We Value Your Feedback! Help us shape better content and experiences by participating in our survey. Join the Survey Now!

Company Overview:

Umm Al Qura for Development and Construction (MASAR) was established in Mecca in 2012 with an initial registered capital of SAR 916 million. The company later increased its capital to SAR 14.39 billion following its IPO. It focuses on real estate development (residential, hotel, and commercial properties) and infrastructure construction and operation, particularly on the Masar Destination project. Major shareholders include GOSI (24.05% stake), PIF (19.62%), and Dallah Albaraka Holding (7.17%). In addition, Dallah-affiliated companies and individual shareholders, acting in concert, hold a combined stake of 15.82%.

The Masar Destination project, a flagship urban complex in Mecca spanning 1.25 million square meters, comprises 23,000 hotel rooms, 18,000 serviced apartments, 330,000 square meters of leasable commercial space, and a transportation hub. The project's infrastructure is 99.77% complete and is expected to be fully finished in the first half of 2025. The company has signed development agreements for 61 plots, partnering with internationally renowned firms such as Hamat Group, Kempinski, and Hilton.

The Saudi construction and real estate development sector has flourished, driven by extensive government infrastructure programs and rising market demand. The Saudi government's "Vision 2030" aims to diversify the economy, decrease oil dependence, and stimulate growth in real estate, tourism, and infrastructure, creating significant opportunities for industry players. As Islam's holiest site, Mecca draws millions of pilgrims annually, generating robust real estate demand, particularly during pilgrimage seasons. The local market focuses on hotels, residential units, commercial spaces, and retail outlets. Given Mecca's religious importance, local authorities impose strict regulations on real estate projects to preserve cultural heritage. Being one of Saudi Arabia's most valuable publicly traded companies, Umm Al Qura holds a prominent position in the national construction and real estate sector, with considerable influence in Mecca's real estate market.

Company Business and Competitive Advantages

Umm Al Qura's operations span the development of the MASAR destination and infrastructure projects. The MASAR destination, its flagship project, integrates luxury hotels, apartments, retail spaces, entertainment facilities, and transport hubs, located in Mecca's heart, offering a prime location. The company is also involved in constructing roads, bridges, and other municipal infrastructure, supporting Saudi urban development. As a Saudi state-owned enterprise, Umm Al Qura enjoys strong government backing, including policy preferences and financial support. "Vision 2030" and associated plans provide a stable policy environment and abundant project opportunities. It has achieved high brand recognition and a good reputation in Saudi construction and real estate, and the MASAR project has enhanced its image and market standing, aiding customer and partner attraction. Furthermore, the company emphasizes technological innovation, applying advanced technologies to enhance construction quality and efficiency, and incorporating innovative concepts into project planning and design to boost competitiveness.

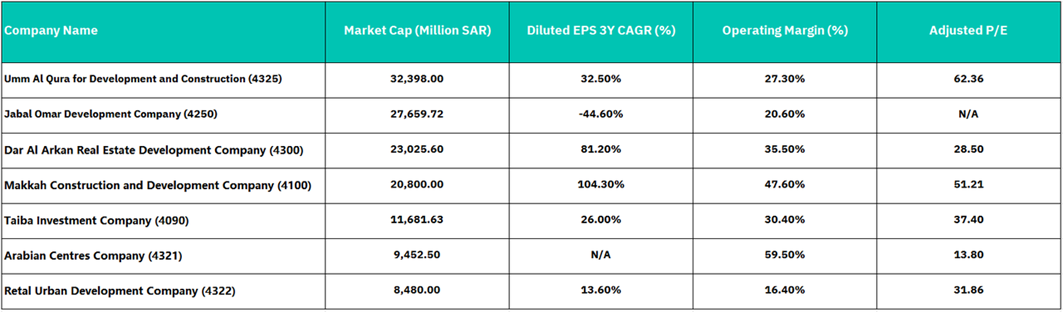

Industry analysis:

- Market Cap and Enterprise Value: Umm Al Qura has a relatively high market cap and enterprise value compared to its peers, indicating a significant presence in the industry.

- Diluted EPS 3Y CAGR: Umm Al Qura's EPS growth over the past three years is positive at 32.5%, a good indicator of profitability growth, although not the highest among its peers.

- Operating Margin: With an operating margin of 27.3%, Umm Al Qura is performing well, though some peers like Makkah Construction and Arabian Centres have higher margins, indicating potentially better cost management or pricing power.

