We Value Your Feedback! Help us shape better content and experiences by participating in our survey. Join the Survey Now!

Company Overview:

Cenomi Retail is Saudi Arabia's leading retail platform. As a core subsidiary of Cenomi Group (formerly Fawaz Alhokair Group) focusing on brand retail operations, it carries the strategic mission of the group's transformation from a traditional physical retailer to an omnichannel lifestyle platform. The company's history can be traced back to 1990, when it was established under the name of Fawaz Alhokair Group. It has accumulated deep retail experience through three decades of brand franchising. In December 2022, the group completed a comprehensive brand reshaping and changed its name to Cenomi Group. Its retail department was renamed Cenomi Retail accordingly, marking the company's entry into a new stage of development.

Core business model and scale

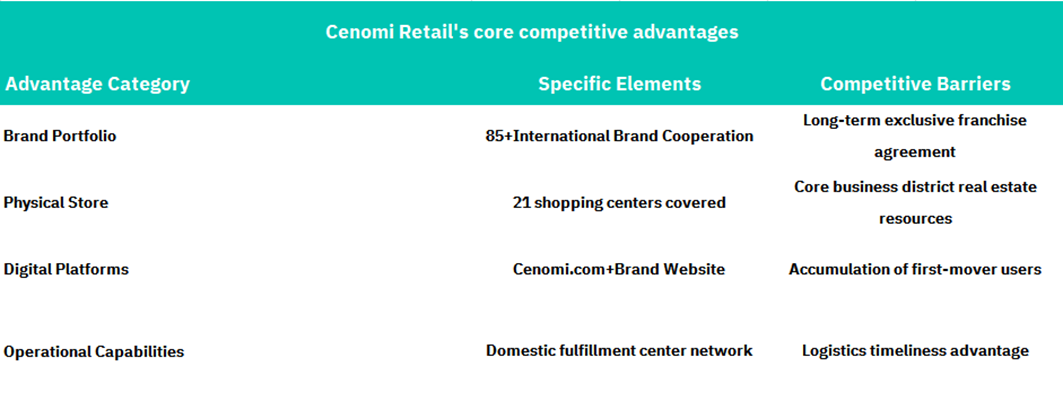

Brand portfolio and retail network: Cenomi Retail operates the largest brand portfolio in Saudi Arabia, covering fashion, catering, entertainment and lifestyle, and manages the business of more than 85 international brands in Saudi Arabia. The company has established a long-term strategic partnership with global retail giant Inditex (parent company of Zara), and has successfully introduced iconic brands such as Aleph, the first high-end Apple distributor in Saudi Arabia. As of 2024, Cenomi Retail operates 21 shopping malls across Saudi Arabia, forming a nationwide retail network.

Benchmark for physical retail innovation: In December 2024, the company opened the largest Zara concept store in the Middle East and North Africa, covering an area of more than 3,000 square meters in Al Nakheel Mall in Riyadh. The store integrates the latest technology of Zara's integrated online and offline platform, with dedicated areas for women's, men's and children's wear, as well as a "boutique" space for newborn series and a professional footwear and accessories area, representing the latest achievements of the company's physical retail innovation.

Digital retail infrastructure: As a leader in the digital transformation of traditional physical retailers, Cenomi Retail directly manages Saudi localized e-commerce websites for more than 30 international brands, attracting millions of visits per month, laying the technical and operational foundation for the group to launch its e-commerce platform Cenomi.com.

Market Leadership

Cenomi Retail holds an undisputed leadership position in the Saudi retail market, which is reflected in the following key indicators:

Breadth of physical coverage: Through the 21 shopping malls and 3,000+ brand stores owned by its parent company, Cenomi Group, the company has formed the most dense retail network coverage in Saudi Arabia.

Depth of brand cooperation: The company's partnership with international brands has an average of more than 10 years, and its cooperation with Inditex Group is particularly deep, making it the preferred partner for brands such as Zara to develop in Saudi Arabia.

First-mover advantage in digital transformation: Before launching the Cenomi.com platform, the company had accumulated rich digital retail experience by operating e-commerce websites for partner brands. This unique advantage puts it in a leading position in the wave of digital transformation of traditional retailers.

