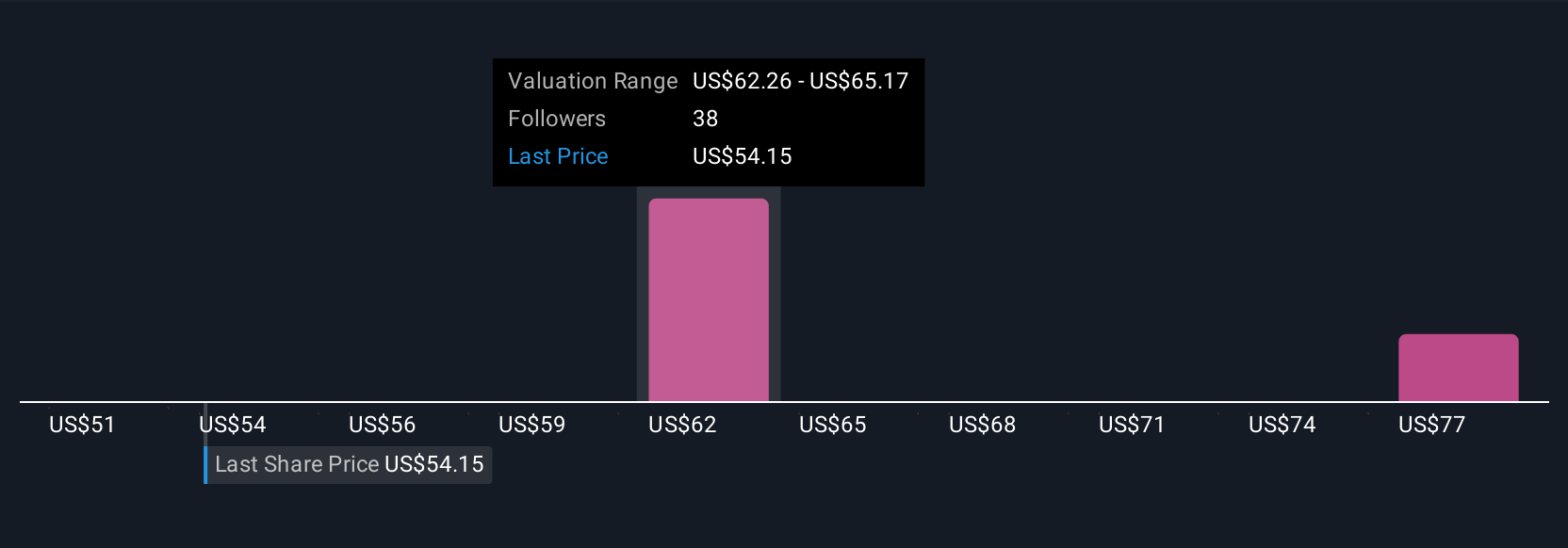

Simply Wall St Community members estimated Dynatrace’s fair value between US$50.62 and US$71.25 across 4 perspectives. Alongside these varying outlooks, the risk of elongated enterprise deal cycles remains front of mind for many following the stock.

Explore 4 other fair value estimates on Dynatrace - why the stock might be worth as much as 45% more than the current price!

Build Your Own Dynatrace Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dynatrace research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Dynatrace research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dynatrace's overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 28 best rare earth metal stocks of the very few that mine this essential strategic resource.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.