Umm Al Qura for Development and Construction (MASAR), with a 32,398 million SAR market cap, is 17% larger than its nearest competitor, Jabal Omar. It has achieved a 32.50% Diluted EPS 3Y CAGR, better than Taiba Investment but significantly lower than Makkah Construction and Dar Al Arkan. Its 27.30% operating margin is solid but ranks 4th, trailing Arabian Centres, Makkah Construction, and Dar Al Arkan. The highest P/E ratio of 62.36 indicates high investor confidence but raises concerns about meeting high expectations and scope for improving operating efficiency. Overall, MASAR offers a balanced profile of size, growth, and profitability, with stability compared to more volatile competitors.

Valuation:

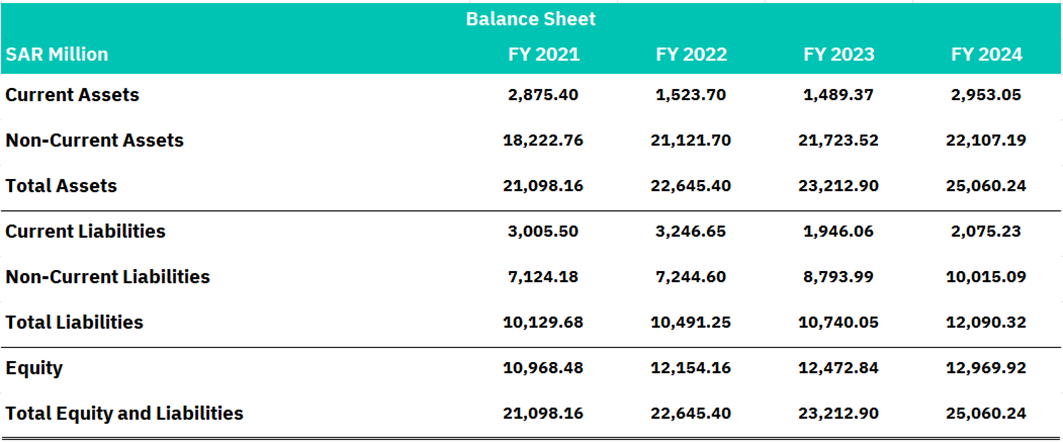

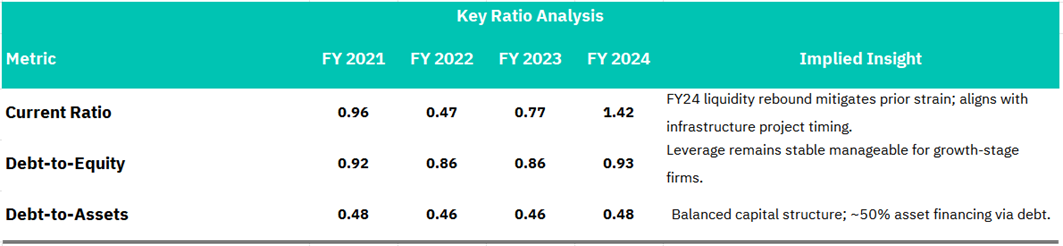

From SAR 21,098.16M (FY21) to SAR 25,060.24M (FY24), Umm Al Qura for Development and Construction (MASAR) has witnessed a remarkable growth in total assets, primarily driven by non-current assets registering a +21.3% CAGR. Non-current assets, representing 88% of the total assets in FY24, amounting to SAR 22,107.19M, reflect the company's substantial investment in long-term infrastructure or property development. On the other hand, current assets demonstrated yearly volatility, hitting a trough in FY23 at SAR 1,489.37M before rebounding by 98% in FY24 to reach SAR 2,953.05M, which might be attributed to inventory cycles or short-term capital reallocation. Regarding liability management, non-current liabilities increased by 40.6%, from SAR 7,124M to SAR 10,015M, in line with the financing needs of long-term projects. Conversely, current liabilities decreased by 30.9%, from SAR 3,006M to SAR 2,075M, indicative of enhanced working capital efficiency. Equity has shown steady growth to SAR 12,969.92M in FY24, supporting a conservative debt-to-equity ratio of 0.93.

Strategic Outlook

Strengths: Stable leverage (D/E ~0.9), equity growth (+18.2%), and FY24 liquidity recovery.

Risks: Execution risk on long-term projects; interest rate sensitivity given debt load.

