We Value Your Feedback! Help us shape better content and experiences by participating in our survey. Join the Survey Now!

Company Overview:

Established in 1975, Mouwasat is a company specializing in operating hospitals and medical clinics. Mr. Muhammad Sultan Al-Subaie founded it with a capital of 100,000 Saudi riyals. The company has a flexible business model, which includes direct ownership of medical institutions, as well as leasing or operating based on profit-sharing contracts. In 1984, Mouwasat built its first comprehensive medical facility, Al-Mouwasat Hospital, in Dammam, which officially opened in 1988. As the business expanded, the number of medical institutions under Mouwasat's operation increased, creating economies of scale. Bulk purchasing enabled the company to obtain more favorable prices for medicines and medical equipment, reducing unit costs. Moreover, by integrating internal resources and optimizing management processes, Mouwasat achieved higher operational efficiency in human resource allocation, equipment maintenance, and logistical support, further reducing operating costs. This cost advantage allows Mouwasat to maintain strong profitability and risk-resistance capabilities in the face of market competition and industry fluctuations.

Market Position and Competitive Advantages

Mouwasat occupies an important position in the Saudi medical market, and its competitive advantages are mainly reflected in the following aspects:

- Brand and Reputation: Mouwasat has accumulated extremely high brand awareness and a good reputation in the Saudi medical market. As one of the earliest comprehensive medical institutions in Saudi Arabia, it has set an industry benchmark in terms of medical service quality, professional medical team building, and patient satisfaction.

- Broad Customer Base: Mouwasat has a broad customer base, including Saudi Aramco, Saudi Basic Industries Corporation (SABIC), Saudi Arabian Airlines, the General Administration of Social Insurance (GOSI), and all insurance companies affiliated with the Cooperative Health Insurance Committee.

- Advanced Information System: The company has advanced information systems to support efficient operation management. These systems combine local and global experience to ensure high-quality and efficiency of medical services.

- International Cooperation and Certification: Mouwasat has established cooperative relations with many international companies, organizations, hospitals, and medical centers. In addition, the company has obtained several international certifications, such as the College of American Pathologists (CAP), the American College of Radiology (ACR), and the Healthcare Information and Management Systems Society (HIMSS).

Industry analysis:

Industry Structure & Competitive Landscape

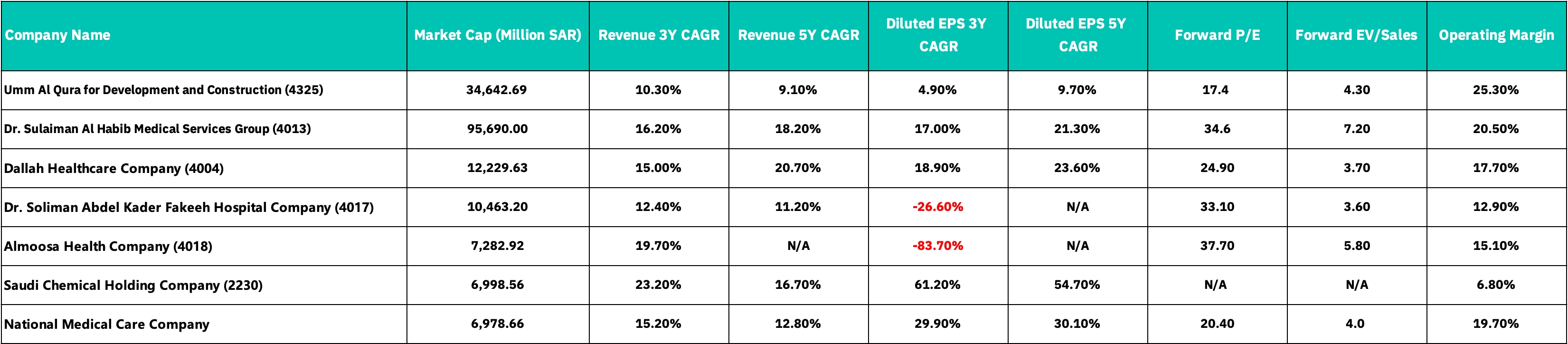

The Saudi healthcare sector exhibits a clear tiered structure with several key players commanding significant market share. Healthcare companies in Saudi Arabia can be categorized into:

