يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Workday (WDAY): Assessing Valuation After Recent Share Price Volatility

Workday, Inc. Class A WDAY | 162.92 | +2.62% |

Workday (WDAY) has been on investors’ radar lately, as its stock price has shown some shifts over the past month. The company continues to navigate the broader software market landscape. As a result, investors are keeping an eye on its performance.

Workday’s share price has seen some volatility, softening with a 6.6% decline over the past month, and its year-to-date share price return is now down 10%. Despite this, the bigger picture still points to solid growth with a 3-year total shareholder return of 56%. However, the 1-year total return of -15% suggests momentum has faded recently as the market reassesses growth and risk potential.

If you’re looking beyond software, now’s a great moment to broaden your search and discover fast growing stocks with high insider ownership.

With shares now trading 34% below estimated intrinsic value and analysts forecasting upside, the key question is whether the recent pullback creates a compelling entry point or if the market has already factored in Workday’s future growth.

Most Popular Narrative: 19.6% Undervalued

With a fair value estimate of $282.05 from the most widely followed narrative and Workday’s last close at $226.64, bulls will notice a sizable gap. The narrative turns attention to key innovations and expansion bets, setting up a deeper dive into the drivers behind this optimism.

Broad adoption of Workday's AI-enabled HR and finance products (with over 70% of customers using Workday Illuminate and over 75% of net new deals including at least one AI product), along with acquisitions like Paradox and Flowise, is fueling cross-sell/upsell activity, increasing average contract values and bolstering future topline growth.

Wondering what could spark Workday’s next big move? There’s a bold earnings trajectory and profit margin leap embedded in this fair value. Discover which sky-high financial assumptions the consensus is betting on, as one figure in particular might flip your perspective on the company’s potential.

Result: Fair Value of $282.05 (UNDERVALUED)

However, rapidly intensifying AI competition or tightening regulations could put pressure on Workday’s margins and growth prospects. This could challenge the current bullish narrative.

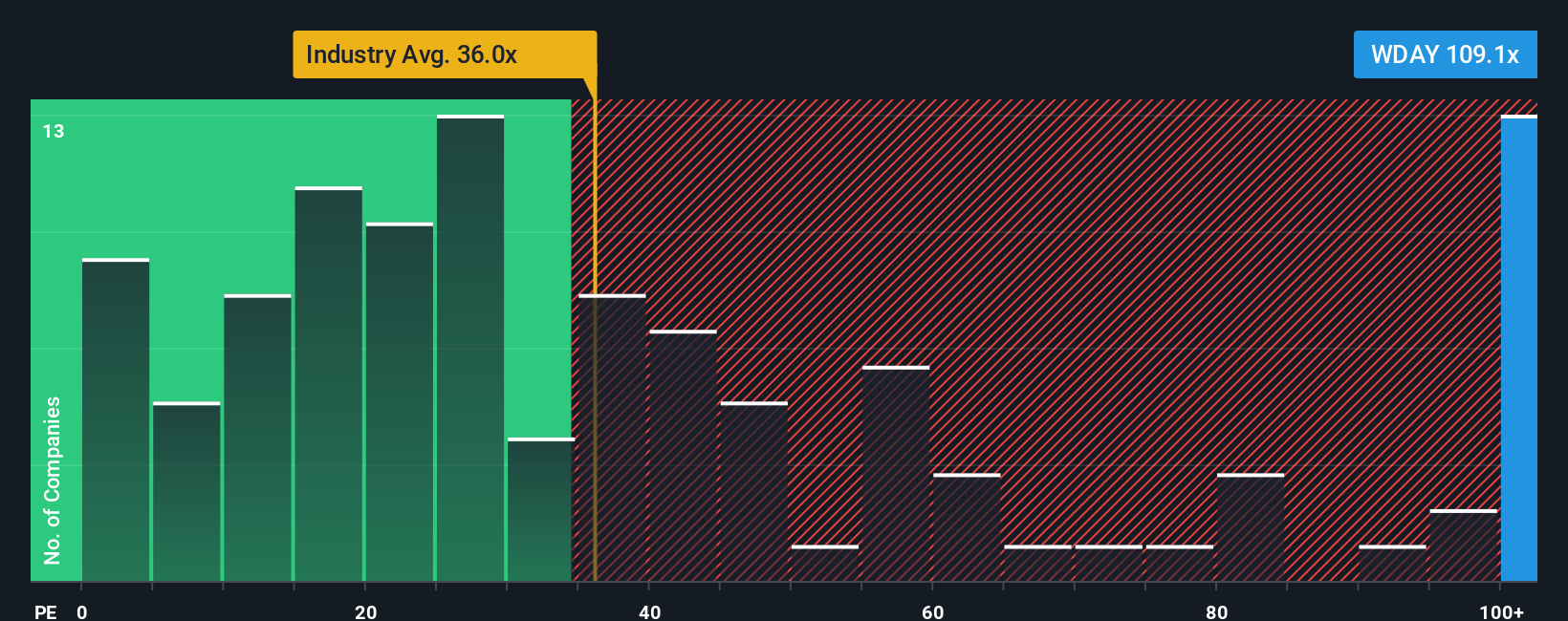

Another View: The Multiples Challenge

While many see Workday as undervalued on a fair value basis, a look at its price-to-earnings ratio tells another story. The company is trading at 103.8 times earnings, far above the US Software industry average of 28.8 and its peer average of 57.9. Even its fair ratio is just 52.7. This large gap suggests the market is pricing in high expectations, and offers little margin for error if growth stalls. Does the multiples view indicate investors may be overestimating Workday's prospects?

Build Your Own Workday Narrative

If the current story doesn't fit your outlook, take a closer look at the numbers and shape your own perspective in just a few minutes. Do it your way.

A great starting point for your Workday research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t miss your chance to uncover fresh opportunities beyond Workday. With the Simply Wall Street Screener, you can pinpoint stocks primed for outperformance in just minutes.

- Unlock the potential of cutting-edge healthcare with these 30 healthcare AI stocks, matching innovative companies to the future of medicine and technology.

- Capture market moves by targeting undervalued businesses using these 924 undervalued stocks based on cash flows, so you can access tomorrow’s growth leaders today.

- Boost your income strategy by finding quality picks among these 14 dividend stocks with yields > 3% yielding over 3%, allowing your portfolio to do more for you.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.