يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Will Stable Assets and Long-Term Outflows Reshape Victory Capital Holdings' (VCTR) Organic Growth Narrative?

Victory Capital Holdings, Inc. Class A VCTR | 75.59 | -0.51% |

- Victory Capital Holdings recently reported Total Client Assets of about US$316.60 billion as of December 31, 2025, alongside long-term Assets Under Management net outflows of US$2.10 billion in the fourth quarter, and it has already scheduled its fourth-quarter 2025 results release and conference call for early February 2026.

- This combination of broadly stable overall asset levels with continued long-term net outflows raises fresh questions about the strength and durability of the firm’s organic growth profile.

- Against this backdrop of stable overall assets but renewed long-term outflows, we’ll examine how the update influences Victory Capital’s investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Victory Capital Holdings Investment Narrative Recap

To own Victory Capital today, you need to be comfortable with an asset manager whose overall client assets look steady at about US$316.60 billion, while long term AUM continues to leak out. The latest US$2.10 billion in quarterly outflows reinforces that organic growth is still the key short term catalyst and also the biggest near term risk, but the update itself does not materially change that core debate.

The most relevant near term milestone is the upcoming fourth quarter 2025 results release on February 4, 2026, followed by the conference call on February 5. Those events should give investors better clarity on how long term outflows are affecting fee rates, margins and the broader growth story, especially in light of prior acquisitions and product expansion efforts.

Yet behind the steady headline asset figure, investors should be aware that persistent long term net outflows could...

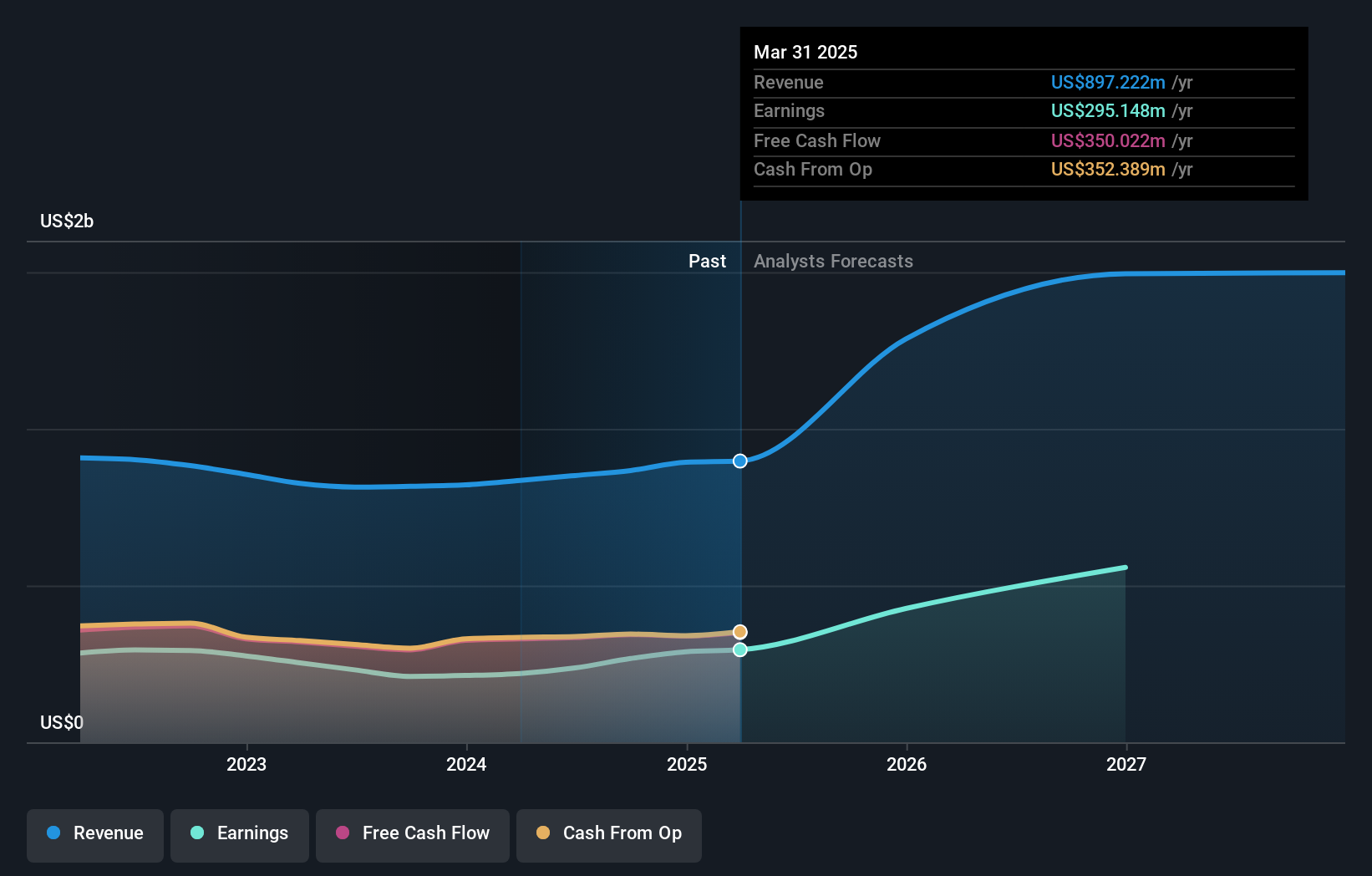

Victory Capital Holdings' narrative projects $1.8 billion revenue and $735.1 million earnings by 2028. This requires 20.4% yearly revenue growth and a $470.5 million earnings increase from $264.6 million today.

Uncover how Victory Capital Holdings' forecasts yield a $73.67 fair value, a 9% upside to its current price.

Exploring Other Perspectives

Three Simply Wall St Community fair value estimates for Victory Capital cluster between US$66.35 and US$73.67, showing how far individual views can stretch. Against that spread, the recent US$2.10 billion in long term net outflows highlights why you may want to compare several different takes on the company’s growth prospects before deciding how it might fit in your portfolio.

Explore 3 other fair value estimates on Victory Capital Holdings - why the stock might be worth just $66.35!

Build Your Own Victory Capital Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Victory Capital Holdings research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Victory Capital Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Victory Capital Holdings' overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

- We've found 12 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.