Tier 1 (Market Leaders):

Dr. Sulaiman Al Habib Medical Services Group stands as the dominant player with a market capitalization of 95.7 billion SAR, significantly ahead of competitors

Tier 2 (Mid-Cap Players):

Dallah Healthcare Company (12.2 billion SAR)

Dr. Soliman Abdel Kader Fakeeh Hospital Company (10.5 billion SAR)

Tier 3 (Smaller Competitors):

Almoosa Health Company (7.3 billion SAR)

National Medical Care Company (7.0 billion SAR)

Based on its size and market penetration in the Saudi healthcare sector, Mouwasat Medical Services would likely be positioned somewhere in the second tier, competing directly with Dallah Healthcare and Dr. Soliman Abdel Kader Fakeeh Hospital.

Growth Dynamics & Market Expansion

The healthcare sector demonstrates robust revenue growth dynamics, averaging 15.7% 3-year CAGR across companies, significantly outpacing GDP growth. This indicates a rapidly expanding market driven by:

- Growing healthcare insurance penetration

- Rising prevalence of lifestyle diseases

- Demographic shifts toward an aging population

- The 5-year revenue CAGR data (ranging from 11.2% to 20.7% for most providers) suggests sustainable long-term growth, creating a favorable operating environment for established players like Mouwasat to capitalize on market expansion opportunities.

Profitability Analysis & Operational Efficiency

- Operating margins across healthcare providers average 17.2%, with significant variability:

- Dr. Sulaiman Al Habib: 20.5% (industry-leading)

- Dallah Healthcare: 17.7% (above sector average)

- Dr. Soliman Abdel Kader: 12.9% (below average)

- Almoosa Health: 15.1% (slightly below average)

- National Medical Care: 19.7% (strong performer)

This margin dispersion reflects differing operational models, patient mix, and efficiency in resource utilization.

Earnings Quality & Growth Sustainability

- Two providers show deeply negative EPS growth despite revenue increases (Dr. Soliman at -26.6%, Almoosa at -83.7%)

- National Medical Care demonstrates exemplary earnings growth (29.9% 3Y CAGR)

- Dallah Healthcare shows strong earnings acceleration (18.9% 3Y CAGR)

This bifurcation signals fundamental challenges in translating top-line growth to shareholder value for certain operators, potentially due to:

- Rising staffing costs and medical professional shortages

- Increased competition is forcing price concessions

- High capital expenditure requirements for technological modernization

- Changing reimbursement models from insurance providers

- For Mouwasat, the key analytical question is whether its earnings growth trajectory aligns with revenue expansion or faces similar margin pressures as underperforming peers.

Valuation Framework & Investment Attractiveness

Healthcare valuations reflect premium multiples across the sector:

- Forward P/E ratios range from 20.4x to 37.7x, substantially above broader market averages

- EV/Sales multiples between 3.6x and 7.2x indicate investor willingness to pay for growth

- Companies with demonstrated earnings growth command the highest multiples

This valuation framework creates an investment hierarchy:

- Premium Valuation Tier: Dr. Sulaiman Al Habib (34.6x P/E, 7.2x EV/Sales)

- Growth-at-Reasonable-Price Tier: Dallah Healthcare (24.9x P/E, 3.7x EV/Sales)

- Value Opportunity Tier: National Medical Care (20.4x P/E, 4.0x EV/Sales)

- Speculative Growth Tier: Companies with negative earnings growth but high P/E ratios

Mouwasat's positioning within this valuation spectrum would depend on its demonstrated ability to convert revenue growth to sustainable earnings expansion, with investors likely demanding a premium for consistent execution.

