We warmly invite you to participate in the Sahm Research Center survey! Your feedback is crucial to us. By participating in this survey, you will have the opportunity to:

Influence Future Content: Your feedback will directly shape the types and topics of reports we publish in the future.

Enhance User Experience: We aim to improve the layout and presentation of our reports based on your suggestions, ensuring you receive valuable investment insights.

Engage with Us: Your voice matters! We are committed to listening to your needs and providing services that align with your expectations.

Click the link to start the survey: Participate in the Survey

Salesforce, Inc.

Leveraging AI Capabilities to Strengthen Market Leadership

Date:November 27, 2024

Financial Insights:

The company released its FY2025 Q2 results, showing strong performance in both revenue and profit margins.

1. Q2 revenue reached $9.33 billion, representing an 8.4% year-over-year growth and exceeding expectations by approximately 1 percentage point. The non-GAAP Operating Margin reached a record high of 33.7%.

2. The company demonstrated strong expense management, with sales expense ratio decreasing by 1.61% to 34.57%.

3. The Q2 overall customer churn rate remained stable at 8%, consistent with Q1 levels.

4. For guidance, the company expects FY25 Q3 revenue to be between $9.31-9.36 billion, representing a 7% year-over-year growth, which falls below market expectations of $9.41 billion.

Key Points:

The investment thesis is based on several aspects:

From a business perspective, the company has expanded its scope through acquisitions while maintaining strong competitive advantages in the industry through its PaaS + SaaS operating model; Financially, the company has passed its peak investment phase, suggesting potential for further margin expansion in the future; Thirdly, the company has demonstrated strong development in the AI field, with certain first-mover advantages.

1. The PaaS + SaaS business model enhances customer stickiness while creating its own ecosystem. Additionally, the proprietary PaaS platform improves interoperability between upper-layer software applications.

2. SaaS companies typically require significant upfront investments, particularly in infrastructure, which makes it difficult for most SaaS companies to achieve profitability in their early stages. The key is that growth in paying users helps spread fixed costs. From current indicators, CRM appears to have passed its peak spending phase, with sales expense ratio declining by 1.61% year-over-year this quarter. Additionally, both administrative and R&D expense ratios have been decreasing in recent years, suggesting further potential for margin expansion in the future.

3. Salesforce launched Einstein GPT last year and integrated it with other products, creating synergistic effects. Additionally, their AI Agent product, Agentforce, has been launched, further improving overall efficiency and capable of solving more complex problems. In terms of business model, they are exploring a transition from subscription-based pricing to per-conversation pricing. The product has already been purchased by several companies.

NVIDIA's recent earnings report didn't create significant waves in the capital markets. Some market participants believe that trading in chip stocks and AI hardware has reached a plateau, shifting focus towards AI applications and software.

Looking at the results, NVIDIA and other AI hardware stocks are already trading at relatively high valuations with sufficient market participation, suggesting limited upside potential. Following better-than-expected earnings from software companies like APP and SNOW, some traders have begun pivoting towards software sector investments.

Historical patterns in major tech trends show that hardware stocks typically perform well in the first wave, followed by software stocks in the second wave. Therefore, the next phase of trading may shift towards AI applications. Salesforce, with its first-mover advantage in the CRM space, is well-positioned to benefit from this transition.

From a valuation perspective, CRM has risen approximately 40% since September, with its current price-to-sales ratio at around 9x, which is slightly above its historical average. This indicates that market enthusiasm for AI applications has contributed to the stock price appreciation. Following the Q2 earnings release, most investment banks have maintained an optimistic outlook, with many raising their price targets. Continued attention to this stock is recommended.

Key Concepts:

1. SaaS (Software as a Service) refers to a model where software services are provided to customers through subscriptions. Typically, customers pay annually or monthly to access these services. SaaS companies generally command higher valuations because they generate consistent cash flows and maintain strong customer stickiness, with less concern about customer acquisition challenges.

2. PaaS (Platform as a Service) is a cloud computing model that provides developers with a platform and environment to build, deploy, and manage applications without worrying about the underlying infrastructure.

Technical Analysis:

CRM entered a broad consolidation phase [1] between June and September, followed by an upward trend beginning in mid-September, accompanied by moderately increasing trading volume. The earnings release during this period served as a major catalyst, leading to optimistic market expectations regarding AI Agent. Notably, many AI application companies entered upward trends during this period, with the broader AI application theme contributing to stock price momentum.

Another noteworthy technical observation is that after the stock price peaked in mid-November, its pullback found support at the previous phase's high of around $316, which coincided with the prior resistance level. From a technical analysis perspective, this is a positive signal, indicating strong buying interest at this level and suggesting it could serve as a new support level [2].

[1] Wide-range consolidation: refers to a period when a stock's price moves sideways within a relatively broad price range, characterized by significant price fluctuations between support and resistance levels without establishing a clear directional trend.

[2] Previous resistance becoming new support: occurs when a price level that once acted as a ceiling for price movement becomes a floor after being broken through, indicating a shift in market psychology and often serving as a strong technical signal for continued upward momentum.

