يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Will Tariffs and a Riley Sheehey Collaboration Reshape Williams-Sonoma’s (WSM) Brand Strategy?

Williams-Sonoma, Inc. WSM | 186.47 | -0.60% |

- In September 2025, Pottery Barn Kids, a Williams-Sonoma brand, announced its first collaboration with watercolor artist Riley Sheehey, launching a holiday-inspired collection of children’s home furnishings featuring her hand-painted illustrations.

- This partnership marks Sheehey’s debut in home furnishings and blends artful, storybook design with Pottery Barn Kids’ craftsmanship, aiming to captivate families during the holiday season.

- We'll examine how newly announced tariffs on imported furniture could reshape Williams-Sonoma’s investment narrative amid evolving industry challenges.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Williams-Sonoma Investment Narrative Recap

To be confident as a Williams-Sonoma shareholder, you must believe in the company's ability to consistently deliver design-focused innovation and capture affluent consumers, despite a retail sector facing headwinds from tariffs and shifting demand. The most immediate catalyst is continued brand success, notably partnerships like Pottery Barn Kids' collaboration with Riley Sheehey, while the biggest near-term risk remains pronounced tariff volatility on furniture imports, an issue brought to the fore by recent US government actions.

One recent announcement stands out against this backdrop: the newly declared US tariffs on imported furniture products, including categories core to Williams-Sonoma. This development adds fresh near-term cost pressure and uncertainty to the business, posing potential risks to margins and earnings, particularly if cost increases cannot be offset through pricing or supply chain adjustments.

Yet, with these new external risks, investors should be especially aware of how quickly tariff policy shifts can...

Williams-Sonoma's narrative projects $8.7 billion revenue and $1.2 billion earnings by 2028. This requires 3.4% yearly revenue growth and a $0.1 billion earnings increase from $1.1 billion today.

Uncover how Williams-Sonoma's forecasts yield a $204.32 fair value, a 4% upside to its current price.

Exploring Other Perspectives

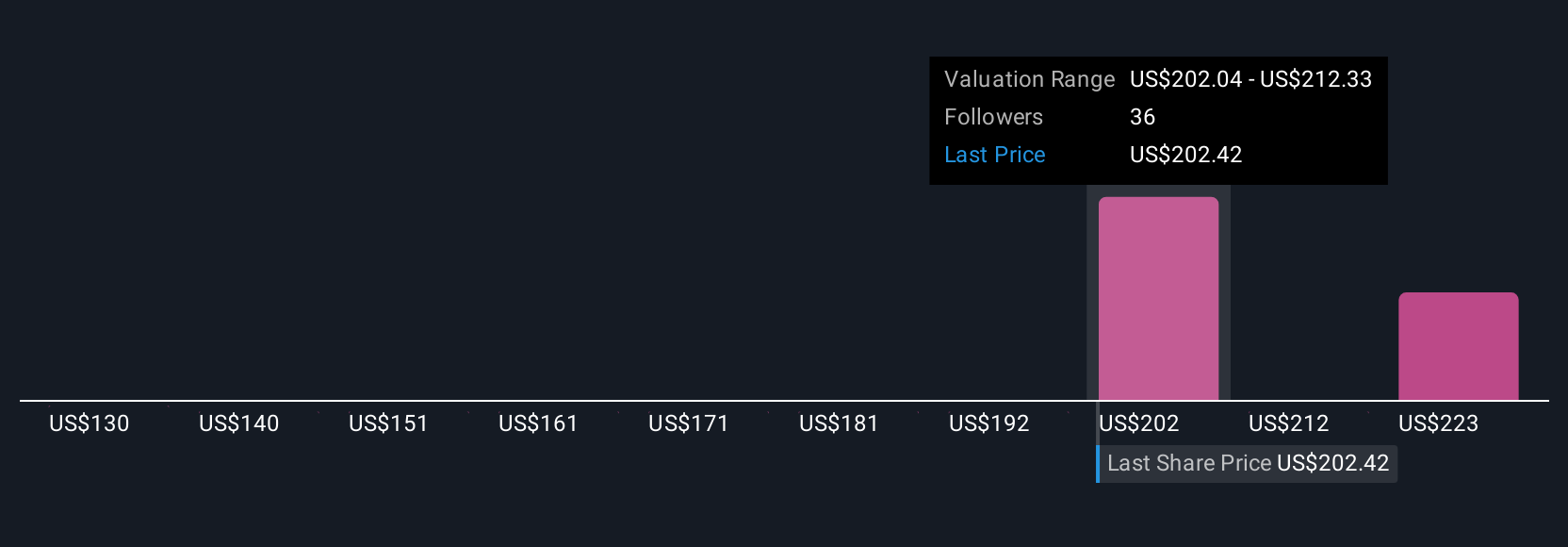

The four fair value estimates from the Simply Wall St Community range widely, from US$130 to US$229.30 per share. Amid this diversity, the threat of ongoing tariff changes stands out as a key factor that could alter both margins and sentiment, reminding you to weigh multiple viewpoints on Williams-Sonoma’s outlook.

Explore 4 other fair value estimates on Williams-Sonoma - why the stock might be worth 34% less than the current price!

Build Your Own Williams-Sonoma Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Williams-Sonoma research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Williams-Sonoma research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Williams-Sonoma's overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.