Valuation:

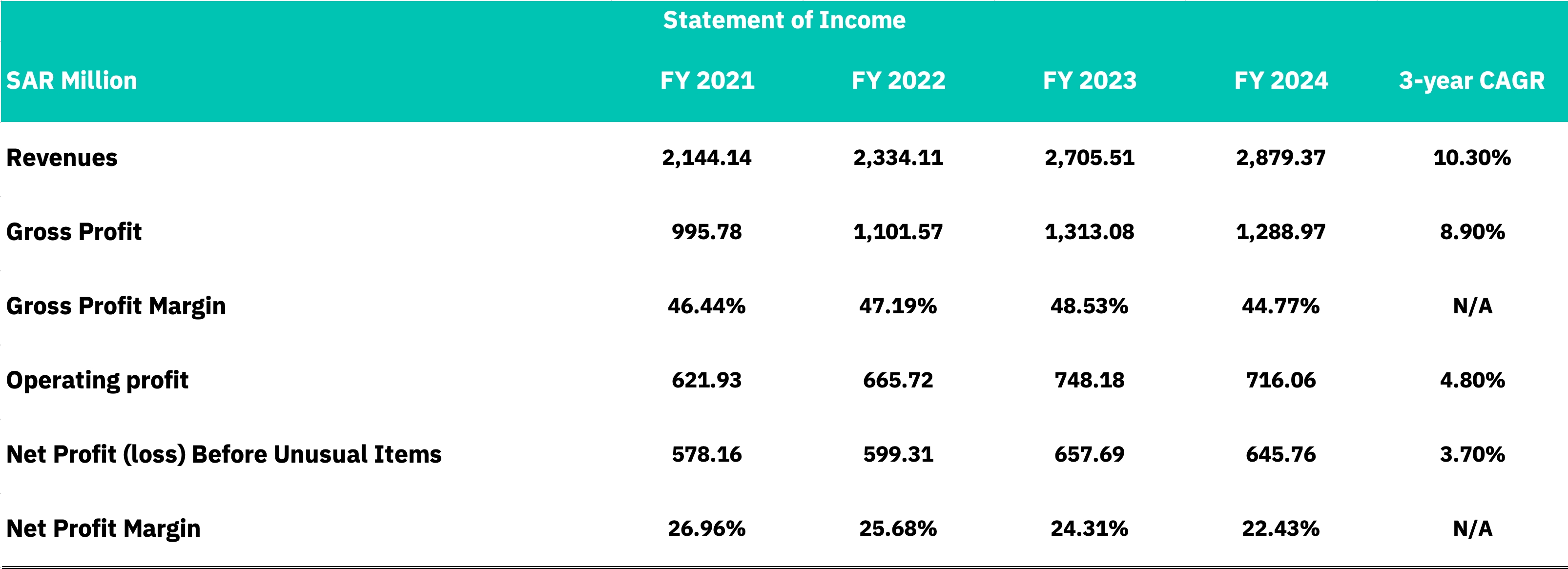

Mouwasat has maintained a consistent growth trajectory, increasing from SAR 2,144.14 million in FY2021 to SAR 2,879.37 million in FY2024, achieving a compound annual growth rate (CAGR) of 10.30%. However, year-over-year growth rates exhibit a worrying trend, with growth rates of 8.86% in FY2022, 15.91% in FY2023, and a decline to 6.43% in FY2024. Despite this, its growth significantly outpaces the average growth rate of approximately 6-7% in Saudi Arabia's healthcare sector, and Mouwasat has gained market share.

In terms of profitability analysis, Mouwasat's gross profit rose from SAR 995.78 million in FY2021 to SAR 1,288.97 million in FY2024, but its gross margin faced pressure, peaking at 48.53% in FY2023 before dropping to 44.77% in FY2024, suggesting rising cost pressures or challenges in pricing. Operating profit grew from SAR 621.93 million in FY2021 to SAR 716.06 million in FY2024, yet it experienced a 4.29% decline from FY2023 to FY2024. Operating margins contracted from 29.01% in FY2021 to 24.87% in FY2024, reflecting challenges in operational efficiency. Net profit increased from SAR 578.16 million in FY2021 to SAR 645.76 million in FY2024, but decreased by 1.81% from FY2023 to FY2024. Net margins fell from 26.96% in FY2021 to 22.43% in FY2024, indicating reduced efficiency in converting revenue into net profit.