Industry analysis:

The company has successfully created a seamless online and offline consumer experience, achieving synergy between physical and digital channels:

O2O closed-loop system: Cenomi Retail has taken the lead in Saudi Arabia to implement the "online browsing and ordering + offline store pickup" integrated model, drawing on the successful experience of the UAE market (such as Emaar and Majid Al Futtaim Group). This strategy effectively utilizes the company's existing physical retail network advantages while meeting the needs of young Saudi consumers (70% of the population is under the age of 30) for digital shopping.

Owned e-commerce platform Cenomi.com: As the core carrier of the company's digital transformation, Cenomi.com was officially launched in the first half of 2023, and plans to introduce 92 international brands and 1,700 sellers. The platform relies on the company's domestic fulfillment center network in Saudi Arabia to provide "fast delivery" and "online ordering, in-store pickup" services, shortening the logistics time to the industry-leading level.

Brand portfolio and franchise advantages

Diversified brand matrix: The brand portfolio managed by Cenomi Retail covers multiple price bands and consumption scenarios, from mass fashion (such as Zara, Mango) to high-end electronic products (such as Apple distributor Aleph), to catering and entertainment brands, forming a complete consumer ecosystem.

Exclusive cooperation agreement: The company has signed exclusive operating rights in the Saudi market with many international brands. For example, the long-term cooperation relationship with Inditex Group ensures that the expansion of brands such as Zara in Saudi Arabia must be carried out through Cenomi Retail. This exclusive cooperation constitutes an important competitive barrier.

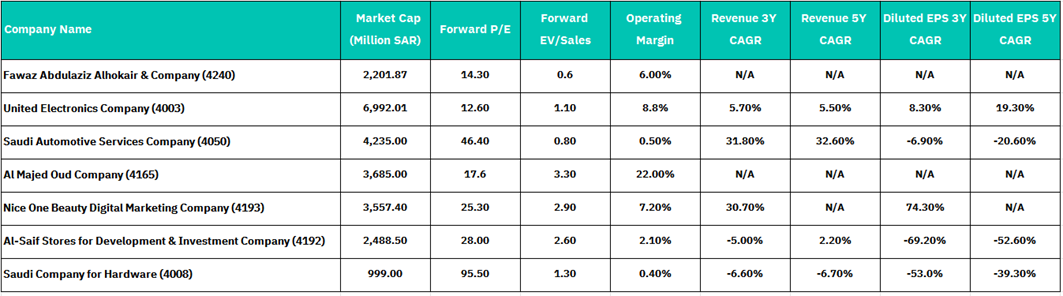

The Saudi retail and consumer services sector presents a mixed investment landscape with significant valuation disparities and operational challenges. United Electronics Company (4003) emerges as the most compelling investment opportunity within this cohort, trading at a reasonable 12.6x forward P/E while maintaining healthy revenue growth momentum of 5.7% (3Y) and 5.5% (5Y) CAGR, coupled with a robust 8.8% operating margin and strong earnings acceleration of 8.3% (3Y) and 19.3% (5Y) diluted EPS CAGR.

Al Majed Oud Company (4165) commands a premium 17.6x forward P/E multiple justified by superior 22% operating margins, while Nice One Beauty Digital Marketing Company (4193) demonstrates exceptional growth velocity with 30.7% revenue CAGR despite elevated 25.3x forward P/E valuation. CENOMI RETAIL's complete absence of revenue growth guidance (N/A across all CAGR metrics) and diluted EPS projections suggests fundamental operational distress, particularly troubling when contrasted with Nice One Beauty Digital Marketing's robust 30.7% revenue CAGR and even the modest but positive growth trajectories of United Electronics Company. However, the concerning trend across multiple names, including Al-Saif Stores (4192) and Saudi Company for Hardware (4008) showing negative revenue growth and deteriorating earnings suggests broader sector headwinds that may pressure valuations. Investors should prioritize companies with sustainable competitive advantages and operational leverage, as the sector's growth differential indicates a flight-to-quality dynamic that will likely favor market leaders with proven execution capabilities over the medium term.

CENOMI RETAIL operates within the Retailing sector, yet trades at a modest 14.3x forward P/E with a critically low 6.0% operating margin and an alarming 0.6x forward EV/Sales ratio, indicating severe revenue efficiency challenges compared to sector leaders like Al Majed Oud Company (4165) which commands 22% operating margins and United Electronics Company (4003) with 8.8% margins.

