There's Been No Shortage Of Growth Recently For Tencent Music Entertainment Group's (NYSE:TME) Returns On Capital

Tencent Music Entertainment Group TME | 0.00 |

To find a multi-bagger stock, what are the underlying trends we should look for in a business? Ideally, a business will show two trends; firstly a growing return on capital employed (ROCE) and secondly, an increasing amount of capital employed. Basically this means that a company has profitable initiatives that it can continue to reinvest in, which is a trait of a compounding machine. With that in mind, we've noticed some promising trends at Tencent Music Entertainment Group (NYSE:TME) so let's look a bit deeper.

Return On Capital Employed (ROCE): What Is It?

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. To calculate this metric for Tencent Music Entertainment Group, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.13 = CN¥10b ÷ (CN¥98b - CN¥19b) (Based on the trailing twelve months to March 2025).

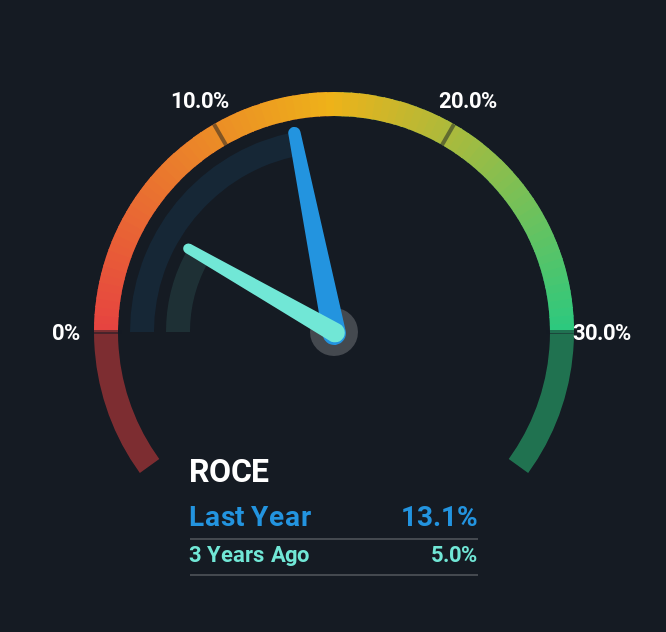

So, Tencent Music Entertainment Group has an ROCE of 13%. In absolute terms, that's a satisfactory return, but compared to the Entertainment industry average of 9.0% it's much better.

In the above chart we have measured Tencent Music Entertainment Group's prior ROCE against its prior performance, but the future is arguably more important. If you're interested, you can view the analysts predictions in our free analyst report for Tencent Music Entertainment Group .

What Does the ROCE Trend For Tencent Music Entertainment Group Tell Us?

The trends we've noticed at Tencent Music Entertainment Group are quite reassuring. The data shows that returns on capital have increased substantially over the last five years to 13%. The amount of capital employed has increased too, by 79%. This can indicate that there's plenty of opportunities to invest capital internally and at ever higher rates, a combination that's common among multi-baggers.

The Key Takeaway

A company that is growing its returns on capital and can consistently reinvest in itself is a highly sought after trait, and that's what Tencent Music Entertainment Group has. Since the stock has returned a solid 43% to shareholders over the last five years, it's fair to say investors are beginning to recognize these changes. So given the stock has proven it has promising trends, it's worth researching the company further to see if these trends are likely to persist.

While Tencent Music Entertainment Group looks impressive, no company is worth an infinite price. The intrinsic value infographic for TME helps visualize whether it is currently trading for a fair price.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

موصى به

- Benzinga News 02/12 14:38

حققت شركة Simulations Plus نتائج قوية في الربع الرابع، وانضمت إلى Credo Technology Group وUnited Natural Foods وBoeing وغيرها من الأسهم الكبرى التي ارتفعت يوم الثلاثاء

Benzinga News 02/12 15:30عرض كومكاست يهدف إلى دمج وحدة إن بي سي يونيفرسال مع وارنر براذرز - بلومبرج

Benzinga News 02/12 18:57ارتفاع أسهم الشركات الصغيرة، وارتفاع أسعار الغاز الطبيعي إلى أعلى مستوياتها في ثلاث سنوات: ما الذي يحرك الأسواق يوم الأربعاء؟

Benzinga News 03/12 17:46Manchester United (NYSE:MANU): Weighing Valuation as Shares Drift and Fundamentals Slowly Improve

Simply Wall St اليوم 00:32TKO Group Holdings Deputy CFO Shane Kapral Reports Sale of Common Shares

Reuters اليوم 01:00Salesforce وSnowflake وUiPath وiRobot وNetflix: لماذا تُعد هذه الأسهم الخمسة محل اهتمام المستثمرين اليوم؟

Benzinga News اليوم 02:18عرض-صراع ثلاثي على اللقب في ختام بطولة العالم لسباقات فورمولا 1

Reuters اليوم 05:30