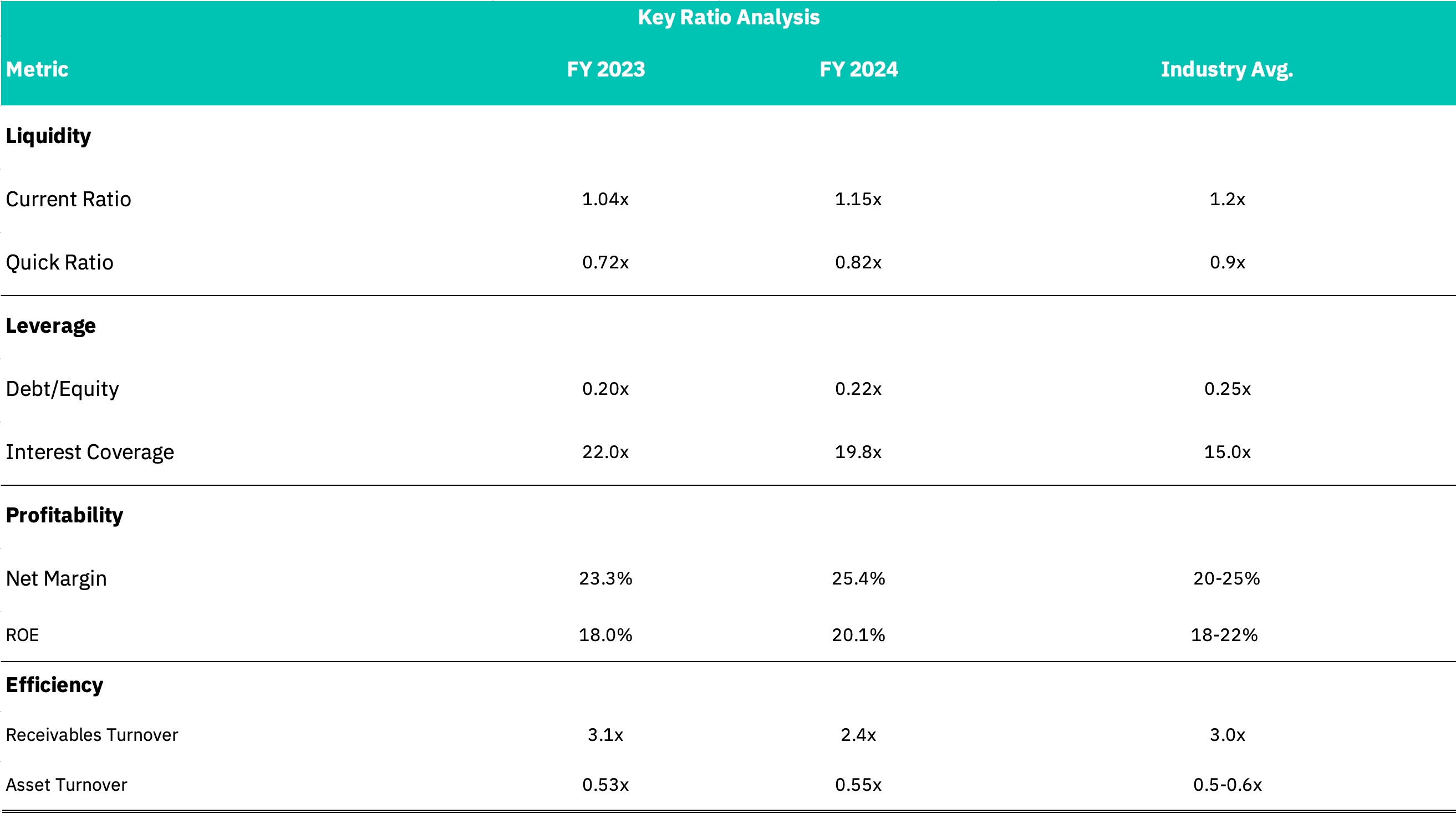

In comparative analysis, despite margin compression, Mouwasat's net margin of 25.4% in FY2024 remains superior to the industry average range of 20-25%. Its return on equity (ROE) of 20.1% in FY2024 also outperforms the industry average range of 18-22%, demonstrating effective capital utilization. However, the widening gap between gross margin and operating margin suggests that selling, general, and administrative (SG&A) costs are growing at a faster rate than revenue.