CENOMI RETAIL's positioning as the weakest performer in this peer group becomes evident when examining its structural disadvantages relative to specialized competitors. While the company operates in the highly competitive apparel retail space with razor-thin margins, peers like Al Majed Oud Company benefit from higher-margin fragrance and luxury goods positioning, and United Electronics Company enjoys the resilience of consumer electronics demand with consistent growth visibility. The company's SAR 2.2 billion market capitalization appears vulnerable given net losses exceeding SAR 1.1bn in 2023 (Includes goodwill impairment of SAR 370 million, losses of SAR 7.1 million on liquidation of subsidiary, write off of property, plant and equipment (PP&E) worth SAR 221.6 million, write off of prepayments worth SAR 73.3 million, losses on change in fair value of other investments worth SAR 33 million.) creating a stark contrast to the earnings growth demonstrated by United Electronics (19.3% diluted EPS 5Y CAGR) and Nice One Beauty's exceptional expansion trajectory.

Valuation:

Income statement analysis

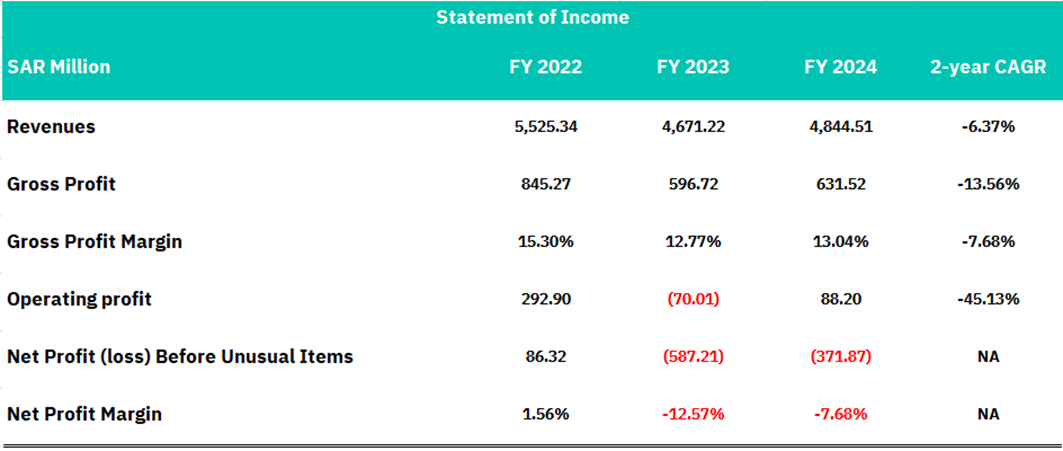

CENOMI RETAIL has encountered severe financial headwinds during FY 2022-2024, exhibiting a persistent revenue decline trajectory with a 2-year CAGR of -6.37%. The company's top-line contracted from SAR 5.53 billion in FY 2022 to SAR 4.67 billion in FY 2023 (down 15.46% YoY), though demonstrating modest recovery to SAR 4.84 billion in FY 2024 (up 3.71% YoY), revenues remain 12.3% below FY 2022 baseline. Profitability metrics deteriorated more significantly, with gross margins compressing from 15.30% to 13.04% and gross profit declining at a 2-year CAGR of -13.56%. Operating earnings exhibited extreme volatility, swinging from SAR 293 million profit in FY 2022 to a SAR 70 million operating loss in FY 2023, before recovering to SAR 88 million in FY 2024, though operating margin of 1.82% remained substantially below the FY 2022 level of 5.30%.

Net profitability presents the most concerning performance, with consecutive years of substantial losses in FY 2023 and FY 2024, recording net losses of SAR 587 million and SAR 372 million respectively, translating to net margins of -12.57% and -7.68%, contrasting sharply with FY 2022's positive 1.56% net margin. The significant divergence between operating profit and net income suggests potential asset impairments or extraordinary non-operating charges. Our comprehensive analysis indicates that CENOMI RETAIL confronts not merely top-line pressure from market dynamics, but fundamental structural issues encompassing cost control deterioration and operational inefficiencies. Given the confluence of risk factors including persistent losses, margin erosion, operational instability, and negative revenue growth, we recommend investors adopt an AVOID stance on the equity until the company demonstrates clear evidence of sustainable earnings recovery and operational turnaround.

