We Value Your Feedback! Help us shape better content and experiences by participating in our survey. Join the Survey Now!

Company Overview:

Corporate Structure & History

Cherry Trading Company has established itself as a significant player in Saudi Arabia's vehicle leasing and sales sector. Headquartered in Riyadh, the company has built a substantial operational footprint across the Kingdom, leveraging its strategic positioning to serve both individual and corporate clients. The company's upcoming IPO represents a pivotal moment in its corporate development, offering public market investors an opportunity to participate in Saudi Arabia's growing mobility sector. The offering structure involves existing shareholders—Saudi Edarah Holding Company and Abdulaziz Saleh Mohammed AlSowail—divesting a portion of their holdings, with the company itself receiving no proceeds from the share sale.

Business Operations & Service Offerings

Cherry Trading's business model centers around two complementary revenue streams:

Vehicle Leasing Services: The core of Cherry Trading's operations involves short-to-medium term vehicle rentals for both individual consumers and corporate clients. This segment provides stable recurring revenue and represents the company's primary market differentiation.

Vehicle Sales Operations: Supplementing the leasing business, Cherry Trading engages in vehicle sales activities, potentially offering customers flexible pathways from leasing to ownership or managing fleet rotation.

The company's operational infrastructure enables it to serve key markets across Saudi Arabia, with particular strength in regions with high economic activity and population density. While specific fleet size and composition details are not fully disclosed in available information, the company's asset base of SAR 1.4 billion suggests a substantial fleet inventory diversified across vehicle segments to address varying customer preferences.

Market & Industry Analysis:

Saudi Automotive Market Dynamics

The Saudi automotive market presents a compelling growth story with several structural advantages that benefit established players like Cherry Trading:

• Substantial Vehicle Fleet: Saudi Arabia represents the largest automotive market in the Middle East, with passenger car ownership exceeding 710 million vehicles and commercial vehicles numbering approximately 75 million. This massive installed base creates continuous demand for rental services as consumers and businesses seek flexible mobility solutions.

• Favorable Demographic Trends: With a young, growing population and rising disposable incomes, the underlying drivers for automotive services remain robust. The country's high GDP per capita, exceeding $23,000 supports premium and convenience-based services like car rentals.

• Infrastructure Development: Massive government investments in transportation infrastructure, including the planned procurement of 12,000 new energy buses by the Saudi Public Transport Company (SAPTCO), create additional opportunities for complementary mobility services.

Car Rental Sector Landscape

Saudi Arabia's car rental sector is characterized by fragmented competition alongside certain structural barriers that benefit established operators:

• Highly Competitive Market: The Saudi car rental landscape comprises approximately 1,699 car rental agencies nationwide, with the Eastern Province (448 agencies), the Riyadh Region (355 agencies), and the Makkah Region (347 agencies) representing the most concentrated markets. This competitive environment necessitates differentiation through service quality, fleet diversity, and pricing strategy.

• Market Concentration Dynamics: While the market appears fragmented at first glance, approximately 25% of rental agencies (429 operators) belong to larger brand networks, suggesting some level of market consolidation that may benefit scaled players like Cherry Trading through brand recognition and operational efficiencies.

• Digital Transformation: The sector is undergoing rapid digitization, with 681 car rental companies maintaining websites, and a significant portion maintaining a social media presence. This shift toward digital channels creates opportunities for operators with sophisticated customer acquisition capabilities.

Consumer Behavior & Technological Trends

Understanding evolving customer preferences is essential for assessing Cherry Trading's strategic positioning:

• Hybrid Purchase Journey: Middle Eastern automotive consumers increasingly embrace digital tools for research and initial decision-making, but still strongly value in-person experiences during final purchase stages. This creates an imperative for seamless omnichannel strategies that blend digital convenience with physical touchpoints.

• Experience Over Transaction: Consumers are increasingly prioritizing ownership experiences over mere vehicle acquisition, favoring operators that provide "value creation across the customer lifecycle" through flexible mobility solutions and ongoing engagement.

• Electric Vehicle Transition: Saudi Arabia has articulated ambitious targets for electric vehicle adoption (30% by 2030), creating both challenges and opportunities for rental operators to refresh fleets and develop charging infrastructure.