Attractive for investors seeking exposure to Saudi infrastructure growth, contingent on project ROIC exceeding debt costs. Quarterly cash flow statements to validate project ROI and liquidity management.

MASAR non-current asset concentration and debt servicing require vigilance. The FY24 liquidity rebound and stable leverage ratios underscore disciplined financial stewardship. The company is well-positioned to capitalize on Saudi Arabia’s infrastructure development agenda, provided operational execution aligns with strategic targets.

Income analysis

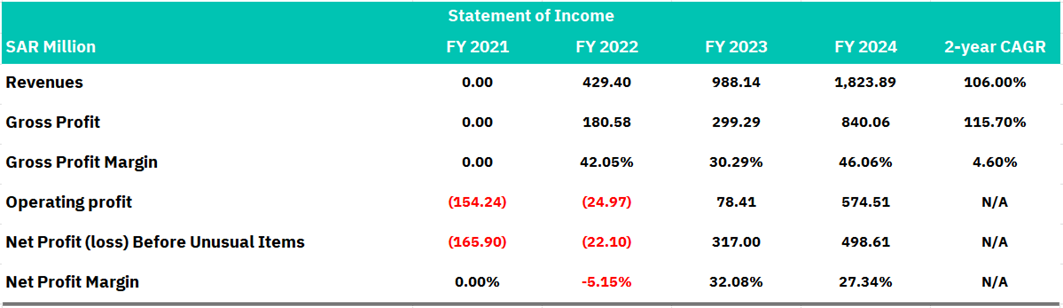

Umm Al Qura for Development and Construction (MASAR) highlights its early-stage growth trajectory with exceptional revenue expansion and rapid margin improvement. The company successfully transitioned from a pre-revenue development phase to high-margin operations in just 48 months, with profitability inflection occurring in FY2023. Its revenue growth trajectory shows a 106% 2-year CAGR, significantly outpacing sector averages, with sequential growth of 130% YoY (FY22-23) followed by 84.6% YoY (FY23-24). The absolute dollar increase widened from 558.7M SAR (FY22-23) to 835.8M SAR (FY23-24), indicating strengthening momentum. The margin profile demonstrates a V-shaped recovery in gross margin from 42.05% → 30.29% → 46.06%, reflecting initial scaling challenges followed by operational optimization. The 1,577bps expansion in gross margin from FY23 to FY24 signals potential economies of scale and pricing power.

The operating leverage reflects substantial fixed cost absorption with a dramatic swing from -154.2M SAR to 574.5M SAR operating profit. The operating margin progression from -∞ → -5.8% → 7.9% → 31.5% showcases best-in-class profitability in FY24. However, there are red flags such as the 1,176bps margin contraction in FY23, followed by a 1,577bps expansion, and a 474bps net margin compression from FY23 to FY24 despite gross margin expansion, suggesting increased OpEx or non-operating expenses. The premium valuation (62.36x P/E) appears supported by exceptional growth and an improving margin profile. Forward estimates assuming modest growth deceleration and continued margin expansion would support current valuation, with project completions and new development announcements serving as catalysts to verify revenue sustainability.

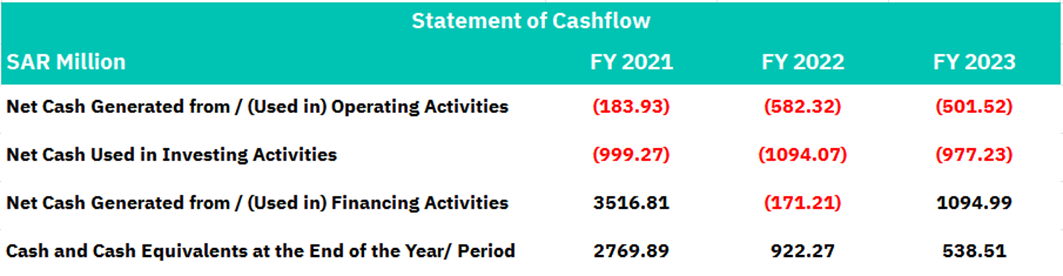

Cashflow analysis

Cash flow analysis of Umm Al Qura for Development and Construction (MASAR) indicates a development-stage capital allocation profile with significant cash burn across operating and investing activities, primarily funded by capital raises. The company has reported three consecutive years of operating cash outflows, peaking in FY2022 at -582.32M SAR, showing a modest 13.9% improvement in FY2023 to -501.52M SAR. Notably, there is a critical disconnect between the reported accounting profitability (317M net income in FY2023) and continued negative operating cash flow (-501.52M in FY2023), suggesting significant capital is tied up in receivables, inventory, or other current assets. The liquidity position has deteriorated severely, with cash depletion from 2769.89M to 922.27M to 538.51M SAR, implying approximately 1-2 years of runway at the current burn rate.