Balance sheet analysis

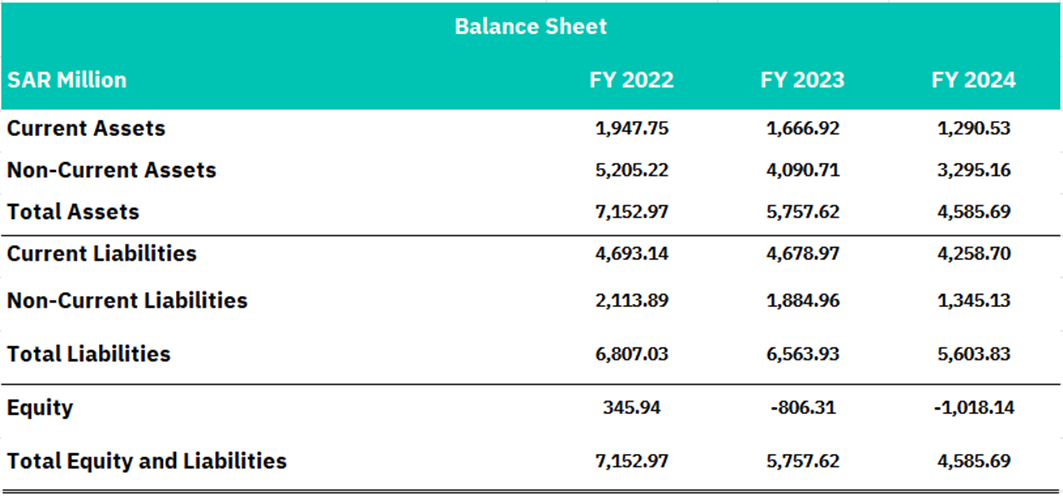

CENOMI RETAIL's balance sheet presents a deteriorating financial profile characterized by significant asset contraction and alarming equity erosion. Total assets declined precipitously from SAR 7.15 billion in FY 2022 to SAR 4.59 billion in FY 2024, representing a 35.9% cumulative decline and highlighting severe value destruction. Current assets compressed from SAR 1.95 billion to SAR 1.29 billion (-33.7%), while non-current assets experienced more dramatic deterioration, falling from SAR 5.21 billion to SAR 3.30 billion (-36.7%), suggesting potential asset write-downs or disposal of core operating assets. The liability structure remained relatively stable with total liabilities declining modestly from SAR 6.81 billion to SAR 5.60 billion, though current liabilities of SAR 4.26 billion substantially exceed current assets of SAR 1.29 billion, creating a negative working capital of SAR 2.97 billion and indicating severe liquidity constraints.

The most critical concern is the complete erosion of shareholder equity, which deteriorated from a positive SAR 346 million in FY 2022 to negative SAR 1.02 billion in FY 2024, representing technical insolvency. This negative equity position of -22.2% of total assets signals that liabilities exceed assets, placing the company in financial distress territory. The current ratio collapsed from 0.42x in FY 2022 to 0.30x in FY 2024, well below the minimum 1.0x threshold for adequate liquidity, while the debt-to-total-assets ratio increased from 95.2% to 122.2%, indicating an over-leveraged capital structure. Given the confluence of negative equity, severe working capital deficit, asset deterioration, and technical insolvency, CENOMI RETAIL exhibits characteristics of a distressed enterprise requiring immediate capital restructuring or facing potential bankruptcy proceedings. Emphasis on the elevated risk of total equity loss for existing shareholders.