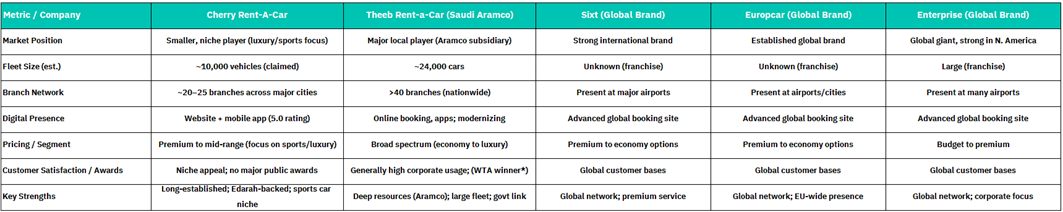

Competitive Benchmarking

Strengths: Cherry has a long track record (over 40 years) as one of Saudi Arabia’s first car rental companies. It enjoys strong parentage (Saudi Edarah Holding) and a diversified model (rentals + sales). Its brand is known for quality and a luxury/sports focus. The upcoming IPO could provide capital for growth. Its 2024 profit margin (~14%) was solid, reflecting operational efficiency.

Weaknesses: Cherry remains small relative to peers. Its branch network (~20+) is much smaller than Theeb’s, limiting reach. Fleet size is constrained. This scale disadvantage could mean higher per-unit costs. The company’s margins and growth prospects may also be volatile, given fixed costs of vehicles and possible seasonality in tourism.

Opportunities: Saudi Vision 2030 and tourism expansion are tailwinds. The kingdom aims to attract 150 million tourists annually by 2030, which should boost demand for rentals. Government initiatives (e.g., digital contracts, EV incentives) are modernizing the sector. Cherry can expand into new segments (EV rentals, ride-sharing partnerships) or geographies. Its IPO proceeds (to existing owners) could also reinject resources for fleet expansion.

Threats: Competition is intense. Theeb dominates with huge fleets, likely pressuring rates. Ride-hailing apps (Uber/Careem) are growing rapidly – Q3 2025 saw 39 million ride-hailing trips (up 78% YoY) alongside a 21% increase in e-contract rentals. This indicates consumers may substitute rentals with app-based mobility. Regulatory changes (e.g., the TGA’s new unified digital rental contract) raise service standards but also compliance costs. Economic downturns or further pandemic waves would similarly hit travel demand.

Market Outlook

Saudi Arabia’s car rental industry is poised for robust growth. Total market value is estimated at around USD 2–2.6 billion (2024), with projections to exceed USD 3.5 billion by 2029. Key drivers include surging tourism (the country exceeded 100 million annual visitors in 2024, up 19% from 2023) and urbanization. Business travel and conferences also fuel demand. Vision 2030 itself highlights mobility: the government targets 150 million visitors by 2030 and is investing heavily in infrastructure and entertainment. On the regulatory front, authorities have introduced a unified e-contract for rentals (protecting consumers and standardizing terms) and incentives for electrifying rental fleets. Digitization is another trend: online bookings and telematics-enabled fleet optimization are becoming standard. However, the growth of ride-hailing (a 78% jump in trips recently) presents an alternative to traditional rental, especially for short stays. Overall, the market outlook is positive (tourism and Vision 2030 fuel demand) but will be shaped by tech-driven mobility shifts and regulatory reforms.

Valuation:

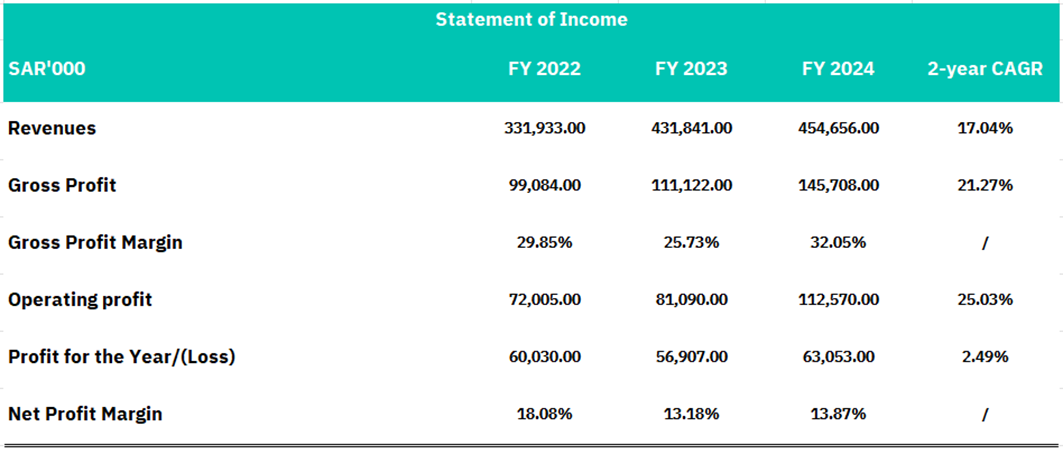

Income statement analysis

Cherry Car Rentals demonstrated robust top-line growth and significant margin expansion over the two years from FY2022 to FY2024. Revenues increased at a 17.04% CAGR, growing from SAR 331.9 million to SAR 454.7 million, reflecting strong demand and successful market penetration. More impressively, Gross Profit expanded at a 21.27% CAGR, outpacing revenue growth and expanding from SAR 99.1 million to SAR 145.7 million. This disproportionate growth in gross profit was accompanied by a 210-basis-point improvement in Gross Profit Margin, from 29.85% in FY2022 to 32.05% in FY2024, indicating enhanced operational efficiency and improved cost management. Operating Profit showed the most robust performance, growing at a 25.03% CAGR to reach SAR 112.6 million, demonstrating the company's ability to leverage its growing scale while maintaining disciplined expense control.

