يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Will Robust Earnings and Upbeat Outlook Shift Burlington Stores' (BURL) Long-Term Investment Narrative?

Burlington Stores, Inc. BURL | 288.24 | +1.50% |

- Burlington Stores reported second-quarter earnings for the period ended August 2, 2025, with sales reaching US$2.70 billion and net income of US$94.19 million, alongside announcing recent share repurchases under its existing buyback program.

- The company also issued higher full-year sales guidance, anticipating total sales growth of 7% to 8% and comparable store sales growth of 1% to 2% for the year ending January 31, 2026, reflecting confidence in continued operational momentum.

- We'll examine how Burlington Stores' strong quarterly earnings and higher sales outlook may influence its long-term investment narrative.

Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Burlington Stores Investment Narrative Recap

To invest in Burlington Stores, you need to believe that its focus on expanding store count and improving its brand assortment will translate into lasting sales and margin growth. The latest quarterly earnings and raised sales guidance reinforce the company's operational momentum, which supports near-term growth catalysts, while short-term sales volatility and profit margin pressures from higher costs remain the most important risks. In my view, these results are material for the short-term outlook, signaling that Burlington is executing well against its core growth strategy for now.

Among recent announcements, the company's active share repurchase program stands out. Repurchasing over US$368 million in stock since late 2023 reflects management's confidence in Burlington's performance and may provide support to shareholder returns, which aligns closely with the company’s improved guidance and momentum as a potential catalyst ahead of new store openings.

By contrast, investors should be aware that any rapid changes in consumer demand or elevated costs could still pressure Burlington’s profit margins and liquidity if...

Burlington Stores' narrative projects $14.1 billion in revenue and $925.4 million in earnings by 2028. This requires 9.5% annual revenue growth and a $399.4 million increase in earnings from the current $526.0 million.

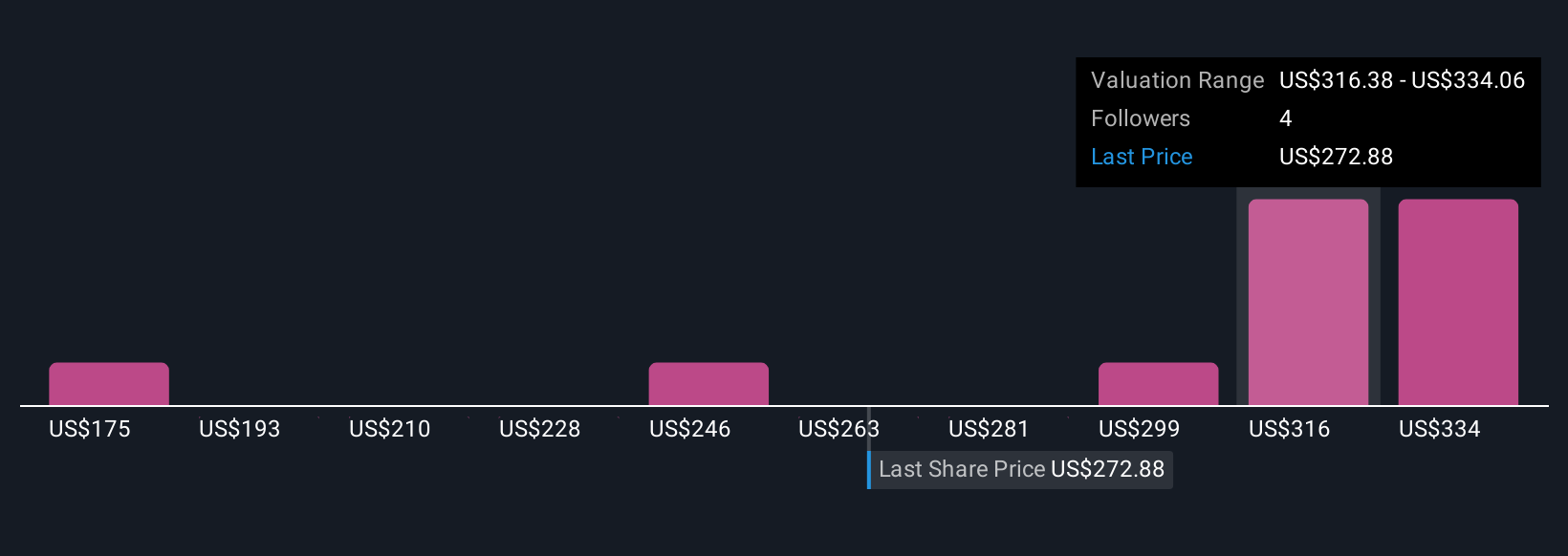

Uncover how Burlington Stores' forecasts yield a $337.06 fair value, a 16% upside to its current price.

Exploring Other Perspectives

Five individual fair value estimates from the Simply Wall St Community range from US$174.88 to US$403.98 per share. While some see significant upside, others may weigh ongoing risks like volatility in consumer spending due to economic factors, highlighting a wide array of possible outcomes.

Explore 5 other fair value estimates on Burlington Stores - why the stock might be worth 40% less than the current price!

Build Your Own Burlington Stores Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Burlington Stores research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Burlington Stores research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Burlington Stores' overall financial health at a glance.

No Opportunity In Burlington Stores?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.