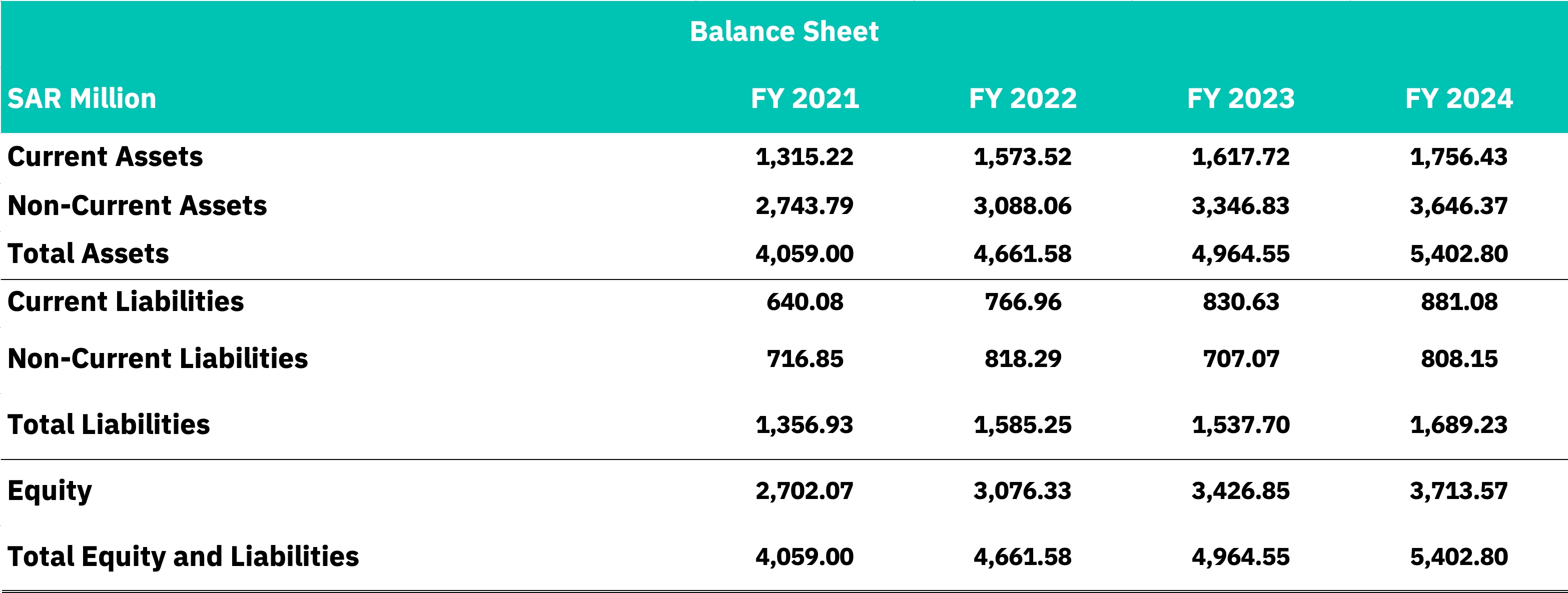

Mouwasat has experienced significant growth in its asset structure from FY2021 to FY2024. Total assets expanded by 33.1%, increasing from SAR 4,059.00 million to SAR 5,402.80 million. During this period, non-current assets consistently accounted for approximately 65-67% of total assets, reflecting a capital-intensive business model. Current assets grew by 33.5%, rising from SAR 1,315.22 million in FY2021 to SAR 1,756.43 million in FY2024. Non-current assets also showed a notable growth of 32.9%, increasing from SAR 2,743.79 million in FY2021 to SAR 3,646.37 million in FY2024.

In terms of liquidity position, Mouwasat has demonstrated certain improvements. The current ratio improved from 1.04x in FY2023 to 1.15x in FY2024, although it remains below the industry average of 1.2x. The quick ratio also saw an enhancement, rising from 0.72x in FY2023 to 0.82x in FY2024, indicating better short-term liquidity management capabilities. The positive trends in these liquidity ratios reflect the company's effective working capital management strategies.