However, bottom-line profitability showed relative weakness compared to the operational metrics, with Profit for the Year growing modestly at only 2.49% CAGR, increasing from SAR 60.0 million to SAR 63.1 million. The Net Profit Margin contracted by 221 basis points over the period, declining from 18.08% to 13.87%, suggesting that higher non-operating expenses, finance costs, or tax burdens have offset operational gains. This divergence between strong operating leverage and muted net income growth warrants further investigation into below-the-line items. Nevertheless, the company's operational momentum remains solid, with the 25.03% CAGR in Operating Profit and improving gross margins indicating a fundamentally sound business trajectory, provided that the company addresses the factors pressuring bottom-line profitability.

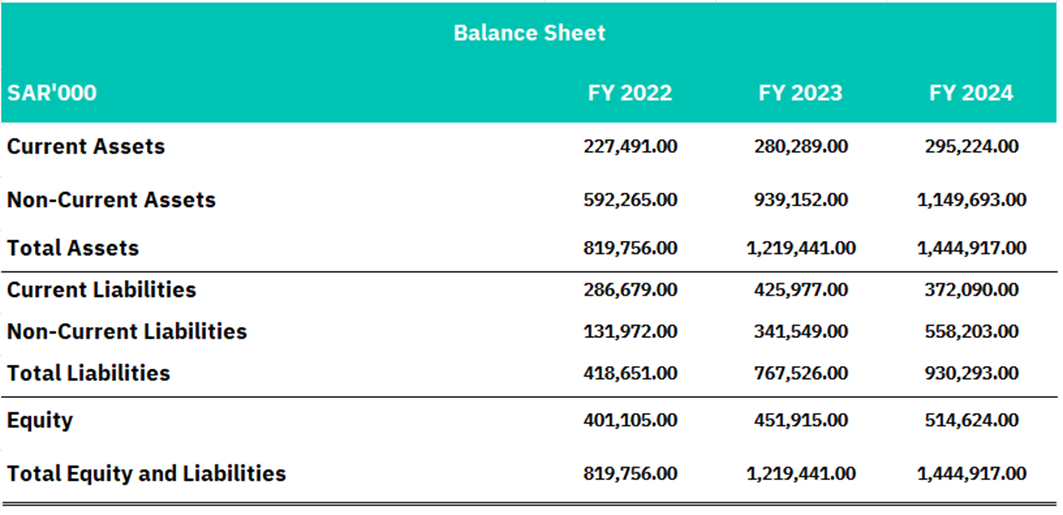

Balance sheet analysis

Cherry Car Rentals exhibited substantial balance sheet expansion and significant capital intensity growth over the FY2022-FY2024 period, with Total Assets increasing 76.3% from SAR 819.8 million to SAR 1,444.9 million. Non-Current Assets surged dramatically by 94.1% to reach SAR 1,149.7 million, reflecting substantial capital investments in the vehicle fleet and infrastructure necessary to support the company's aggressive growth strategy. This capital-heavy asset base is typical for car rental operators and underscores the business model's inherent asset intensity. Current Assets grew more modestly at 29.7% to SAR 295.2 million, suggesting that working capital management remained relatively disciplined despite the rapid top-line expansion. The balance sheet composition reveals that Non-Current Assets now represent 79.6% of total assets in FY2024, compared to 72.3% in FY2022, confirming the company's ongoing investment in long-term productive capacity.

On the liabilities side, Total Liabilities more than doubled, increasing 122.3% from SAR 418.7 million to SAR 930.3 million, outpacing total asset growth and indicating the company has relied significantly on debt financing to fund its expansion. Non-Current Liabilities grew particularly rapidly at 323.0% to SAR 558.2 million, likely comprising long-term debt and lease obligations associated with vehicle financing. Current Liabilities increased 29.8% to SAR 372.1 million, maintaining a relatively stable proportion of total liabilities. Equity grew a more modest 28.3% to SAR 514.6 million, resulting in a deteriorating leverage profile with the Debt-to-Equity ratio expanding materially. While the company's equity base has strengthened in absolute terms, the disproportionate growth in liabilities—particularly non-current obligations—suggests increased financial leverage and warrants close monitoring of debt service capacity relative to operating cash flows.