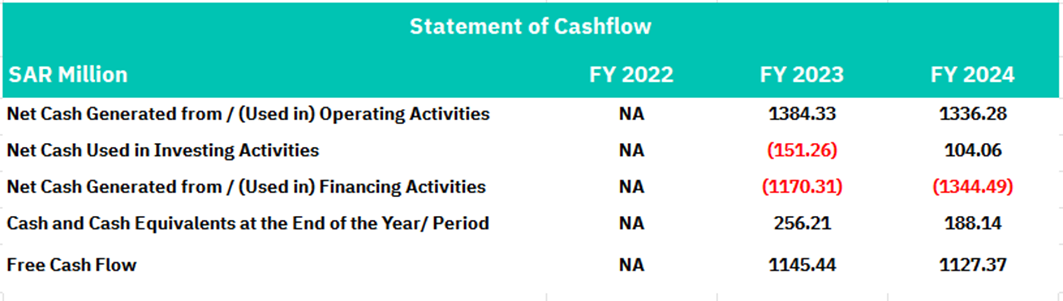

Cashflow Statement Analysis

CENOMI RETAIL's cash flow profile presents a mixed picture with strong operational cash generation offsetting significant financing outflows and modest investing activities. Operating cash flow remained robust and relatively stable, generating SAR 1.38 billion in FY 2023 and SAR 1.34 billion in FY 2024, demonstrating the company's ability to convert operations into cash despite the deteriorating profitability evidenced in the income statement. This operational cash generation capability of approximately SAR 1.3-1.4 billion annually provides crucial liquidity support and suggests that underlying business operations retain cash-generative capacity even amid financial distress. Investment activities were minimal, with net cash used in investing activities of SAR 151 million in FY 2023 reversing to net cash generated of SAR 404 million in FY 2024, likely reflecting asset disposals or reduced capital expenditure as part of cash preservation strategies during the financial restructuring period.

The financing activities reveal significant capital structure stress, with substantial net cash outflows of SAR 1.17 billion in FY 2023 and SAR 1.34 billion in FY 2024, indicating debt repayments or other financing obligations that consumed available liquidity. Free cash flow remained positive at SAR 1.15 billion in FY 2023 and SAR 1.13 billion in FY 2024, representing a critical lifeline for the financially distressed entity and providing flexibility for debt service and operational continuity. However, cash and cash equivalents declined from SAR 256 million to SAR 188 million (-26.5%), reflecting the net impact of strong operating performance being offset by financing outflows. While the positive operational and free cash flow generation offers some optimism for near-term liquidity management, the substantial financing cash burns and declining cash balances underscore the urgent need for comprehensive capital restructuring to address the negative equity position and over-leveraged balance sheet identified in previous analysis.

Conclusion

CENOMI RETAIL's substantial operational assets and market-leading positioning cannot offset the severe financial distress evidenced across all key metrics. The fundamental financial deterioration creates an untenable risk-reward profile for equity investors. The confluence of technical insolvency with negative SAR 1.02 billion shareholder equity, persistent operating losses, and severe liquidity constraints reflected in the 0.30x current ratio positions CENOMI RETAIL as a distressed enterprise requiring immediate capital restructuring. While the positive operational cash flow generation of approximately SAR 1.3-1.4 billion annually demonstrates underlying business viability, the substantial financing cash burns and over-leveraged capital structure with a 122.2% debt-to-total-assets ratio underscore the urgent need for comprehensive debt restructuring or potential bankruptcy proceedings.

Given the company's position as the weakest performer within the Saudi retail sector peer group, trading at a modest 14.3x forward P/E despite alarming operational metrics including a critically low 6.0% operating margin and negative equity position, with heightened emphasis on the elevated risk of total equity loss for existing shareholders. The structural challenges encompassing revenue decline, margin compression, and balance sheet deterioration cannot be addressed through operational improvements alone and require fundamental capital restructuring that would likely result in significant equity dilution or total loss. Investors seeking exposure to Saudi Arabia's retail transformation under Vision 2030 should consider better-capitalized alternatives such as United Electronics Company (4003) with its sustainable 8.8% operating margins and positive earnings trajectory, rather than engaging with CENOMI RETAIL's distressed equity until clear evidence of successful financial restructuring emerges.

Disclaimer:

Sahm is subject to the supervision and control of the CMA, pursuant to its license no. 22251-25 issued by CMA.

The Information presented above is for information purposes only, which shall not be intended as and does not constitute an offer to sell or solicitation for an offer to buy any securities or financial instrument or any advice or recommendation with respect to such securities or other financial instruments or investments. When making a decision about your investments, you should seek the advice of a professional financial adviser and carefully consider whether such investments are suitable for you in light of your own experience, financial position and investment objectives. The firm and its analysts do not have any material interests or conflicts of interest in any companies mentioned in this report.

Performance data provided is accurate and sourced from reliable platforms, including Argaam, International Business Magazine, Pinsent Masons .

IN NO EVENT SHALL SAHM CAPITAL FINANCIAL COMPANY BE LIABLE FOR ANY DAMAGES, LOSSES OR LIABILITIES INCLUDING WITHOUT LIMITATION, DIRECT OR INDIRECT, SPECIAL, INCIDENTAL, CONSEQUENTIAL DAMAGES, LOSSES OR LIABILITIES, IN CONNECTION WITH YOUR RELIANCE ON OR USE OR INABILITY TO USE THE INFORMATION PRESENTED ABOVE, EVEN IF YOU ADVISE US OF THE POSSIBILITY OF SUCH DAMAGES, LOSSES OR EXPENSES.