Regarding capital structure, total liabilities increased from SAR 1,356.93 million in FY2021 to SAR 1,689.23 million in FY2024, representing a 24.5% growth. The debt-to-equity ratio remained conservative at 0.22x in FY2024, below the industry average of 0.25x. Shareholder equity grew by 37.4%, increasing from SAR 2,702.07 million in FY2021 to SAR 3,713.57 million in FY2024. The faster growth rate of equity compared to liabilities suggests a conservative financing strategy that favors equity financing over debt. In terms of asset utilization, the asset turnover ratio remained relatively stable, rising from 0.53x in FY2023 to 0.55x in FY2024, within the industry range of 0.5-0.6x. However, the receivables turnover ratio decreased from 3.1x in FY2023 to 2.4x in FY2024, falling below the industry average of 3.0x, which may indicate potential challenges in accounts receivable collection.

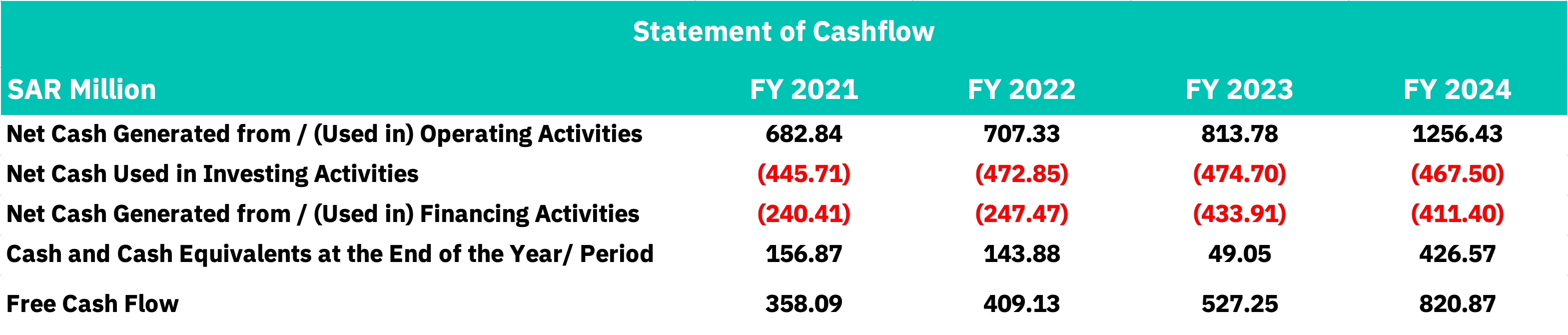

From FY2021 to FY2024, Mouwasat demonstrated robust performance in operating cash flow. Operating cash flow grew significantly from SAR 682.84 million to SAR 1,256.43 million, an increase of 84.0%. The OCF to Revenue ratio improved from 31.8% to 43.6%, reflecting enhanced cash generation efficiency. Meanwhile, the OCF to Net Income ratio rose from 1.18x to 1.95x, indicating high-quality earnings. In terms of investment activities, capital expenditure remained relatively stable, ranging from SAR 445.71 million in FY2021 to SAR 467.50 million in FY2024. The Capex-to-Revenue ratio decreased from 20.8% to 16.2%, suggesting improving capital efficiency. The Capex-to-Depreciation ratio (estimated) indicated that Mouwasat continued to make growth investments above maintenance levels.

In terms of financing activities, financing cash flows consistently showed negative values, ranging from SAR 240.41 million in FY2021 to SAR 411.40 million in FY2024. The increasing negative cash flows were mainly due to higher dividend distributions, reflecting Mouwasat's confidence in future cash generation. The interest coverage ratio reached 19.8x in FY2024, significantly higher than the industry average of 15.0x, demonstrating strong debt servicing capacity. Free cash flow grew dramatically from SAR 358.09 million in FY2021 to SAR 820.87 million in FY2024, an increase of 129.2%. The FCF-to-Revenue ratio improved from 16.7% to 28.5%, showing excellent cash conversion efficiency. The FCF-to-Net Income ratio rose from 0.62x to 1.27x, indicating strong cash generation relative to accounting profits. Consistently positive and growing free cash flow also highlighted the sustainability of the business model.

