يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Will Q3 Results and New Acquisitions Shift Group 1 Automotive’s (GPI) Earnings Trajectory?

Group 1 Automotive, Inc. GPI | 404.21 | -1.01% |

- Group 1 Automotive announced in early October that it will release its third-quarter financial results for the period ended September 30, 2025, before the market opens on October 28, 2025, followed by a management-led conference call later that morning for investors and stakeholders.

- This move reflects the company's ongoing commitment to transparency and investor engagement, following a period marked by record revenues, operational expansion, and portfolio optimization initiatives.

- With the company preparing to discuss Q3 financial results alongside recent dealership acquisitions, we'll examine how this may influence Group 1 Automotive's future earnings story.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Group 1 Automotive Investment Narrative Recap

To be a shareholder in Group 1 Automotive, you need to believe in the company's ability to grow its high-margin parts and service business while expanding through acquisitions, all amid a shifting auto retail landscape. The upcoming Q3 results and conference call, while an important marker, are not expected to materially alter the main short-term catalyst, which remains aftersales momentum, nor do they significantly reduce the most current risk, which is the integration and efficiency of newly acquired dealerships. One recent announcement closely linked to this catalyst is the opening of Mercedes-Benz of South Austin, a luxury dealership equipped with substantial service capacity and EV infrastructure. This aligns with Group 1’s ongoing push to drive higher recurring revenue from aftersales, directly supporting the company's focus on service growth as a counterbalance to cyclicality in vehicle sales. However, investors should be mindful that, in contrast, ongoing integration and operational challenges from rapid acquisitions may still present…

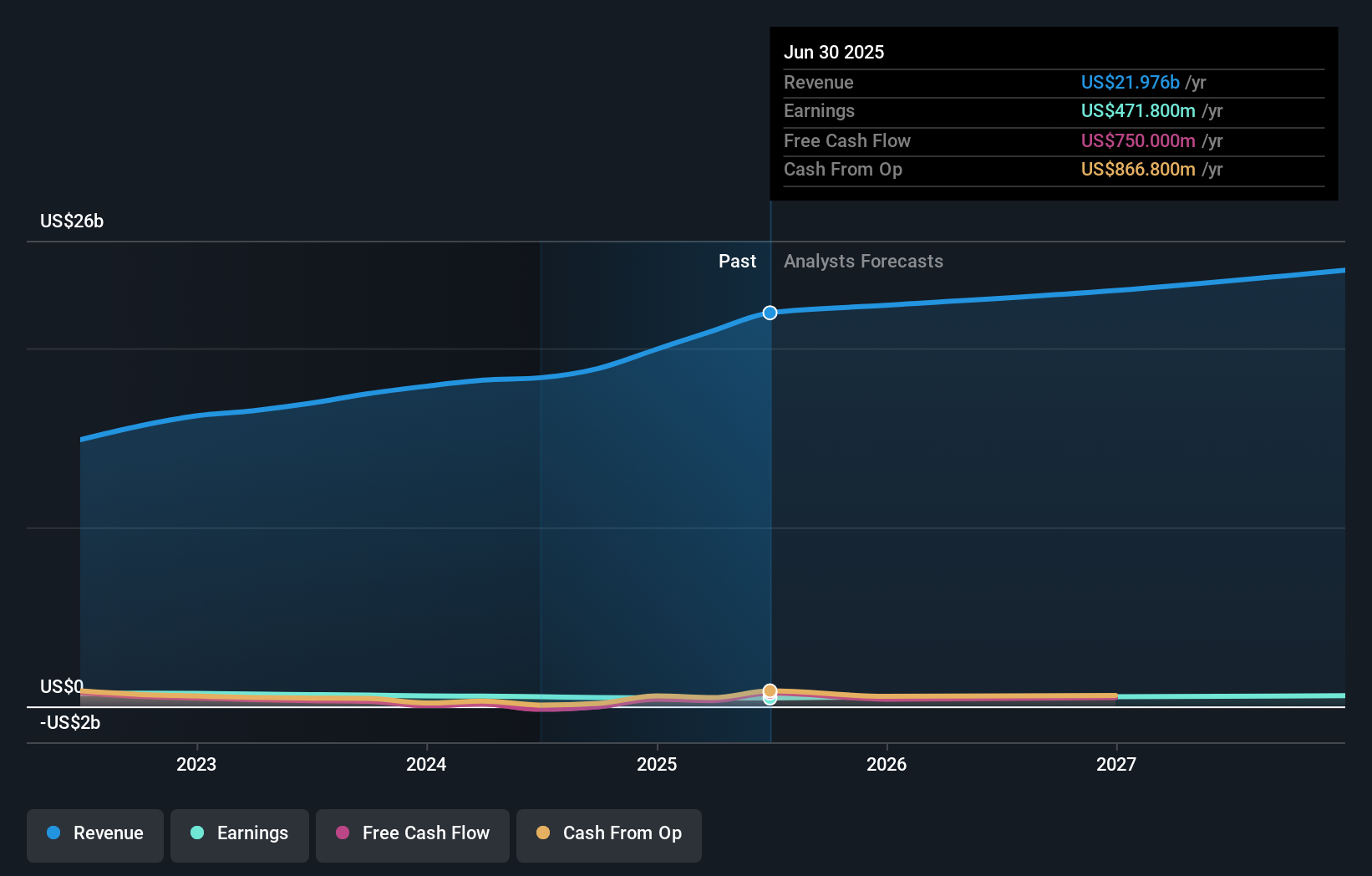

Group 1 Automotive's narrative projects $25.0 billion revenue and $636.8 million earnings by 2028. This requires 4.4% yearly revenue growth and a $165 million earnings increase from $471.8 million.

Uncover how Group 1 Automotive's forecasts yield a $478.25 fair value, a 10% upside to its current price.

Exploring Other Perspectives

Two fair value estimates from the Simply Wall St Community range between US$396 and US$491 per share. While some see clear upside, others see limited margin given the company’s current pace of aftersales growth and ongoing acquisition risks, reminding you to compare several viewpoints before making your own judgement.

Explore 2 other fair value estimates on Group 1 Automotive - why the stock might be worth as much as 13% more than the current price!

Build Your Own Group 1 Automotive Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Group 1 Automotive research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Group 1 Automotive research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Group 1 Automotive's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 39 best rare earth metal stocks of the very few that mine this essential strategic resource.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.