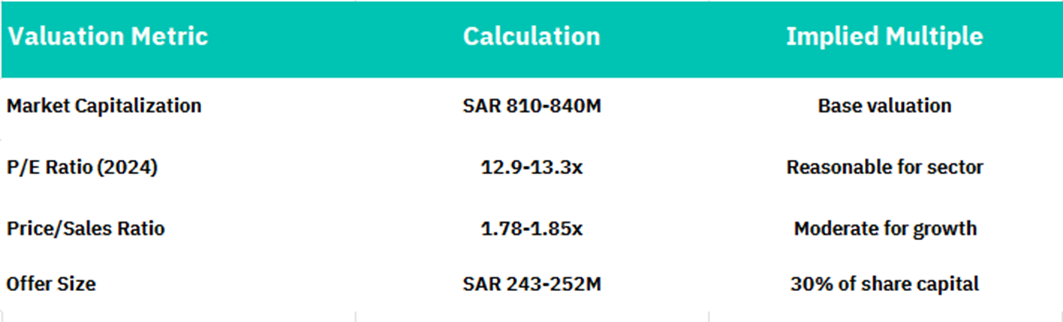

IPO Valuation Analysis

The company has established an IPO price range of SAR 27-28 per share, implying a total equity valuation range of approximately SAR 810-840 million for the entire company ($216-224 million). This valuation reflects the following key metrics:

The price-to-earnings multiple of approximately 13x 2024 earnings appears reasonable given the company's growth prospects, market position, and the defensive characteristics of the car rental industry in Saudi Arabia. The valuation also appears prudent when considering the company's substantial asset base, which provides fundamental support to the equity valuation.

Based on our comprehensive analysis of Cherry Trading's market position, financial performance, growth prospects, and IPO valuation parameters, we issue recommendations for qualified investors with medium-term investment horizons. Several key factors support our positive view:

• Reasonable Valuation: The P/E multiple of approximately 13x does not appear demanding, given the growth prospects and market position.

• Market Defensiveness: Vehicle rental services represent a relatively defensive expenditure within transportation, providing some resilience during economic uncertainty.

• Growth Optionality: The company possesses several credible growth vectors, including market consolidation, digital transformation, and potential EV fleet development.

• Structural Tailwinds: Saudi Arabia's economic transformation program, young demographic profile, and low public transportation penetration create favorable medium-term dynamics for car rental services.

We advise investors to consider participating in the IPO allocation process, with particular attention to the final pricing determination following the book-building process. The institutional book-building period runs from October 26-30, 2025, with retail subscription scheduled for November 12-13, 2025.

Conclusion

Cherry Trading Company represents a compelling investment opportunity to gain exposure to Saudi Arabia's substantial and growing vehicle rental market through an established, profit-generating operator. The company's solid financial foundation, experienced leadership, and strategic market positioning provide a reasonable platform for future growth despite a competitive industry backdrop.

The IPO valuation appears sensible relative to the company's financial metrics, asset base, and growth potential, creating favorable risk-reward dynamics for investors seeking exposure to the Saudi mobility sector. While certain industry-specific risks warrant monitoring, particularly competitive pressures and economic cyclicality, the company's demonstrated profitability and scalable operations suggest resilience across market cycles.

We recommend investors consider participation in the Cherry Trading IPO with a medium-term investment horizon, acknowledging both the growth potential and inherent industry risks. The company's public listing represents a significant milestone in its corporate development and should enhance both its competitive positioning and transparency for public market participants.

Disclaimer:

Sahm is subject to the supervision and control of the CMA, pursuant to its license no. 22251-25 issued by CMA.

The Information presented above is for information purposes only, which shall not be intended as and does not constitute an offer to sell or solicitation for an offer to buy any securities or financial instrument or any advice or recommendation with respect to such securities or other financial instruments or investments. When making a decision about your investments, you should seek the advice of a professional financial adviser and carefully consider whether such investments are suitable for you in light of your own experience, financial position and investment objectives. The firm and its analysts do not have any material interests or conflicts of interest in any companies mentioned in this report.

Performance data provided is accurate and sourced from reliable platforms, including kenresearch, khaleejadvisor, Cherry official disclosiures, and financial

reports.

IN NO EVENT SHALL SAHM CAPITAL FINANCIAL COMPANY BE LIABLE FOR ANY DAMAGES, LOSSES OR LIABILITIES INCLUDING WITHOUT LIMITATION, DIRECT OR INDIRECT, SPECIAL, INCIDENTAL, CONSEQUENTIAL DAMAGES, LOSSES OR LIABILITIES, IN CONNECTION WITH YOUR RELIANCE ON OR USE OR INABILITY TO USE THE INFORMATION PRESENTED ABOVE, EVEN IF YOU ADVISE US OF THE POSSIBILITY OF SUCH DAMAGES, LOSSES OR EXPENSES.