MASAR presents a concerning cash flow profile that contradicts its income statement success story, as it executes a capital-intensive development strategy with prolonged negative free cash flow, creating substantial financing risk. The cash reality suggests continued dependency on external funding sources. Red flags include a significant gap between income statement profitability and cash generation, dependency on capital markets for operational viability, accelerating cash depletion that may force suboptimal financing terms, and no visible improvement in operating cash flow despite revenue growth. Investment implications suggest a high probability of a dilutive equity offering or debt issuance in the near term. The premium multiple (62.36x P/E) appears disconnected from the cash flow. A critical inflection point to positive operating cash flow is needed in FY2025, and debt levels along with interest coverage require scrutiny. Investors should carefully monitor the potential for operating cash flow inflection in FY2025 and management's financing strategy to address the deteriorating cash position.

Conclusion:

MASAR presents a compelling yet complex investment profile characterized by exceptional growth metrics and concerning cash flow dynamics. As Saudi Arabia's largest real estate developer by market capitalization, the company sits at the nexus of the Kingdom's ambitious infrastructure expansion plans while demonstrating execution capabilities that have translated to rapid financial improvement.

MASAR's remarkable transition from pre-revenue status in FY2021 to SAR 1.82B revenue with 46% gross margins in FY2024 validates its operational model. The 106% two-year revenue CAGR and dramatic operating margin expansion to 31.5% substantiate the premium valuation multiple (62.36x P/E) from an earnings perspective.

However, the persistent negative operating cash flow (-SAR 501.52M in FY2023) despite reported accounting profitability (SAR 317M) represents a material disconnect that cannot be ignored. The deteriorating cash position (SAR 538.51M, down 81% from FY2021) suggests immediate financing requirements that may dilute shareholders or increase leverage beyond the current 0.93 debt-to-equity ratio.

Risk/Reward Assessment

The balance sheet demonstrates disciplined financial stewardship with stable leverage ratios and strategic non-current asset concentration (88% of total assets), providing a foundation for long-term value creation. However, execution risk on capital-intensive development projects remains substantial, particularly given the interest rate sensitivity of MASAR's debt load.

MASAR's valuation appears to fully price in its growth trajectory while inadequately discounting cash flow risks. The investment case hinges entirely on management's ability to inflect positive operating cash flow in FY2025 while maintaining access to capital markets on favorable terms.

Investors should closely monitor quarterly cash flow statements in FY2025 to validate project ROI and liquidity management. We would become more constructive at a valuation that better reflects the financing risk inherent in the business model or upon demonstrated improvement in cash conversion.

For investors seeking exposure to Saudi infrastructure development, MASAR's market leadership position remains attractive, but entry points should be disciplined given the significant gap between accounting profitability and economic reality reflected in the cash flow statement.

Disclaimer:

Sahm is subject to the supervision and control of the CMA, pursuant to its license no. 22251-25 issued by CMA.

The Information presented above is for information purposes only, which shall not be intended as and does not constitute an offer to sell or solicitation for an offer to buy any securities or financial instrument or any advice or recommendation with respect to such securities or other financial instruments or investments. When making a decision about your investments, you should seek the advice of a professional financial adviser and carefully consider whether such investments are suitable for you in light of your own experience, financial position and investment objectives. The firm and its analysts do not have any material interests or conflicts of interest in any companies mentioned in this report.

Performance data provided is accurate and sourced from reliable platforms, including Argaam, MASAR Company Prospectus, MASAR Earnings Report.

IN NO EVENT SHALL SAHM CAPITAL FINANCIAL COMPANY BE LIABLE FOR ANY DAMAGES, LOSSES OR LIABILITIES INCLUDING WITHOUT LIMITATION, DIRECT OR INDIRECT, SPECIAL, INCIDENTAL, CONSEQUENTIAL DAMAGES, LOSSES OR LIABILITIES, IN CONNECTION WITH YOUR RELIANCE ON OR USE OR INABILITY TO USE THE INFORMATION PRESENTED ABOVE, EVEN IF YOU ADVISE US OF THE POSSIBILITY OF SUCH DAMAGES, LOSSES OR EXPENSES.