يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Moelis (MC): Assessing Valuation After Strong Q3 Earnings and M&A Advisory Momentum

Moelis & Co. Class A MC | 63.18 | +0.72% |

Moelis (MC) delivered impressive third quarter earnings, with net income rising sharply compared to last year. This performance reflects stronger merger and acquisition activity, as well as steady momentum in its capital markets advisory business.

Despite a challenging year for financials, Moelis’ share price recently regained some ground, driven by strong quarterly results and shareholder-friendly moves such as its latest dividend and buyback. However, the one-year total shareholder return is down 14.5%, reminding investors that momentum is only just starting to rebuild. Last year’s rally saw a remarkable 57% total return over three years and 138% over five years.

If you’re curious what other fast-recovering opportunities are out there, now’s the perfect time to discover fast growing stocks with high insider ownership

With Moelis now recovering from last year’s pullback and strong earnings fueling optimism, investors are left to ask whether the current share price still offers a bargain or if the market is already factoring in future growth.

Most Popular Narrative: 16.8% Undervalued

Moelis is trading below the narrative's fair value estimate, with the most popular view seeing more upside ahead compared to the last close price. The valuation reflects strong optimism about the firm’s evolving business mix and future profit margins.

The strong momentum in global cross-border M&A and a robust, globally integrated platform allows Moelis to benefit from increasing international capital flows, expanding its addressable client base and diversifying revenue streams. This is likely to support both higher and more stable earnings over the medium to long term.

Want the inside story on why this narrative sees so much potential? Key assumptions around international deal-making, top-line growth, and future profit margins power the bullish outlook. Get the details that make this fair value stand out and see what’s really driving Moelis’ next chapter.

Result: Fair Value of $76.86 (UNDERVALUED)

However, continued high compensation costs or slower-than-expected revenue growth could put pressure on Moelis’ margins and challenge analysts’ optimistic outlook.

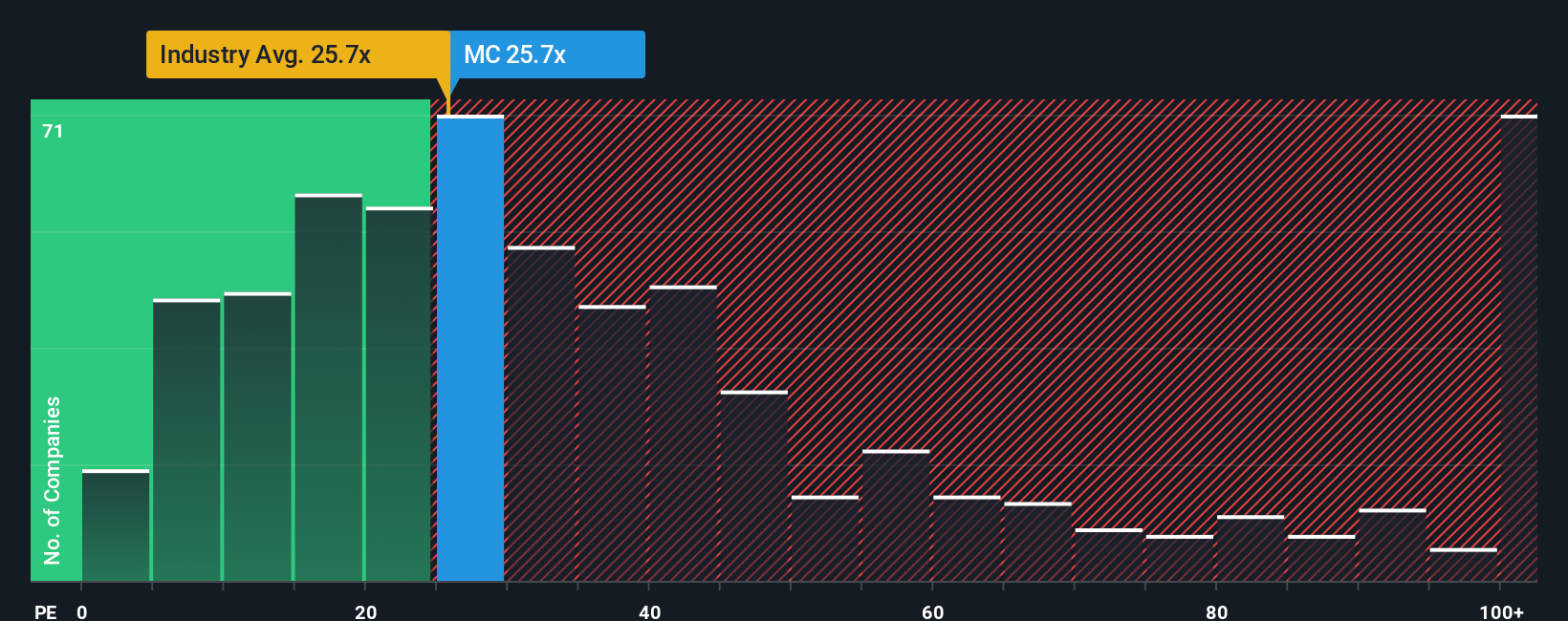

Another View: What Do P/E Ratios Say?

Looking from a different perspective, Moelis trades at a price-to-earnings ratio of 20.2x. This is above both its peer average of 17.1x and the fair ratio of 18.2x that the market could eventually target. It is more affordable than the broader US Capital Markets industry average of 24.1x. However, the current gap signals that shares are not a deep bargain and investors may be exposed to some valuation risk if expectations adjust. Could future earnings growth make this premium worth it?

Build Your Own Moelis Narrative

If you see things differently or want to dig deeper into the data yourself, you can craft a personalized view of Moelis in just a few minutes. So why not Do it your way.

A great starting point for your Moelis research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

You shouldn’t limit your portfolio to just one story. Give yourself the edge by checking out powerful stock ideas that other investors are watching right now.

- Grab the chance to build wealth with reliable income by checking out these 16 dividend stocks with yields > 3% which offers yields above 3% for consistent returns.

- Catch the next wave of innovation and growth by targeting these 25 AI penny stocks with strong exposure to artificial intelligence breakthroughs and future-facing business models.

- Secure hidden value in the market by scanning these 878 undervalued stocks based on cash flows currently priced below their true potential based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.