Research Report Appendix

Company Concept:

Salesforce is a leading global provider of customer relationship management (CRM) software and enterprise cloud computing solutions, founded in 1999 and pioneering the SaaS business model, known for its flagship CRM platform and recent innovations in AI integration through products like Einstein GPT.

Model Explanation:

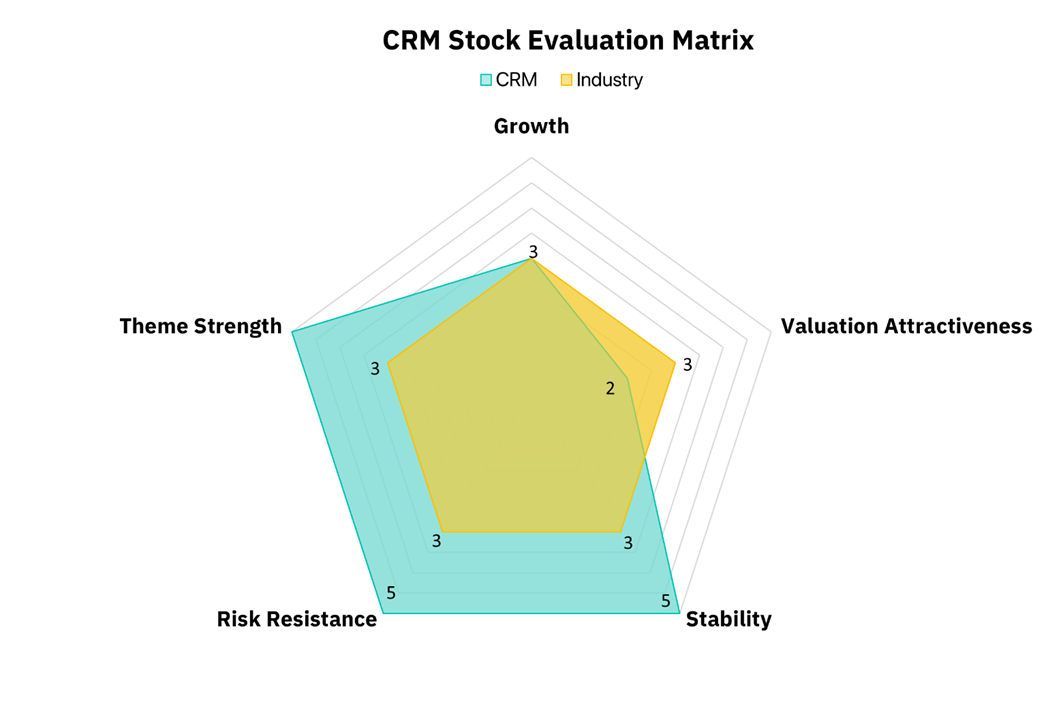

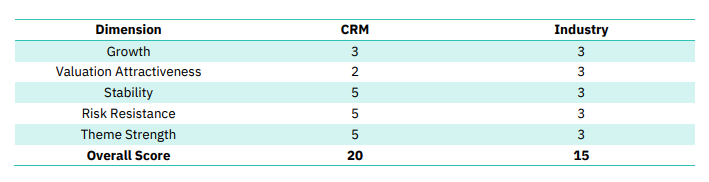

The model primarily evaluates companies and industries across five dimensions: growth ability, valuation attractiveness, stability, risk resistance ability, and theme strength. Each dimension is scored from 1-5, with 1 being the lowest and 5 the highest. Overall, higher scores indicate stronger fundamentals. For each dimension, a multi-factor model will be constructed based on industry and historical data of selected stocks, and a quantitative model will be used to automatically score each dimension.

Here are the dimensions explained:

- Growth Ability: Measures future performance potential; higher growth rates yield higher scores.

- Valuation Attractiveness: Assesses stock valuation; lower valuations earn higher scores.

- Stability: Evaluates the consistency of profit generation; greater stability means higher scores.

- Risk Resistance: Gauges the capacity to endure macroeconomic changes; better risk resistance leads to higher scores.

- Theme Strength: Rates market favor for the stock in the short term; increased favor results in higher scores.

Disclaimer:

The Information presented above is for information purposes only, which shall not be intended as and does not constitute an offer to sell or solicitation for an offer to buy any securities or financial instrument or any advice or recommendation with respect to such securities or other financial instruments or investments. When making a decision about your investments, you should seek the advice of a professional financial adviser and carefully consider whether such investments are suitable for you in light of your own experience, financial position and investment objectives. The firm and its analysts do not have any material interest or conflict of interest in Salesforce, Inc.

IN NO EVENT SHALL SAHM CAPITAL FINANCIAL COMPANY BE LIABLE FOR ANY DAMAGES, LOSSES OR LIABILITIES INCLUDING WITHOUT LIMITATION, DIRECT OR INDIRECT, SPECIAL, INCIDENTAL, CONSEQUENTIAL DAMAGES, LOSSES OR LIABILITIES, IN CONNECTION WITH YOUR RELIANCE ON OR USE OR INABILITY TO USE THE INFORMATION PRESENTED ABOVE, EVEN IF YOU ADVISE US OF THE POSSIBILITY OF SUCH DAMAGES, LOSSES OR EXPENSES.