يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Zillow 2026 Home Sales Outlook Reshapes Rates View And Valuation Case

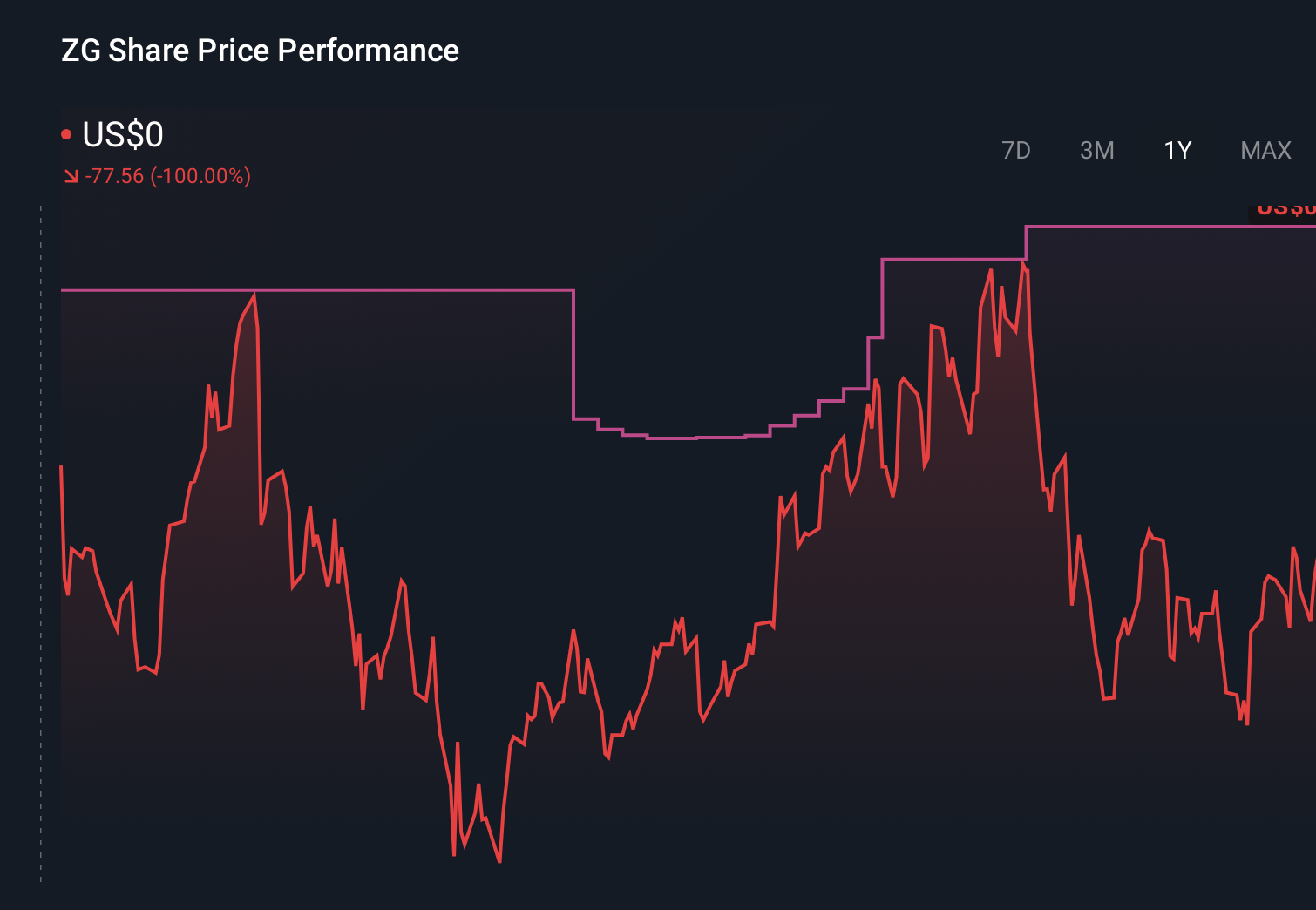

Zillow Group, Inc. Class A ZG | 45.42 | -0.26% |

- Zillow Group issued a new 2026 outlook that calls for a significant increase in U.S. home sales.

- The company shared expectations on national mortgage rate trends and how conditions could differ across local markets.

- The update also touches on inventory patterns, giving investors a fresh read on supply and demand for housing related activity.

For investors watching NasdaqGS:ZG, this forecast lands at a time when the stock trades at $65.06 and has seen mixed performance. Shares are down 13.3% over the past year and 55.3% over five years, while the three year return stands at 50.1%. That kind of pattern makes fresh guidance on the housing backdrop an important reference point.

Zillow's 2026 home sales and mortgage rate commentary provides a company level view of how housing activity could develop for transaction focused and housing adjacent businesses. As you read through the details, it can be useful to consider how different rate and inventory paths might affect buyer demand, seller behavior, and the volume of activity flowing through Zillow's platform and peers.

Stay updated on the most important news stories for Zillow Group by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Zillow Group.

Investor Checklist: How This Forecast Fits Into the Zillow Story

Quick Assessment

- ✅ Price vs Analyst Target: At US$65.06, Zillow trades below the US$85.79 analyst price target range midpoint.

- ✅ Simply Wall St Valuation: Shares are described as trading 29.9% below estimated fair value.

- ❌ Recent Momentum: The 30 day return of about 4.3% decline flags near term weakness.

Check out Simply Wall St's in depth valuation analysis for Zillow Group.

Key Considerations

- 📊 The 2026 home sales uplift and mortgage rate commentary relate directly to future transaction volume on Zillow's platforms.

- 📊 Watch how actual mortgage rate movements, U.S. existing home sales data and inventory trends compare with Zillow's outlook.

- ⚠️ A weaker than expected recovery in local markets could limit the benefit of higher forecast home sales for revenue and earnings.

Dig Deeper

For the full picture including more risks and rewards, check out the complete Zillow Group analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.