The company's cash balance also showed positive growth. Cash and cash equivalents increased from SAR 156.87 million in FY2021 to SAR 426.57 million in FY2024, with a notable jump from SAR 49.05 million in FY2023. The Cash-to-Total Assets ratio improved from 1.0% in FY2023 to 7.9% in FY2024, enhancing the Mouwasat's financial flexibility. In FY2024, cash reserves were sufficient to cover approximately 5.8 months of operating expenses, providing a solid operational buffer.

Conclusion

Mouwasat's financial performance highlights its strength amid challenges. Its revenue grew from SAR 2,144.14 million in FY2021 to SAR 2,879.37 million in FY2024, a 10.30% CAGR surpassing Saudi healthcare sector's average. Cash generation was exceptional, with operating cash flow rising 84% and free cash flow up 129.2% from FY2021 to FY2024, alongside a significant boost in cash balances. However, profitability faced pressure—gross margins dropped from 48.53% in FY2023 to 44.77% in FY2024, and operating margins fell from 29.01% in FY2021 to 24.87% in FY2024, though net margins stayed above industry average. Mouwasat's capital structure is conservative, with a low debt-to-equity ratio of 0.22x and a high interest coverage ratio of 19.8x. Despite some mixed signals in working capital management, its financial health remains robust overall.

Mouwasat operates in a dynamic healthcare sector with a 15.7% average revenue CAGR, benefiting from Saudi Arabia's demographic shifts, rising lifestyle diseases, expanding insurance coverage, and Vision 2030 initiatives. Competing in the Tier 2 segment against the dominant Dr. Sulaiman Al Habib, it stands out with superior margins and cash generation efficiency. Strategic growth drivers include the demographic dividend, insurance expansion, technology integration, geographic expansion potential, and value-based care trends. These factors position Mouwasat well for continued growth.

Key risks for Mouwasat involve margin pressure from cost inflation, regulatory changes, intensifying competition, and economic cyclicality. Despite these, the company presents a compelling long-term investment opportunity. Its established market position, superior cash generation, and conservative financial management align with Saudi Arabia's demographic trends. Mouwasat appeals to investors interested in Saudi economic diversification, long-term demographic growth, quality businesses with strong cash flow, and emerging markets' healthcare sectors. Founded nearly five decades ago, it has grown into a sophisticated healthcare provider pivotal to Saudi Arabia's development. While challenges exist, its adaptation ability, financial foundation, and strategic positioning support a positive long-term outlook, offering an attractive way to engage with Saudi Arabia's healthcare transformation.

Disclaimer:

Sahm is subject to the supervision and control of the CMA, pursuant to its license no. 22251-25 issued by CMA.

The Information presented above is for information purposes only, which shall not be intended as and does not constitute an offer to sell or solicitation for an offer to buy any securities or financial instrument or any advice or recommendation with respect to such securities or other financial instruments or investments. When making a decision about your investments, you should seek the advice of a professional financial adviser and carefully consider whether such investments are suitable for you in light of your own experience, financial position and investment objectives. The firm and its analysts do not have any material interests or conflicts of interest in any companies mentioned in this report.

Performance data provided is accurate and sourced from reliable platforms, including Argaam, Markwideresearch.

IN NO EVENT SHALL SAHM CAPITAL FINANCIAL COMPANY BE LIABLE FOR ANY DAMAGES, LOSSES OR LIABILITIES INCLUDING WITHOUT LIMITATION, DIRECT OR INDIRECT, SPECIAL, INCIDENTAL, CONSEQUENTIAL DAMAGES, LOSSES OR LIABILITIES, IN CONNECTION WITH YOUR RELIANCE ON OR USE OR INABILITY TO USE THE INFORMATION PRESENTED ABOVE, EVEN IF YOU ADVISE US OF THE POSSIBILITY OF SUCH DAMAGES, LOSSES OR EXPENSES.